Laws

- Statute: Ch. 524, Art. 3, Part 12

- Maximum Estate Value (§ 524.3-1201(a)(1)): $75,000, less liens and encumbrances

- Mandatory Waiting Period (§ 524.3-1201(a)): Thirty (30) days

- Where to File: Not mentioned in state statutes.

How to Record (4 Steps)

- Step 1 – Small Estate Requirements

- Step 2 – Complete an Affidavit

- Step 3 – Wait 30 Days

- Step 4 – Collect Property

Step 1 – Small Estate Requirements

Claiming personal property using an affidavit is only possible if the following statements are true (§ 524.3-1201(a)):

- The total value of the entire estate, subtracting any liens and encumbrances, is not greater than $75,000.

- No petition or application has been submitted to the court to appoint a personal representative.

- The claiming successor is the next rightful owner of the property.

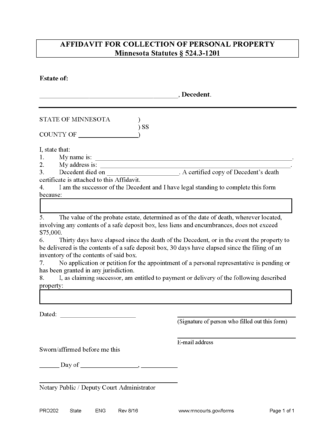

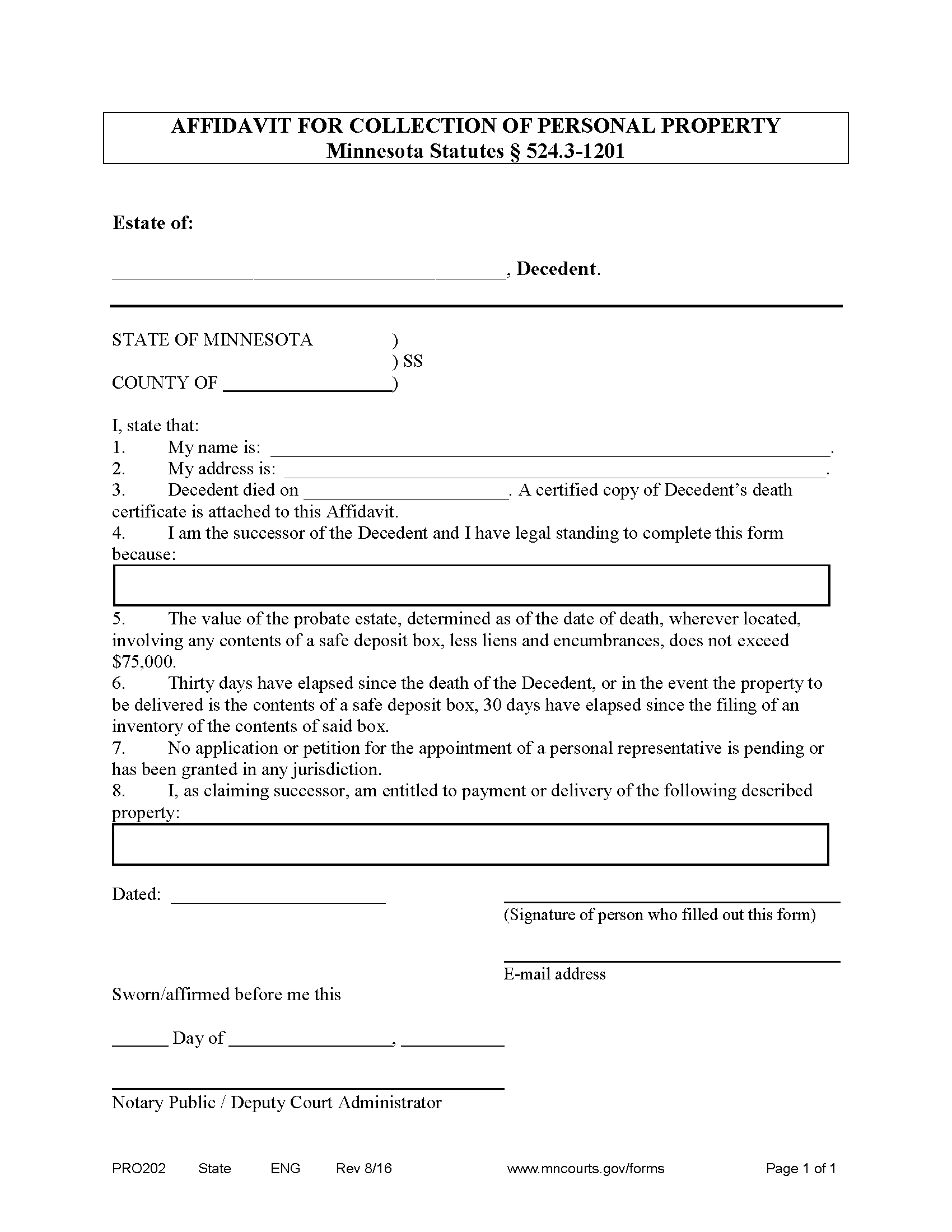

Step 2 – Complete an Affidavit

The person claiming property through the affidavit, called the “affiant,” must complete the Affidavit for Collection of Personal Property and sign it in the presence of a notary public or deputy court administrator. A certified death record must be attached to the affidavit.

Step 3 – Wait 30 Days

Before the affiant can exercise their right to collect small estate assets, they must wait until thirty (30) days have passed since the decedent’s death. If collecting property stored in a safe deposit box, the affiant must instead wait until thirty (30) days have passed from the filing of an inventory of the contents held in the safe deposit box.

Step 4 – Collect Property

The affiant must deliver the notarized affidavit (including a certified death record) to any person or entity holding the decedent’s personal property. Under Minnesota statute § 524.3-1202, the party in possession of the property will be obligated to release the claimed asset to the affiant.

Note: Additional steps may be required if transferring ownership of a motor vehicle (see DVS website for instructions).