Laws

- Statute: Title 62, Article 3, Part 12

- Maximum Estate Value (§ 62-3-1201(a)(1)): $45,000

- Mandatory Waiting Period (§ 62-3-1201(a)) Thirty (30) days

- Where to File (§ 62-3-1201(a)(6)): Probate Court

How to File (3 Steps)

- Step 1 – Requirements

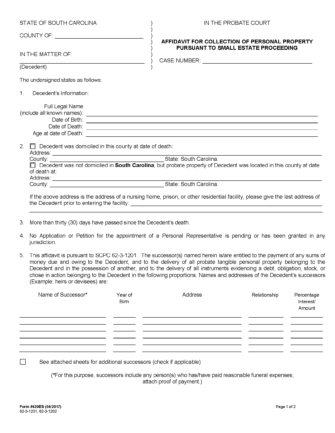

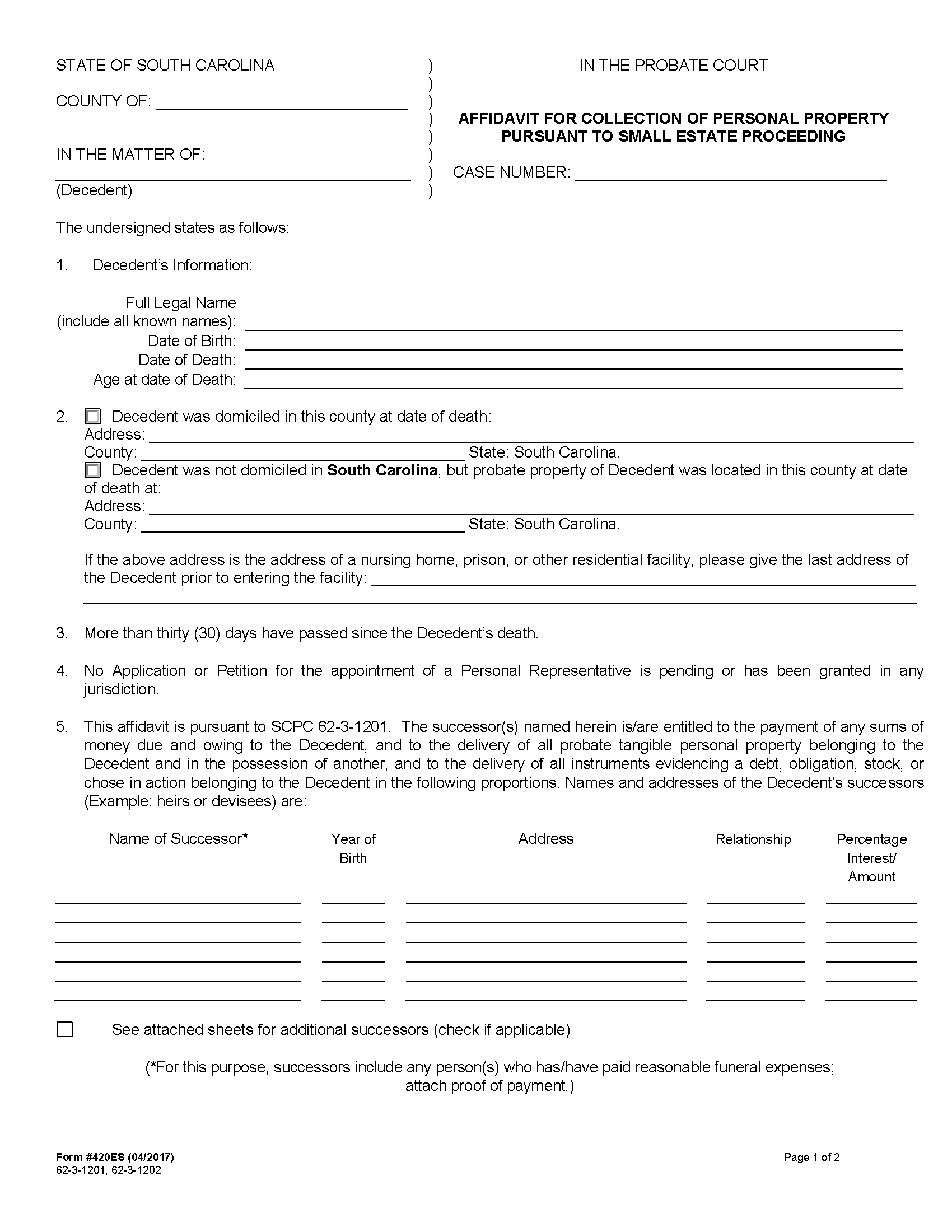

- Step 2 – Complete and File Affidavit

- Step 3 – Judge’s Approval and Collection of Assets

Step 1 – Requirements

If the successors of a decedent wish to file the Affidavit for Collection of Personal Property Pursuant to Small Estate Proceeding, they must ensure that the following is true and stated in the affidavit form:

- At least thirty (30) days have elapsed since the decedent’s death.

- The total value of the estate does not exceed $45,000 and doesn’t include any interest in real property.

- No personal representative has been named, and no application or petition is pending.

- The person who paid for reasonable funeral expenses is designated as a claiming successor.

Step 2 – Complete and File Affidavit

Providing the above statements are true, the claiming successor can complete the affidavit including all information contained in Step 1, and attach the original will (if any), and death certificate. They must also list the names of any other successors that have claimed the decedent’s property, and the description and value of the property being claimed. Finally, the value of any liens or encumbrances against the estate must be stated with attached proof.

Once completed and notarized, the affidavit may be filed with the local probate court.

Step 3 – Judge’s Approval and Collection of Assets

After the affidavit is filed, it will be reviewed by a probate court judge. If approved, the judge will detail the estate’s successors and the percentage they are each entitled to. The original affidavit will be kept with the court while a copy of a court-approved affidavit will be given to the successors to retrieve the decedent’s personal property and distribute it accordingly.