Laws

- Statute: Title 18-C, Article 3, Part 12

- Maximum Estate Value (§ 3-1201(1)(A)): $40,000 – This amount will be adjusted for inflation depending on the Consumer Price Index for the calendar year preceding the year of death (§ 1-108(2)).

- Mandatory Waiting Period (§ 3-1201(1)(B)): Thirty (30) days

- Where to File: Maine does not require the affidavit to be filed.

How to Record (4 Steps)

- Step 1 – Affidavit Requirements

- Step 2 – Complete Affidavit

- Step 3 – File Affidavit with Probate Court

- Step 4 – Collect Assets

Step 1 – Affidavit Requirements

A small estate affidavit can be used to claim a decedent’s personal property and financial assets without involvement from the court. Before putting the affidavit to use, the person claiming property/assets (the “affiant”) must ensure that the following facts are true (§ 3-1201):

- The total value of the decedent’s estate, less any liens and encumbrances, does not exceed $40,000.

- There hasn’t been an application or petition to the court for the appointment of a personal representative (i.e., an executor of the decedent’s will).

- At least thirty (30) days have elapsed from the date of the decedent’s death.

- The affiant is claiming personal property or funds to which they are entitled.

Step 2 – Complete Affidavit

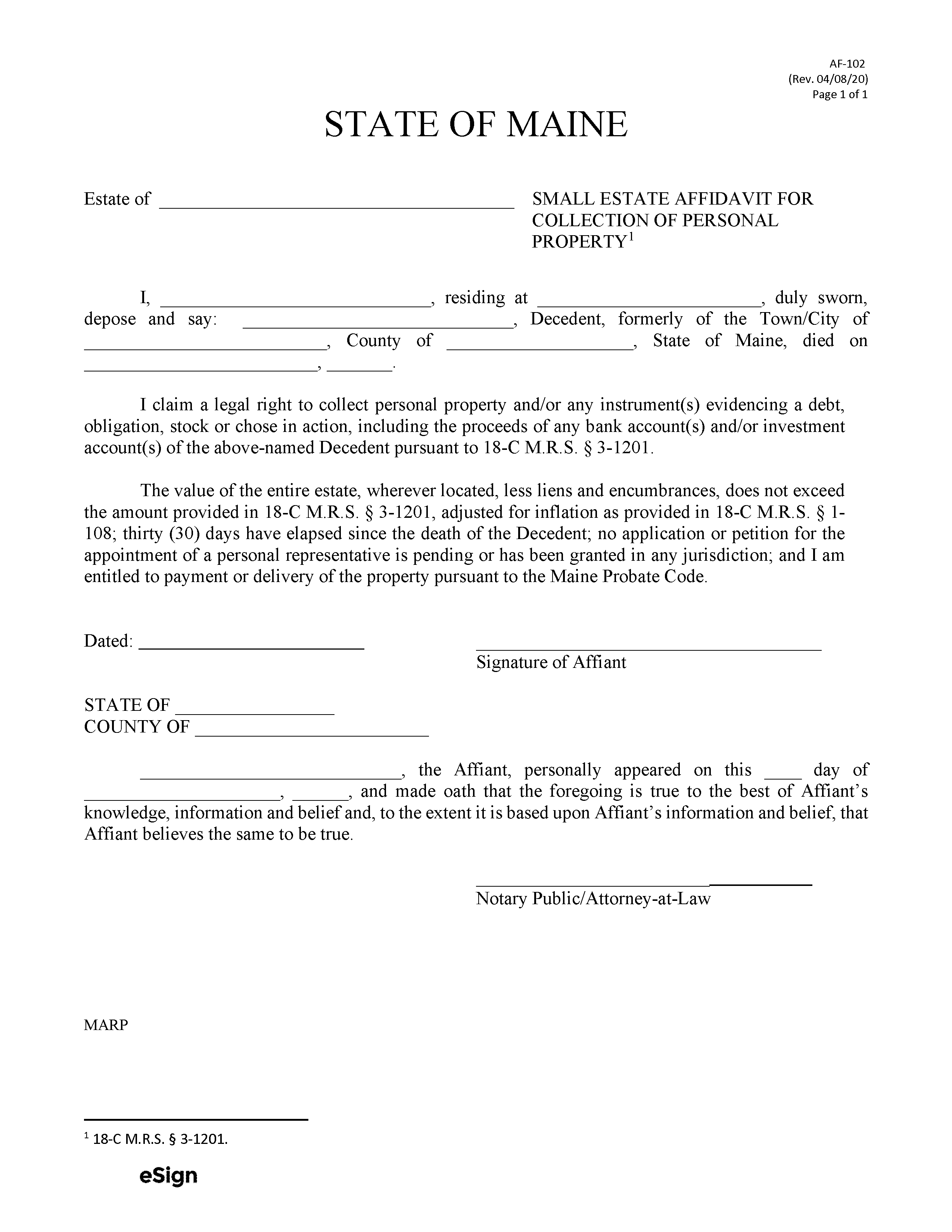

The affiant must fill out the Affidavit of a Small Estate and sign it in the presence of a notary public. Once executed, genuine copies of the death certificate and, if applicable, the decedent’s last will and testament must be attached.

Step 3 – File Affidavit with Probate Court

The affidavit and supporting documents must be filed with the decedent’s local probate court for a $15 filing fee (§ 1-602(2)(R)). Filing can also be completed online (see instructions).

Step 4 – Collect Assets

To collect the decedent’s assets, the affiant will need to present a copy of the affidavit to the asset holder and request that the property be released. The holder will then be obligated by law to transfer possession of the assets to the affiant.

Additional steps must be taken to transfer or sell the decedent’s vehicle (if any) to someone else. This process varies depending on whether the inheritor is a surviving spouse, heir, or joint owner; the requirements for transferring a vehicle title after death title can be found on the Bureau of Motor Vehicles website.