Laws

- Statute: Ch. 190B, § 3-1201

- Maximum estate value (§ 3–1201): $25,000

- Mandatory waiting period (§ 3–1201): Thirty (30) days

- Where to file: Probate and Family Court

How to Record (4 Steps)

Step 1 – Requirements

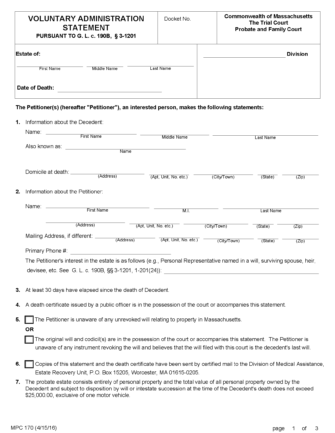

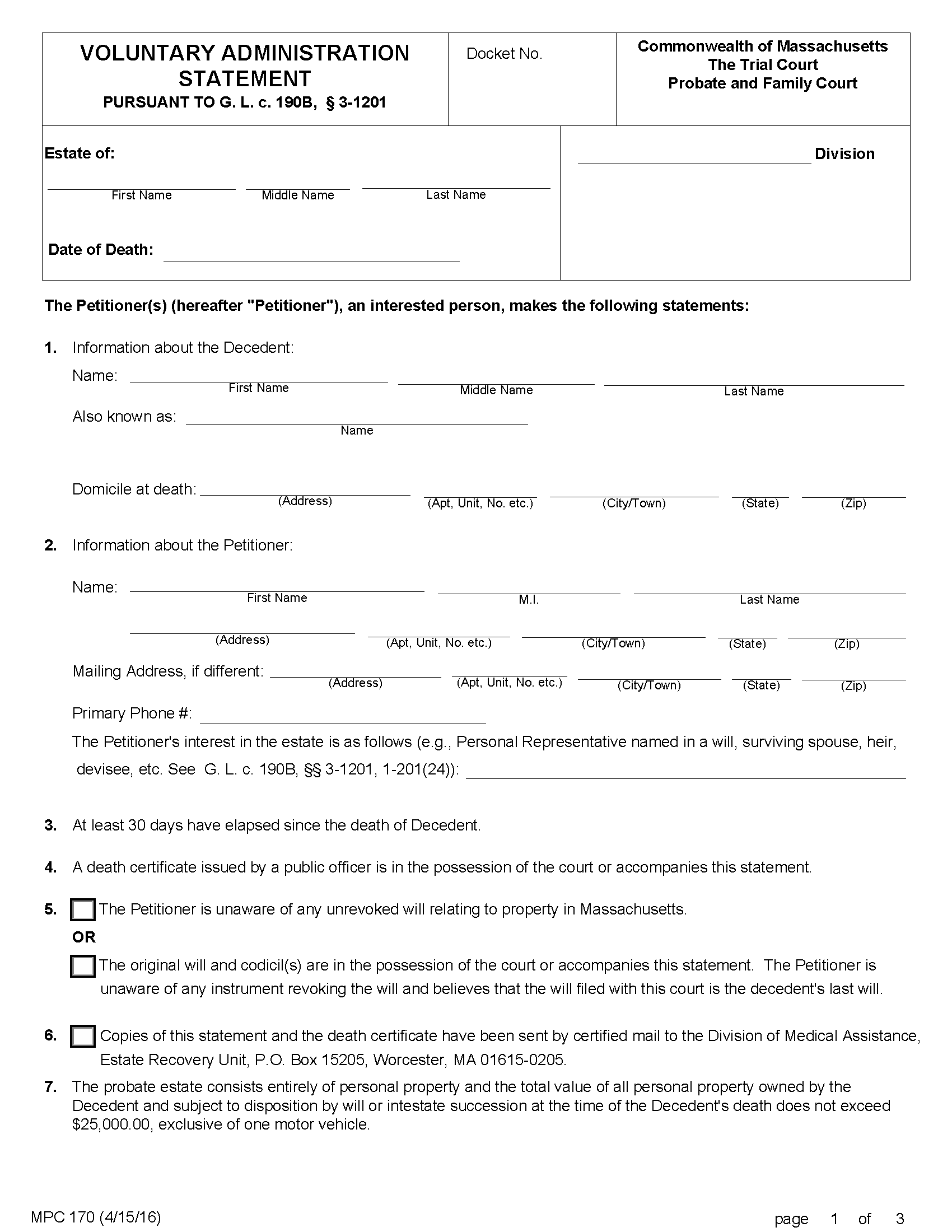

Massachusetts offers a simplified probate procedure known as “voluntary administration,” which may be used regardless of whether the decedent died with or without a valid will. The following requirements must be met in order to be eligible for voluntary administration:

- The decedent’s estate is valued at $25,000 or less (excluding the value of a motor vehicle).

- The decedent resided in Massachusetts at the time of death.

- The decedent’s estate consists of personal property only.

- At least thirty (30) days have passed since the decedent died.

- The petitioner is an interested person as defined by § 1-201(24).

- No other action has been filed to probate the decedent’s will or appoint a personal representative.

Step 2 – Prepare for Filing

To open a voluntary administration proceeding, the petitioner will need to prepare and collect the following documents:

- Voluntary Administration Statement (MPC 170)

- Certified copy of death certificate

- The decedent’s original will (if any)

- Suspicious Death Affidavit (MPC 475)

- Only required if the cause of death written on the death certificate is “pending” or “homicide.”

- Affidavit of Domicile (MPC 485)

- Only required if the address listed on the death certificate is incorrect.

Note: Copies of the Voluntary Administration Statement and the death certificate must be sent by certified mail to the Division of Medical Assistance, Estate Recovery Unit. The address is as follows:

Division of Medical Assistance

Estate Recovery Unit

P.O. Box 15205

Worcester, MA 01615-0205

Step 3 – File Documents

All forms must be filed with the Probate and Family Court in the county where the decedent resided before death. There are three (3) filing methods accepted by the court: by mail, in person, and online (see online filing instructions). The filing fee for voluntary administration is $115. Petitioners should contact the court ahead of time to determine the accepted forms of payment in the applicable county.

If the decedent owned a vehicle, further action will be required to transfer the vehicle’s certificate of title. More information on the subject can be found here.

Step 4 – Await Response

After filing with the Probate and Family Court, the petitioner will receive an attested copy of the Voluntary Administration Statement demonstrating approval of their request. The petitioner can then distribute the estate assets to creditors, heirs, devisees, and other parties entitled to the decedent’s property. At any point while awaiting a response from the court, individuals can check the status of their case online.