Laws

- Statute: Title 72, Ch. 3, Part 11

- Maximum Estate Value (§ 72-3-1101(1)(a)): $50,000, less liens and encumbrances

- Mandatory Waiting Period (§ 72-3-1101(1)(b)): Thirty (30) days

- Where to File: Not mentioned in state statutes.

How to Record (3 Steps)

Step 1 – Small Estate Conditions

Personal property left by a decedent (the deceased person) can be collected using the small estate process. According to § 72-3-1101(1), this legal process is only applicable if the following is true:

- The value of the entire estate is not greater than $50,000, subtracting any liens or encumbrances.

- Thirty (30) or more days have passed from the date of death.

- The successor is entitled to the property being claimed.

- The court has not appointed a personal representative, and there is no application or petition for appointment pending.

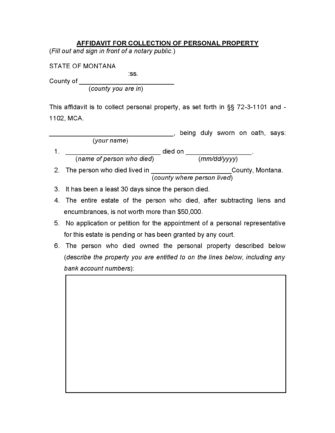

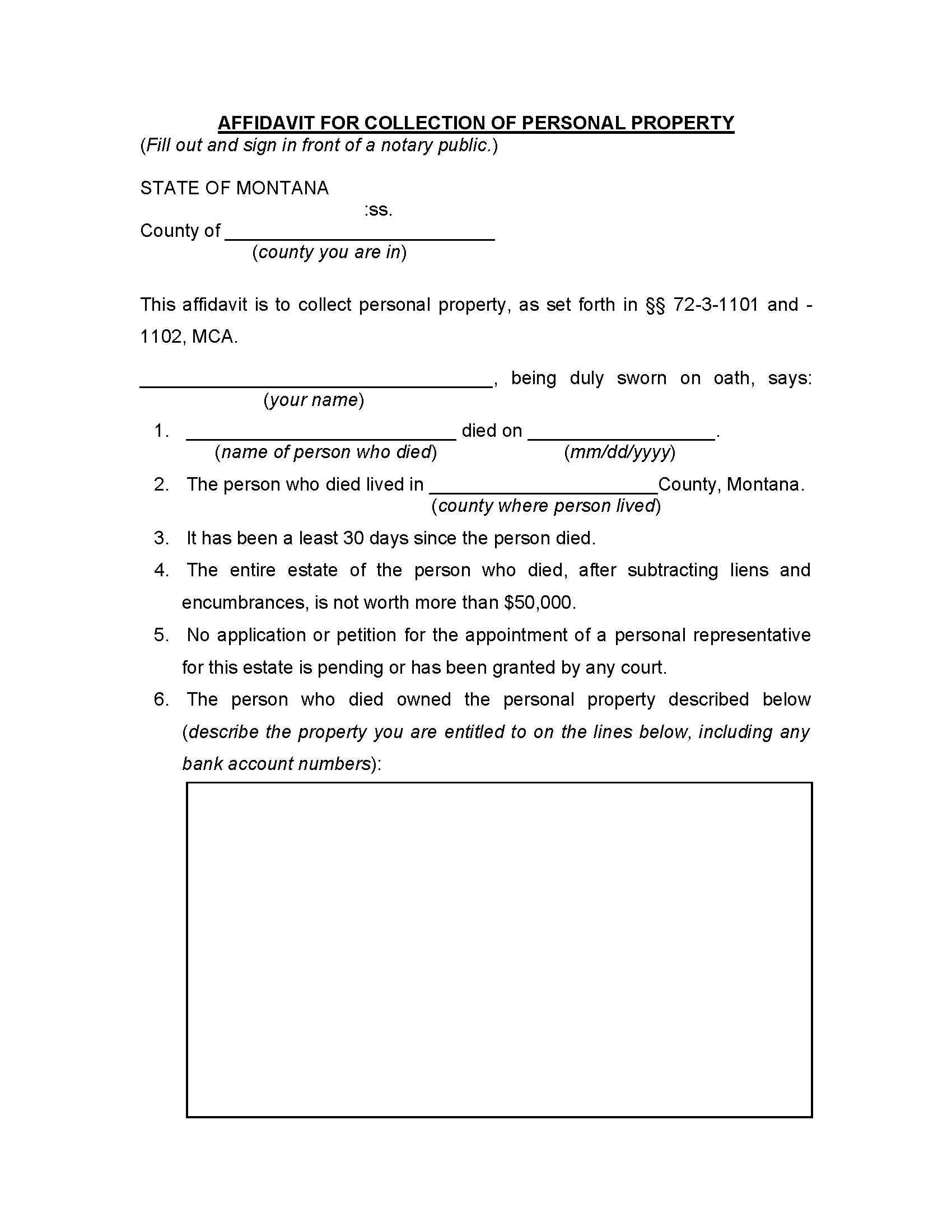

Step 2 – Complete the Affidavit

An Affidavit for Collection of Personal Property must be filled out, signed, and dated in the presence of a notary public. The person who completes the affidavit, called the “affiant,” is the only successor named in the document. If there are multiple successors to the decedent’s estate, each additional individual must complete a separate affidavit. A copy of the death certificate should be attached to the notarized document.

Note: The affiant should make enough copies of the affidavit to distribute to each holder of the decedent’s property.

Step 3 – Collect Personal Property

The affiant will need to give a copy of the affidavit to each current property custodian (i.e., the individual or entity holding the decedent’s assets). The property custodian shall then release the property to the affiant. If transferring a motor vehicle, the affiant must file an Application for Title by Non-Probate Transfer with the Montana Department of Justice – Motor Vehicle Division and pay the filing fee.