Laws

- Statute: § 45-3-1201

- Maximum estate value (§ 45-3-1201(1)): $50,000, less liens and encumbrances

- Mandatory waiting period (§ 45-3-1201(2)): Thirty (30) days

- Where to file: Not mentioned in state statutes.

How to Record (3 Steps)

Step 1 – Affidavit Criteria

An Affidavit for Collection of Personal Property of the Decedent can be used if the claimant verifies the following:

- The total value of the decedent’s estate does not exceed $50,000, less liens and encumbrances.

- Thirty (30) days have passed since the decedent’s death.

- There is no pending or granted application or petition for an appointment of a personal representative.

- The claimant is entitled to the payment or property they intend to collect.

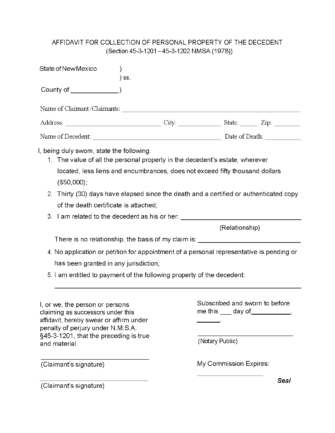

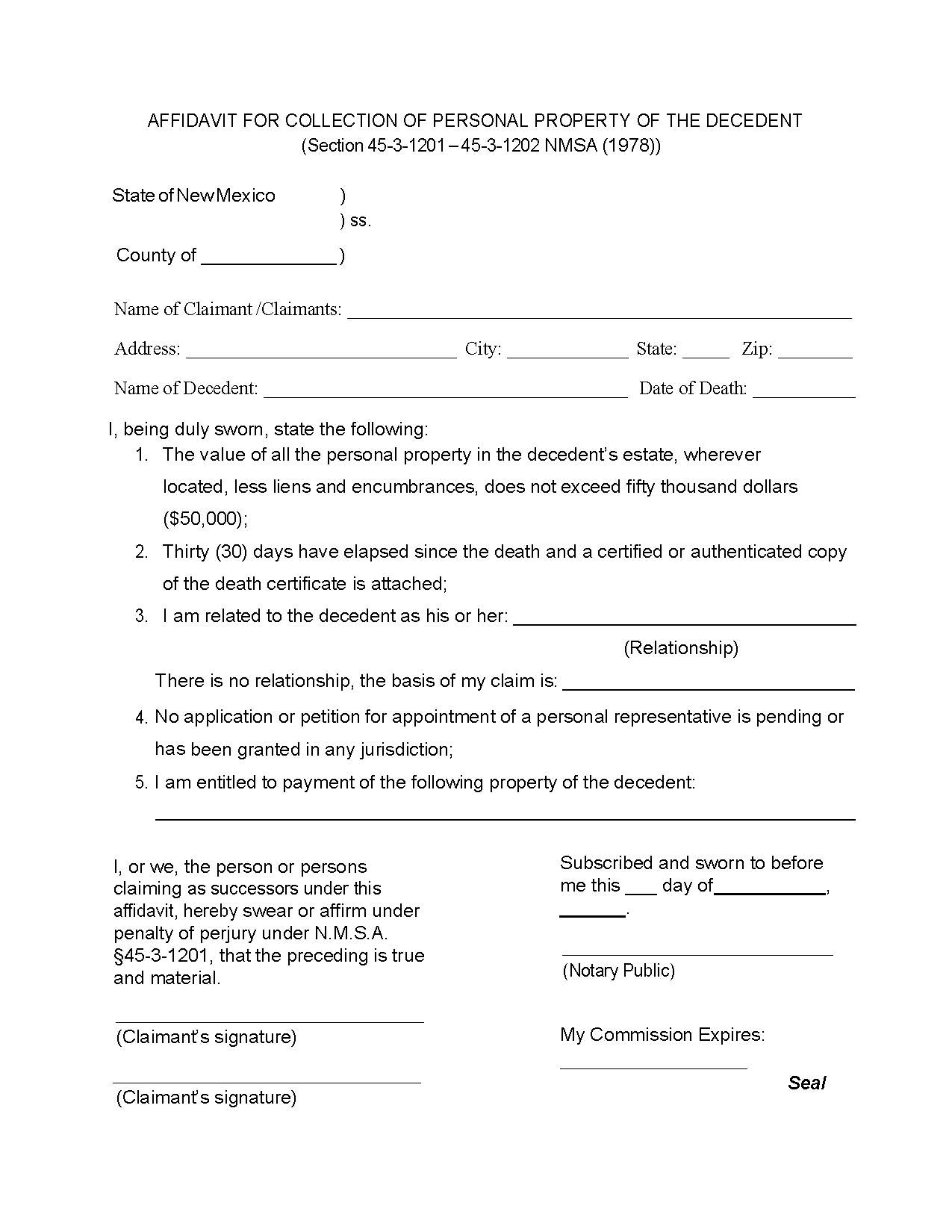

Step 2 – Complete Affidavit

The claimant should execute the Affidavit for Collection of Personal Property of the Decedent in the presence of a notary public and attach a certified or authenticated copy of the decedent’s death certificate. If the claimant is seeking to claim a vehicle, they should complete the Affidavit of Claiming Successor (MVD- 10013) form provided by the New Mexico Motor Vehicle Division.

Note: The affidavit cannot be used to transfer real estate. The claimant may only inherit real estate without probate if there is an existing Transfer on Death Deed.

Step 3 – Collect Property

The completed and notarized document and death certificate should be provided to the party in possession of the decedent’s property. Upon being served the affidavit, that party must deliver to the claimant the payment, property, or instrument evidencing a debt, obligation, stock, or chose in action indicated in the form.