Laws

- Statute: Chapter 30.1 – 23

- Maximum estate value (§ 30.1-23-01(1)(a)): $50,000, less liens and encumbrances

- Mandatory waiting period (§ 30.1-23-01(1)(b)): Thirty (30) days

- Where to file: Not mentioned in state statutes.

How to Record (3 Steps)

Step 1 – Affidavit Requirements

The estate must meet the following requirements (as stated in § 30.1-23-01 and the State of North Dakota Courts website) to be eligible for an Affidavit for Collection of Personal Property of the Decedent:

- The estate’s total value (less debts and liens) does not exceed $50,000.

- Real property is not a part of the estate.

- There is no ongoing or completed probate case for the estate.

- At least thirty (30) days have passed since the decedent’s death.

- There is no pending or granted petition or appointment of a personal representative.

- The affiant is the rightful heir of the property they are claiming by will or intestate succession.

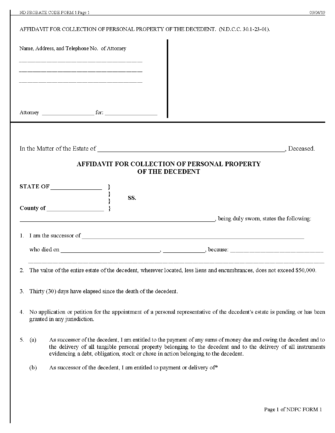

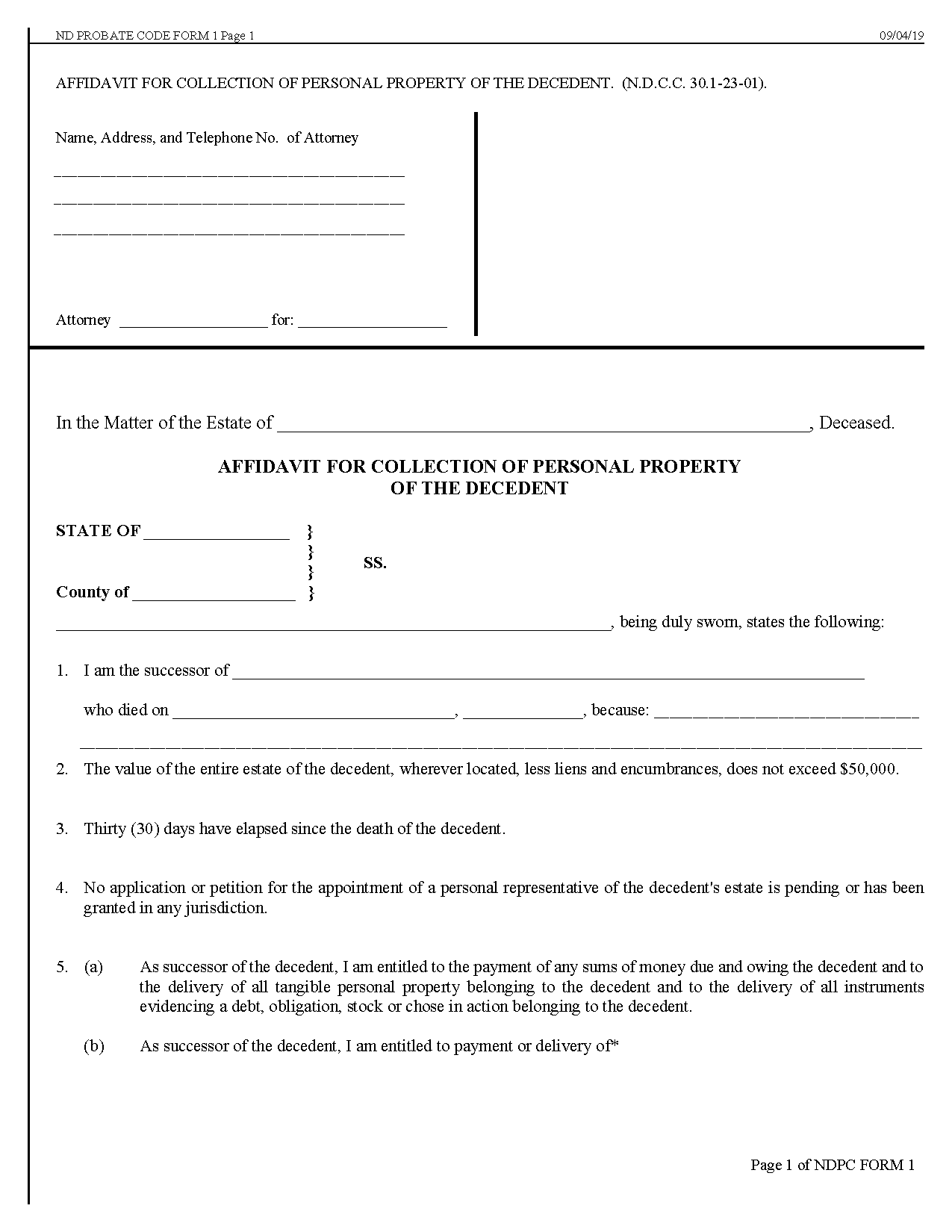

Step 2 – Complete Affidavit

Those seeking to obtain property from qualifying estates must complete the Affidavit for Collection of Personal Property of the Decedent. The affidavit must be completed in the presence of a notary public, but does not need to be filed with any court.

Vehicles can only be collected with the Affidavit for Collection of Personal Property of the Decedent (Form SFN 2916) provided by the North Dakota Department of Transportation. The form must be filed at a Motor Vehicle office (select the district in the dropdown menu) by booking an appointment online or calling toll free at 1-855-633-6835.

Step 3 – Collect Property

A signed and notarized copy of the affidavit must be given to each party holding the decedent’s property. Upon being served the affidavit, they are obligated to transfer the property over to the successor.