Laws

- Maximum Estate Value: $125,000; no limit if the decedent died at least 20 years ago[1]

- Mandatory Waiting Period: Not mentioned in state statutes.

- Where to File: Clerk’s Office (filing required only if real estate is being transferred)[2]

How to Use (4 Steps)

Step 1 – Check Qualifications

A small succession affidavit may be used if the decedent’s estate meets all the following qualifications:

- The estate is valued at $125,000 or less, or the decedent has been deceased for at least 20 years

- The decedent lived in or owned property in Louisiana

- All heirs agree on how the estate will be distributed

- If the decedent lived outside of Louisiana and left a will, the will must have been probated in the other state before a small succession affidavit may be used[3]

Note: A small succession affidavit may not be used if the decedent resided in Louisiana, left a will, and owned real property in the state.[4]

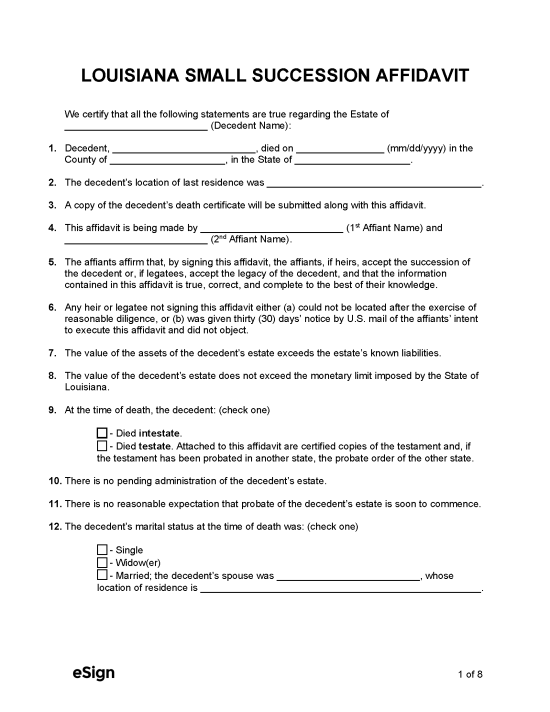

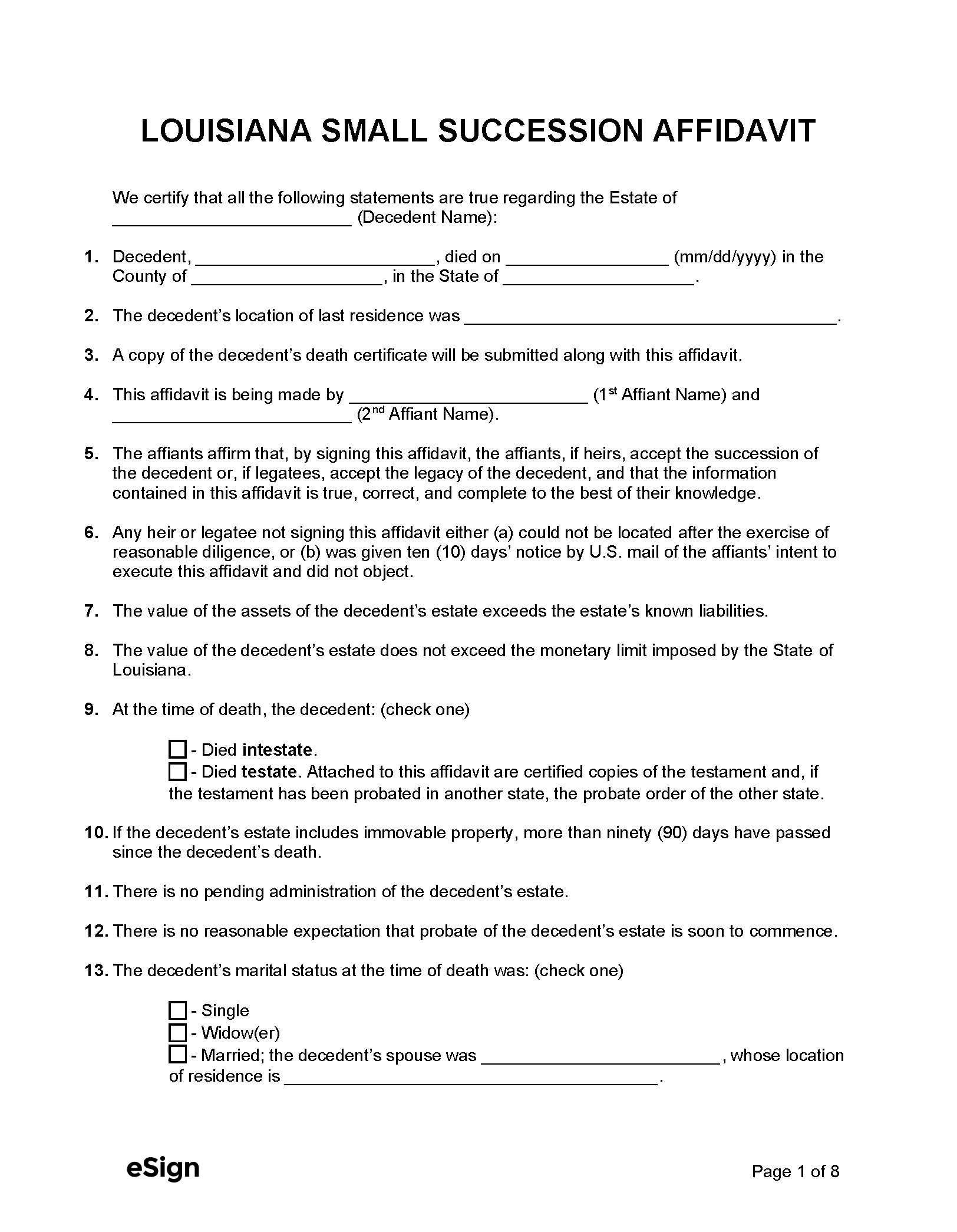

Step 2 – Complete Affidavit

The Small Succession Affidavit must be completed and signed by at least two individuals, including the surviving spouse (if applicable) and one or more of the decedent’s heirs or legatees.[5] All signatures must be notarized.

Additional rules apply in certain circumstances:

- No will, no spouse, and only one heir: One additional person with knowledge of the Affidavit’s contents must sign.[6]

- Louisiana resident with a will: All heirs, legatees, and the surviving spouse (if any) must sign.[7]

- Out-of-state resident with a will but no spouse: Two additional persons with knowledge of the Affidavit’s contents must sign.[8]

- No will OR an out-of-state resident with a will: All known heirs or legatees who do not sign must receive 30 days’ written notice of the intent to execute the Affidavit.[9]

Step 3 – Record (if required)

If the decedent owned real property in Louisiana, the Affidavit must be recorded at the clerk’s office in the parish where the property is located.

Step 4 – Obtain Assets

To collect the decedent’s assets, an affiant must present the Affidavit to the asset holder and request that the property be transferred.[10] The asset holder is then obligated to transfer possession of the asset to the affiant.