Laws

- Statute: Chapter 28A, Article 25

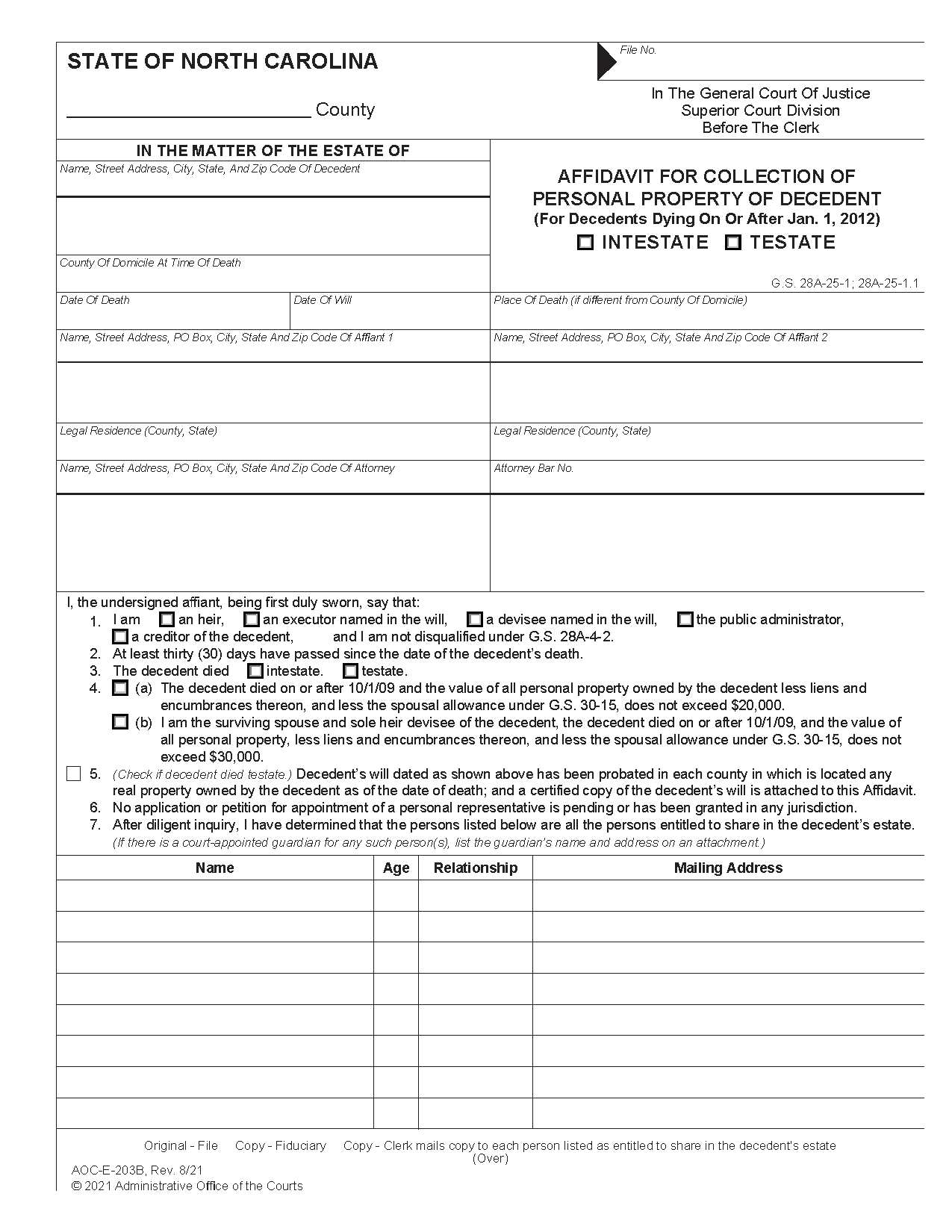

- Maximum estate value (§ 28A-25-1(a)): $20,000 (or $30,000 if the decedent’s surviving spouse is the sole heir), less liens and encumbrances.

- Mandatory waiting period (§ 28A-25-1(a)(4)): Thirty (30) days

- Where to file: The affidavit must be filed in the Superior Court clerk’s office of the county where the decedent resided at the time of death (§ 28A-25-1(b)).

How to File (3 Steps)

Step 1 – Verify Requirements

An Affidavit for Collection of Personal Property of the Decedent can only be used if the following requirements are met:

- The estate has a total value (less liens and encumbrances) not exceeding $20,000, or $30,000 if the affiant is the decedent’s surviving spouse and sole heir.

- Thirty (30) days have elapsed since the date of death.

- An application or petition for the appointment of a personal representative is not pending or has not been granted.

- The affiant is the decedent’s heir, creditor, or a person claiming to be the public administrator (as outlined in § 28A-12-1).

Step 2 – File Affidavit

The completed Affidavit for Collection of Personal Property of the Decedent must be signed before a notary public. The affiant will need to pay the fees outlined in § 7A-307 and file the affidavit in the office of the Superior Court clerk in the county where the decedent resided. If the decedent died testate, a certified copy of their will should be attached to the form.

If the affiant is not a resident of North Carolina, they will need to appoint an agent (within North Carolina) using the Appointment of Resident Process Agent (Form AOC-E-500). The agent will need to sign the completed form before a notary public and file the form in the office of the Superior Court clerk.

Once all the required documentation is received, the clerk will send a copy of the affidavit to the entitled parties.

If the decedent’s surviving spouse is the sole heir, they may instead complete the Application for Probate and Petition for Summary Administration (Form AOC-E-905) which will allow them to inherit the decedent’s entire estate.

Step 3 – Collect and Distribute Property

The certified affidavit and a copy of the death certificate must be presented to each party in possession of the decedent’s property, at which point they will be legally obligated to transfer the property to the affiant.

After the estate has been transferred, the affiant must file the Affidavit of Collection, Disbursement, and Distribution (Form AOC-E-204) with the clerk of the Superior Court within ninety (90) days after filing the initial affidavit in Step 2 (§ 28A-25-3(a)(2)).

The order of priority in which the estate is distributed is as follows (§ 28A-25-3(a)(1)):

- Payment of the surviving spouse and child’s allowance outlined in § 30-15 and § 30-17.

- Expenses, debts, and claims against the estate (§ 28A-19-6)

- Persons in the decedent’s will or entitled to the decedent’s property under the Intestate Succession Act.