Laws

- Statute: Code of Civil Procedure – Title 5 (§§ 3421 – 3443)

- Maximum Estate Value (CCP 3421(A)): $125,000 (There is no maximum if the death occurred at least twenty (20) years prior to filing the affidavit.)

- Mandatory Waiting Period (CCP 3434(C)(1)): If the estate includes immovable property, the filing of an affidavit must take place ninety (90) days after the decedent’s death.

- Where to File: The affidavit must be recorded at the clerk’s office in the parish where the decedent’s immovable property is located (CCP 3434(C)(1)).

How to Record (4 Steps)

- Step 1 – Qualifications

- Step 2 – Complete Affidavit

- Step 3 – Record at Clerk’s Office

- Step 4 – Obtain Assets

- Step 5 – Publish Notice of Sale

Step 1 – Check Qualifications

A small succession affidavit may be used if the decedent’s estate meets the following qualifications:

- The estate is valued at $125,000 or less OR the decedent has been deceased for at least twenty (20) years (CCP 3421(A)).

- The decedent’s sole heirs are descendants, ascendants, siblings (or descendants thereof), a spouse, or beneficiaries of a will that was probated in a state other than Louisiana (CCP 3431(A)).

- One (1) of the following must also apply:

- The decedent died without a will while domiciled in Louisiana (CCP 3431(A));

- The decedent died with a will while domiciled in Louisiana, but left no immovable property, and the probate of the decedent’s will would have the same effect as if they died without a valid will (CCP 3421(B)); or

- The decedent died with a will while domiciled in a state other than Louisiana, and the will has been probated by the court in that state (CCP 3431(A)).

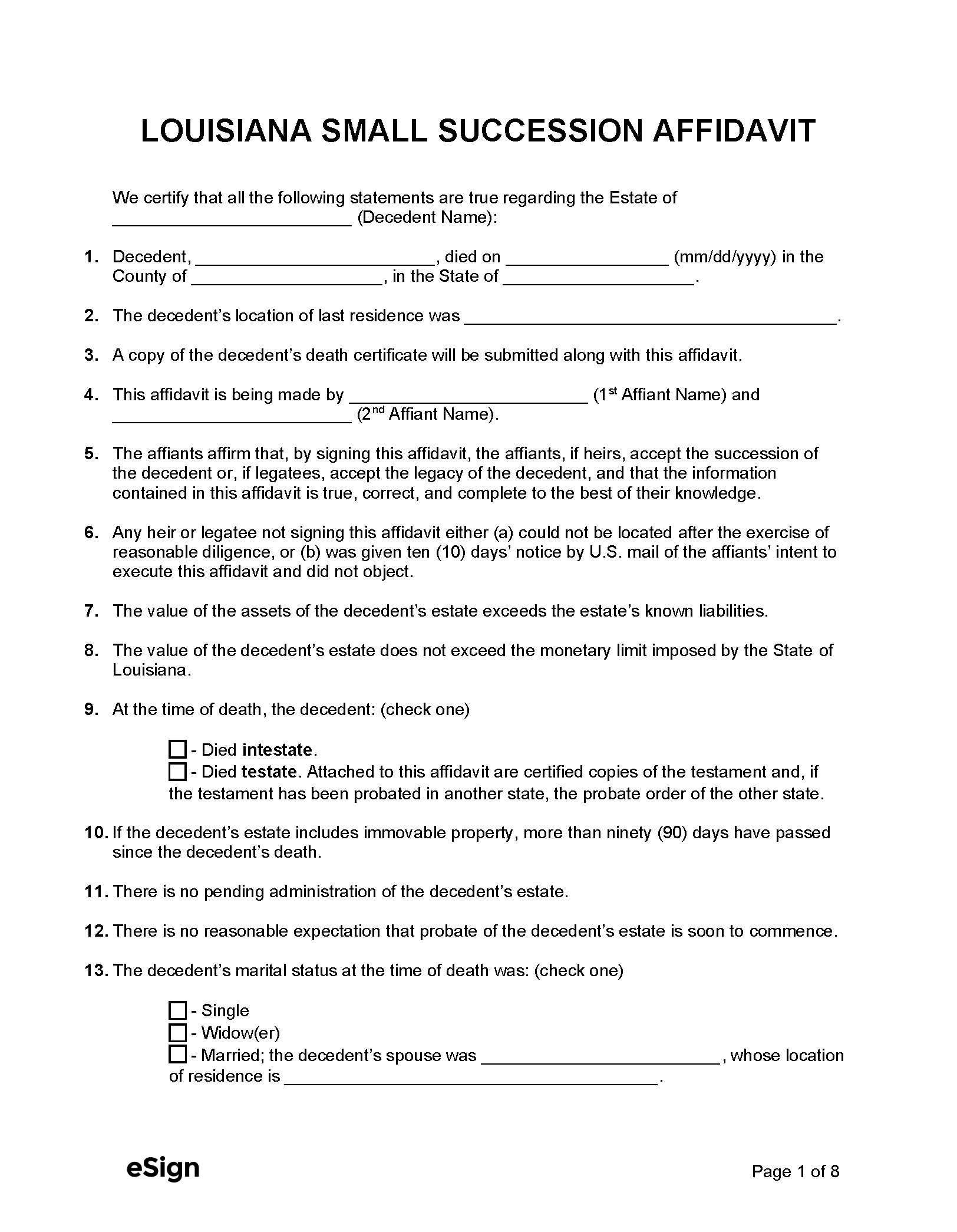

Step 2 – Complete Affidavit

The affidavit must be completed and signed by two (2) or more individuals. If the decedent was married, one (1) signer must be the surviving spouse, and the other must be an adult heir or legatee (a legatee is someone who inherits property from a will). If the decedent didn’t leave a surviving spouse, then the signing requirements will vary depending on whether or not they resided in Louisiana.

- If domiciled in Louisiana – If there is no surviving spouse, the affidavit must be signed by two (2) adult heirs. If there is no surviving spouse and only one (1) heir, the document must also be signed by someone who has actual knowledge of the contents of the affidavit.

- If domiciled outside of Louisiana – If there is no surviving spouse, the document must be signed by two (2) or more individuals who have actual knowledge of the contents of the affidavit.

Step 3 – Record at Clerk’s Office

The affidavit and a certified copy of the death certificate must be filed at the clerk’s office in the local parish or the parish where the decedent’s immovable property is located. If the estate includes immovable property, the recording must occur after ninety (90) days have elapsed from the date of death.

Step 4 – Obtain Assets

According to CCP 3434(A), the affidavit on its own is sufficient authority to obtain any money or property included in the decedent’s small estate. Therefore, to collect the decedent’s assets, the affiant must present the affidavit to the asset holder and request that the property be transferred. The asset holder will then be obligated to transfer possession of the asset to the affiant.

Step 5 – Publish Notice of Sale

Should any of the decedent’s property be sold publicly, the court-appointed succession representative must, prior to the sale, publish a notice of sale in a newspaper where the succession is pending. The property must be sold not less than ten (10) nor more than fifteen (15) days after publication (CCP 3443).