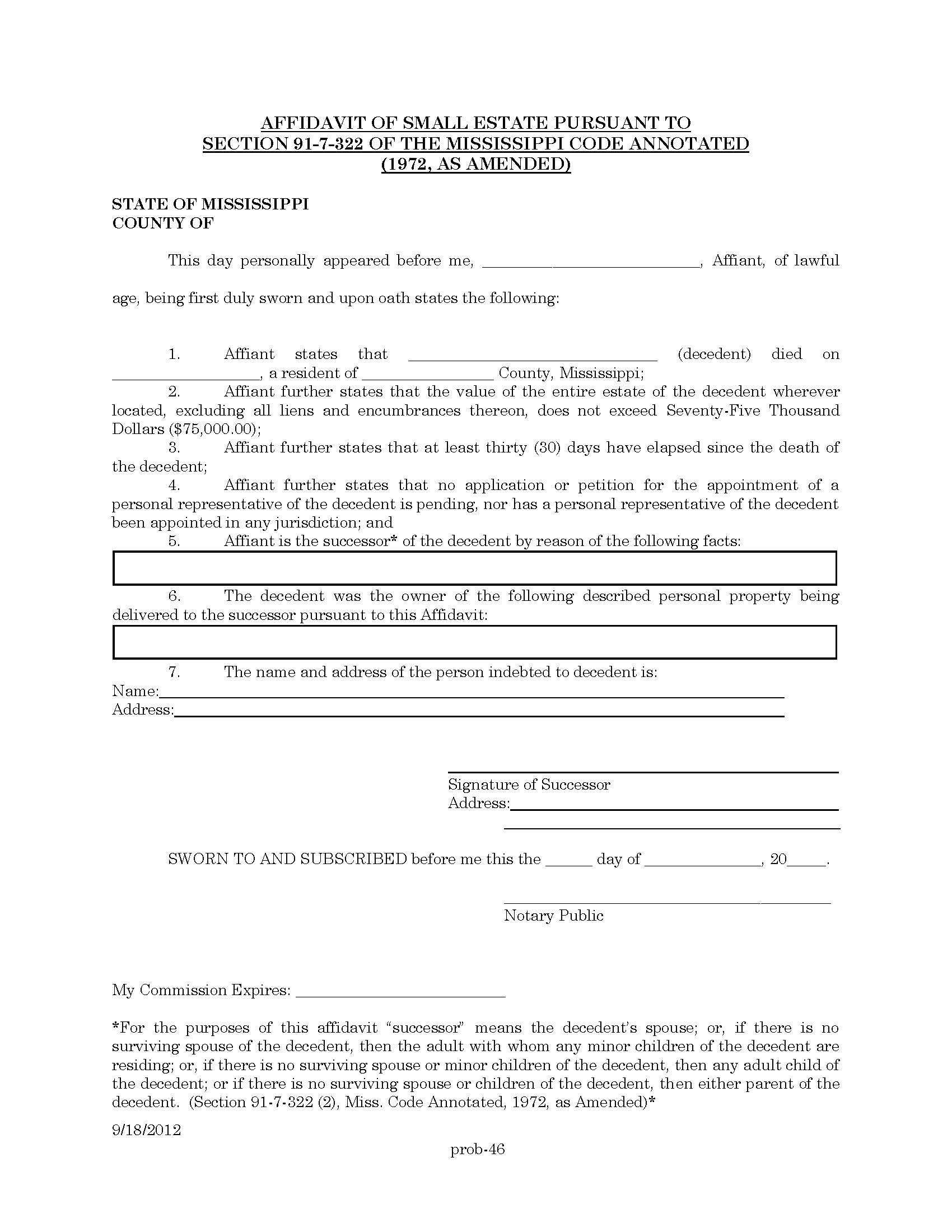

Laws

- Statute: § 91-7-322

- Maximum Estate Value (§ 91-7-322(1)(a)): $75,000, excluding liens and encumbrances

- Mandatory Waiting Period (§ 91-7-322(1)(b)): Thirty (30) days

- Where to File: Not mentioned in state statutes.

How to Record (4 Steps)

- Step 1 – Small Estate Conditions

- Step 2 – Determine Successorship

- Step 3 – Prepare Affidavit

- Step 4 – Obtain Property

Step 1 – Small Estate Conditions

A small estate affidavit can be used to claim personal property left by the decedent so long as the estate satisfies the following statutory requirements (§ 91-7-322(1)):

- The decedent has been deceased for at least thirty (30) days.

- The total value of the decedent’s assets is not greater than $75,000, excluding all liens and encumbrances.

- A personal representative has not been designated by the court, and no application or petition for appointment is pending.

Step 2 – Determine Successorship

The person who drafts the affidavit, known as the “affiant,” must be a successor to the property they intend to collect. According to § 91-7-322(2), the order of successorship is as follows:

- The surviving spouse;

- If no surviving spouse, then the decedent’s children;

- If no surviving spouse or children, then the decedent’s grandchildren; or

- If no surviving spouse, children, or grandchildren, then either of the decedent’s parents or any sibling.

Step 3 – Prepare Affidavit

The affiant must complete the Affidavit of Small Estate and sign the form in the presence of a notary public. Once prepared, the affiant should attach to the document copies of the death certificate and, if applicable, the decedent’s last will and testament.

Note: If there are multiple successors, an affidavit must be signed and notarized by each additional individual.

Step 4 – Obtain Property

To obtain assets in the estate, the affiant must present the affidavit to the person or entity who possesses the property or is indebted to the decedent. The asset holder will be required by § 91-7-322(1) to relinquish the property or make payment to the affiant.

Note: Ownership of a vehicle may be transferred by filing an Affidavit of Heirship for Motor Vehicle with the County Tax Collector (only applicable if the decedent’s will hasn’t been probated).