Laws

- Statute: § 75-3-12

- Maximum Estate Value (§ 75-3-1301(1)(a)): $100,000

- Mandatory Waiting Period (§ 75-3-1301(1)(b)): Thirty (30) days

- Where to File: No filing requirements.

How to Record (3 Steps)

Step 1 – Requirements

A successor (or their authorized agent) of a decedent may use this affidavit as long as the following requirements are met:

- The entire estate is valued at less than $100,000, not including vehicles (up to four (4) total).

- At least thirty (30) days have elapsed since the decedent’s passing.

- No application or petition has been made to the court to appoint a personal representative.

- The successor filing the affidavit is entitled to payment or delivery of the decedent’s property.

Note that this affidavit may not be used to transfer real estate.

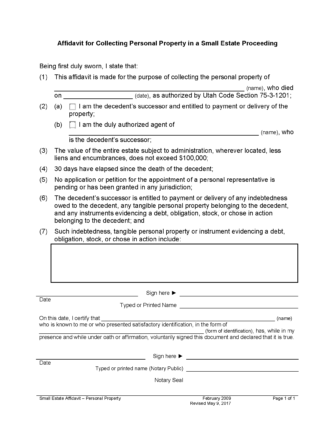

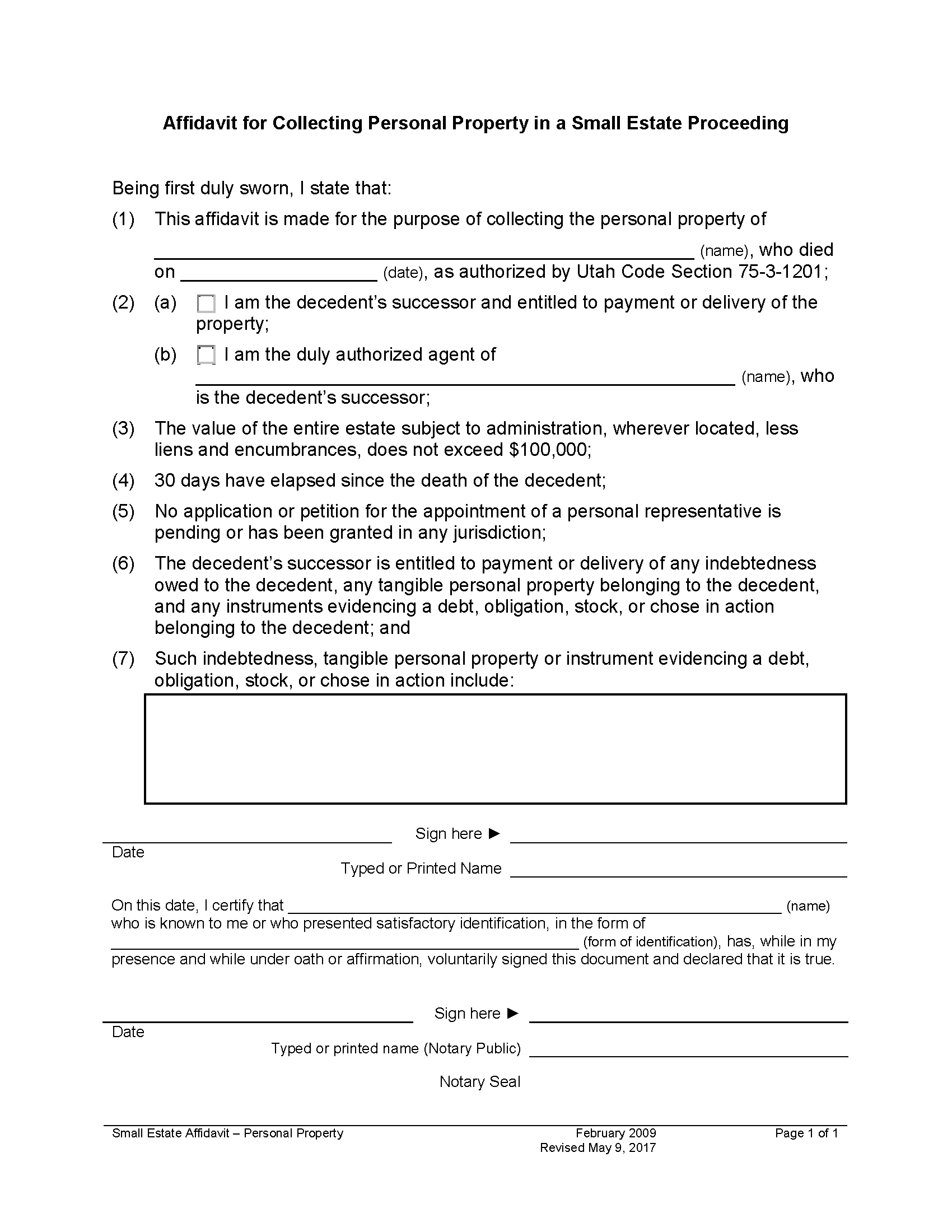

Step 2 – Complete Affidavit

Providing that the estate qualifies for collection via affidavit, the successor or their authorized agent may fill out the Affidavit for Collecting Personal Property in a Small Estate Proceeding. This document must be notarized.

If the successor wishes to claim a vehicle, boat, trailer, or semi-trailer, they may use the Survivorship Affidavit document and submit it to the Department of Motor Vehicles (DMV).

Step 3 – Collect Assets

Once complete, the successor may present the affidavit to the custodian of any of the decedent’s property that they are entitled to and collect the property of the deceased. In the event the custodian refuses to deliver or transfer the property, the successor may choose to file legal action against that custodian, who may be liable for up to three (3) times the value of the property in damages in addition to legal fees.