Laws

- Statute: Chapter 205. Small Estate Affidavit

- Maximum estate value (§ 205.001(3)): $75,000

- Mandatory waiting period (§ 205.001(1)) Thirty (30) days

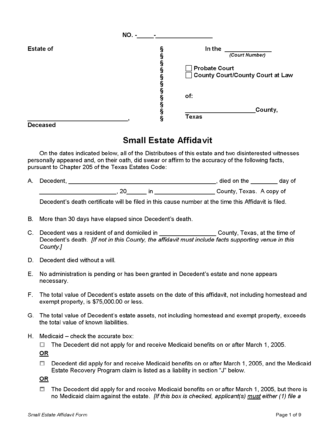

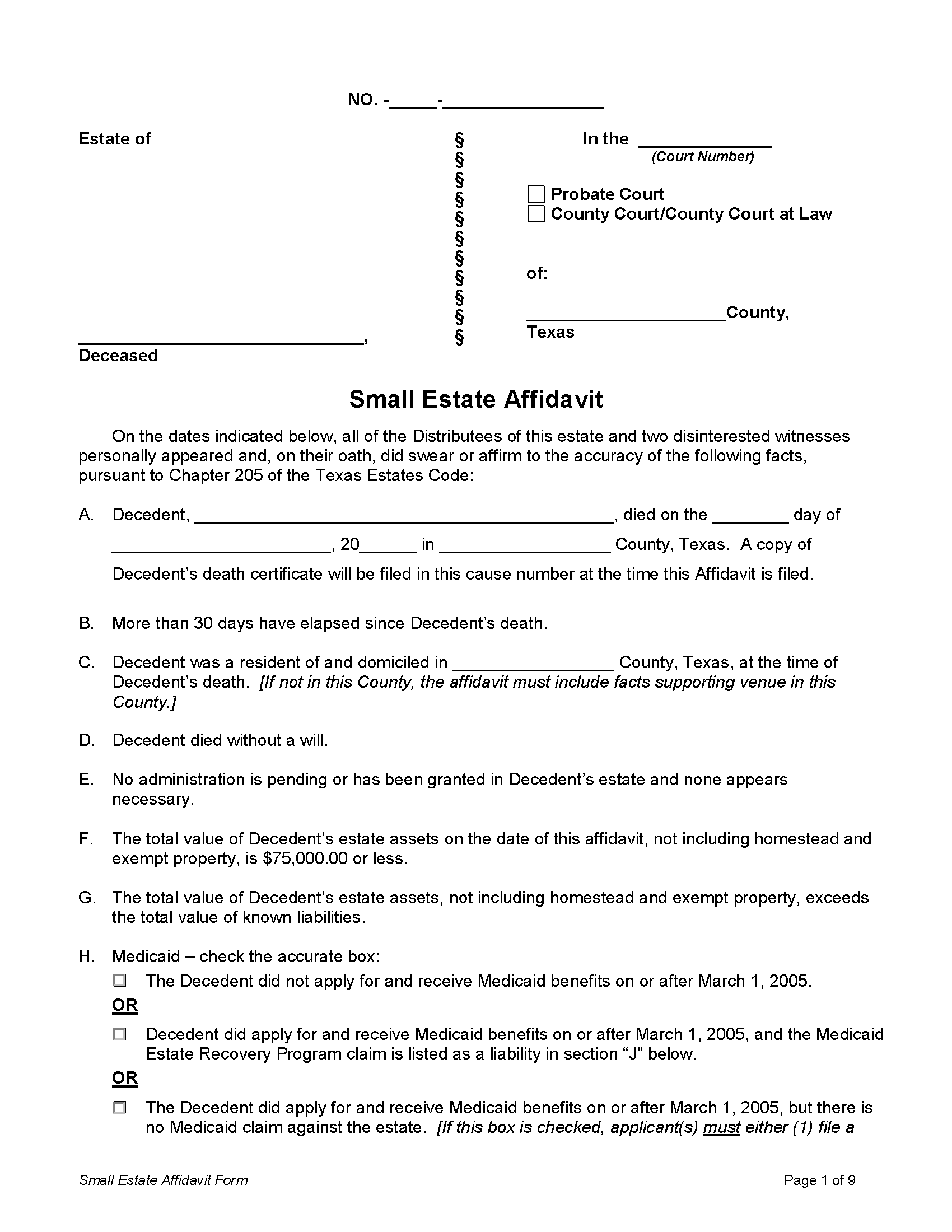

- Where to file: County Probate Court

How to File (3 Steps)

Step 1 – Qualifications

In order to qualify for the distribution of an estate through a small estate affidavit, the following must apply:

- The deceased individual died without a known will.

- At least thirty (30) days have passed since the death of the individual.

- The only real property included in the affidavit is a homestead.

- The total value of the estate (excluding a homestead and personal property exemption as defined in § 42.002(a)) does not exceed $75,000.

- The total value of the estate exceeds its debts.

- No personal representative has been appointed, nor is a petition pending.

- No administration is pending, granted, or appears necessary.

Step 2 – Complete Affidavit

If the aforementioned qualifications have been met, the Small Estate Affidavit can be completed by any distributee (heir). The document must be signed by every distributee, be notarized, and it must be witnessed by two (2) disinterested parties.

The completed form must also include:

- A list of all assets and liabilities and any exempt assets.

- The names and addresses of each distributee.

- A relevant family history explaining heirship.

Once completed, the document may be filed with the local County Probate Court.

Note: An Affidavit of Heirship for a Motor Vehicle must be submitted to the Texas Department of Motor Vehicles if ownership of a vehicle is to be transferred to an heir.

Step 3 – Distribute Assets

After the affidavit is submitted to the court, it will be reviewed by a judge. If approved, a copy of the affidavit should be provided to any person or entity that owes the estate money or is in possession of estate property. A copy must also be furnished to any individual acting as a fiduciary or transfer agent to anything belonging to the estate. The assets will then be distributed to the heirs as detailed in the affidavit.

If the affidavit is used to transfer the title of a homestead, it must be recorded in the deed records in the county where the homestead is located.