Laws

- Statute: Estates and Trusts, Title 5, Sub. 6

- Maximum Estate Value (§ 5–601): $50,000 (or $100,000 if the surviving spouse is the sole heir or legatee).

- Mandatory Waiting Period: Not mentioned in state statutes.

- Where to File: Orphans’ Court or Register of Wills

How to File (4 Steps)

- Step 1 – Prepare Required Documents

- Step 2 – File Petition

- Step 3 – Notice to Creditors

- Step 4 – Distribute Assets

Step 1 – Prepare Required Documents

A small estate may be settled without probate if the value of the decedent’s assets does not exceed $50,000 (or $100,000 if the only heir is the decedent’s surviving spouse). The person who opens the estate, the petitioner, must prepare the following documents for submission to the court:

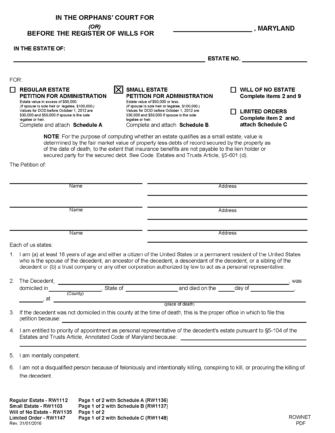

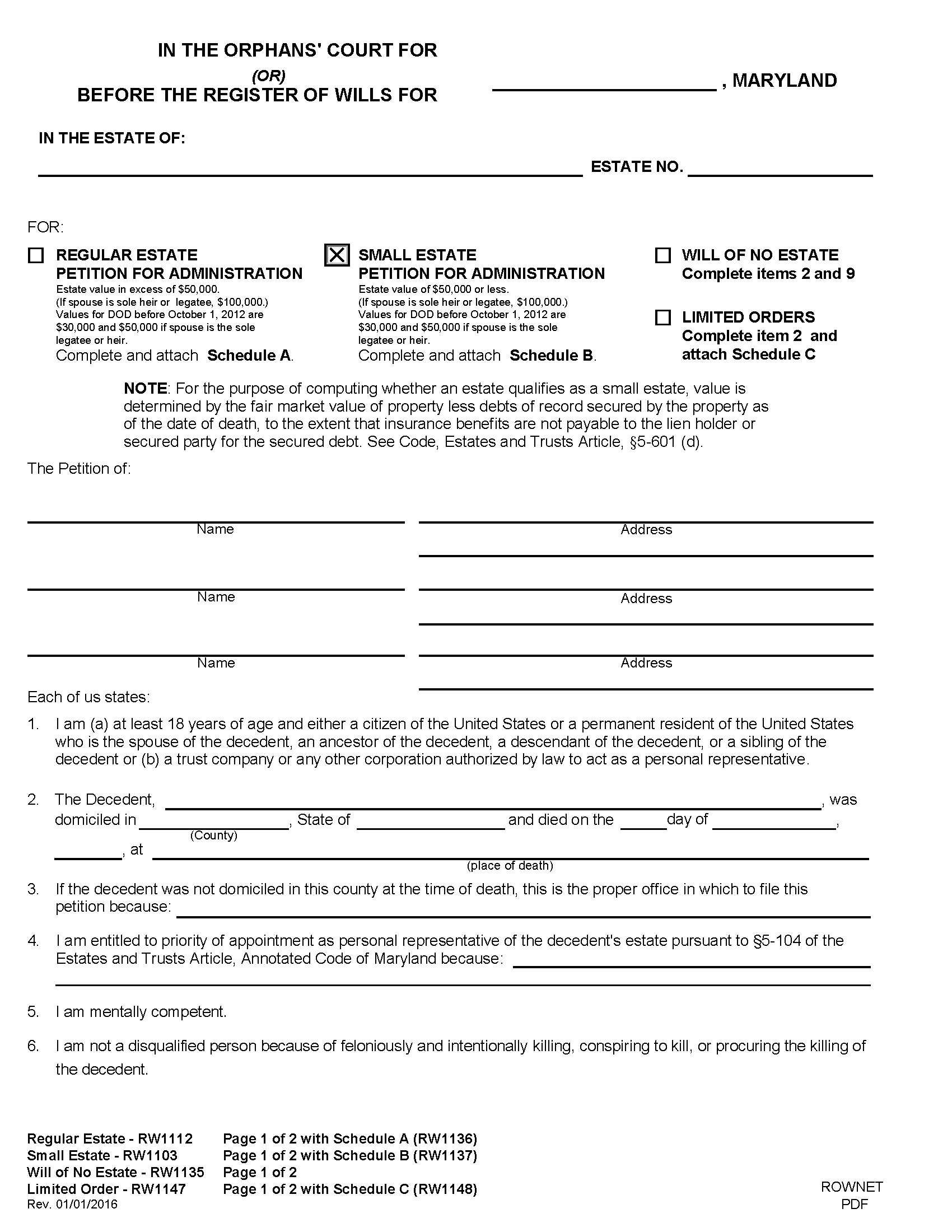

- Petition for Administration of a Small Estate

- Consent to Appointment of Personal Representative

- Only use if the personal representative will be someone other than an individual named in the decedent’s will (if any) or an individual entitled to appointment (e.g., spouse, child).

- Appointment of Resident Agent

- Only use if the petitioner does not reside in Maryland.

- Proof of Execution of Will

- Only use if the decedent’s will (if any) is without an attestation clause.

- Information Report

- Notice of Appointment / Notice to Creditors / Notice to Unknown Heirs

- Except for the date of death, leave all dates blank.

- Bond of Personal Representative

- Schedule C

- Can be used to authorize either a search for the decedent’s assets or a search for the decedent’s will.

- The decedent’s last will (if any)

- Paid funeral bill

- Copy of death certificate – Obtained from the Division of Vital Records

- Copy of the decedent’s vehicle title (if any) and book value

- Printout of property value assessment from the Department of Assessment and Taxation

Step 2 – File Petition

The petitioner must file the required paperwork with either the Register of Wills or the Orphans’ Court in the county where the decedent resided at the time of death. The Register of Wills handles most estates. However, if the decedent didn’t leave a will, or if the decedent left a will but there are questions regarding its validity, the estate may need to be administered by the Orphans’ Court.

Note: The petitioner will need to pay a filing fee (see fee schedule).

Step 3 – Notice to Creditors

If the petitioner’s paperwork was successfully filed, a notice will be issued to the personal representative informing them about their obligations regarding estate management. One such duty requires the representative to notify creditors of the decedent’s death and publish an article in a local newspaper once a week for three (3) consecutive weeks. The creditor notification and publication requirements can be found in § 5–603(b) and § 7–103.

Step 4 – Distribute Assets

Once all filing and publication requirements are met, the personal representative may distribute assets according to the terms set in the decedent’s will and Maryland’s estate administration law (see booklet for administration information).