Laws

- Statute: Title 58, Chapter 8, Section 393

- Maximum Estate Value (§ 393(A)(1)): $50,000, less liens and encumbrances

- Mandatory Waiting Period (§ 393(A)): Ten (10) days

- Where to File: Not mentioned in state statutes.

How to Record (3 Steps)

Step 1 – Check Requirements

A small estate affidavit will allow the affiant to collect the decedent’s assets from another party without involving the court. Before using the affidavit, the affiant must ensure the following is true (§ 393):

- Ten (10) days have passed since the decedent’s death.

- The estate’s total value is $50,000 or less, not including liens and encumbrances.

- The estate’s taxes and debts have been provided for or are barred by limitations.

- A personal representative has not been appointed and there is no application/petition pending for the appointment thereof.

- The affiant is the rightful successor to the assets they are claiming.

Step 2 – Complete Affidavit

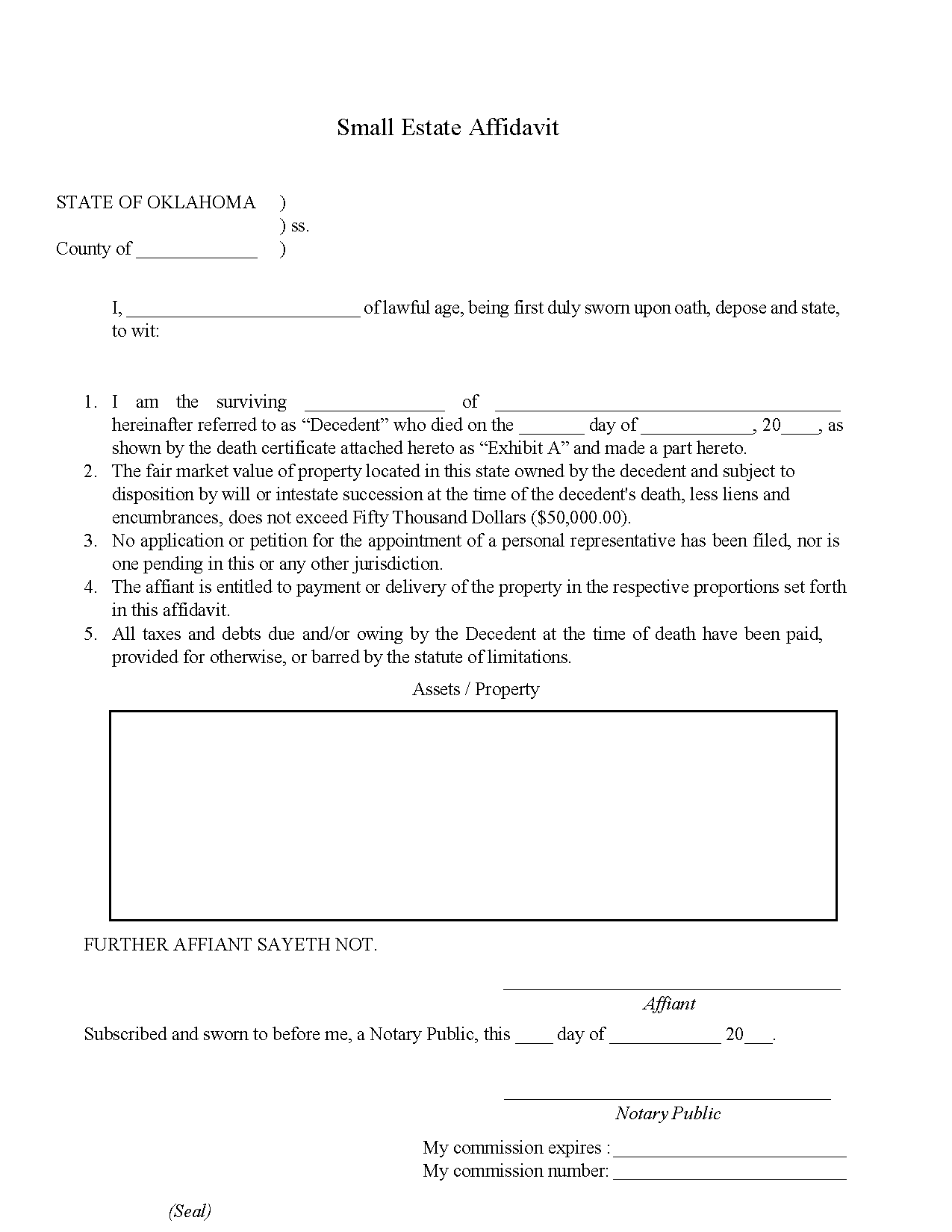

The affiant must indicate in the Small Estate Affidavit the assets they are claiming, then execute the affidavit before a notary public. If the affiant is seeking to collect a vehicle, they should use the Small Estate Affidavit (Form MVC-405) provided by the Oklahoma Tax Commission – Motor Vehicle Division.

If the decedent died intestate, up to $50,000 of their deposit account may be transferred to a successor upon affidavit with the Small Estate Affidavit for financial accounts (§ 906).

Step 3 – Collect Assets

The affidavit does not need to be filed in any office and can be presented directly to the asset holder. Any party in possession of the decedent’s assets must transfer it to the affiant upon being served the affidavit.