Laws

- Statute: Article 1: Virginia Small Estate Act

- Maximum Estate Value (§ 64.2-601(A)(1)): $50,000

- Mandatory Waiting Period (§ 64.2-601(A)(2)): Sixty (60) days

- Where to File: No filing requirements.

How to Record (3 Steps)

Step 1 – Requirements

In order for the decedent’s successors to claim the estate’s small assets, the following requirements must be met:

- At least sixty (60) days have passed since the decedent’s death.

- The decedent’s estate does not exceed $50,000 in value at the time of their death.

- If the decedent had a will, it has been admitted to probate at the circuit court in the county where the decedent lived.

- No application is pending or granted for the appointment of a personal representative.

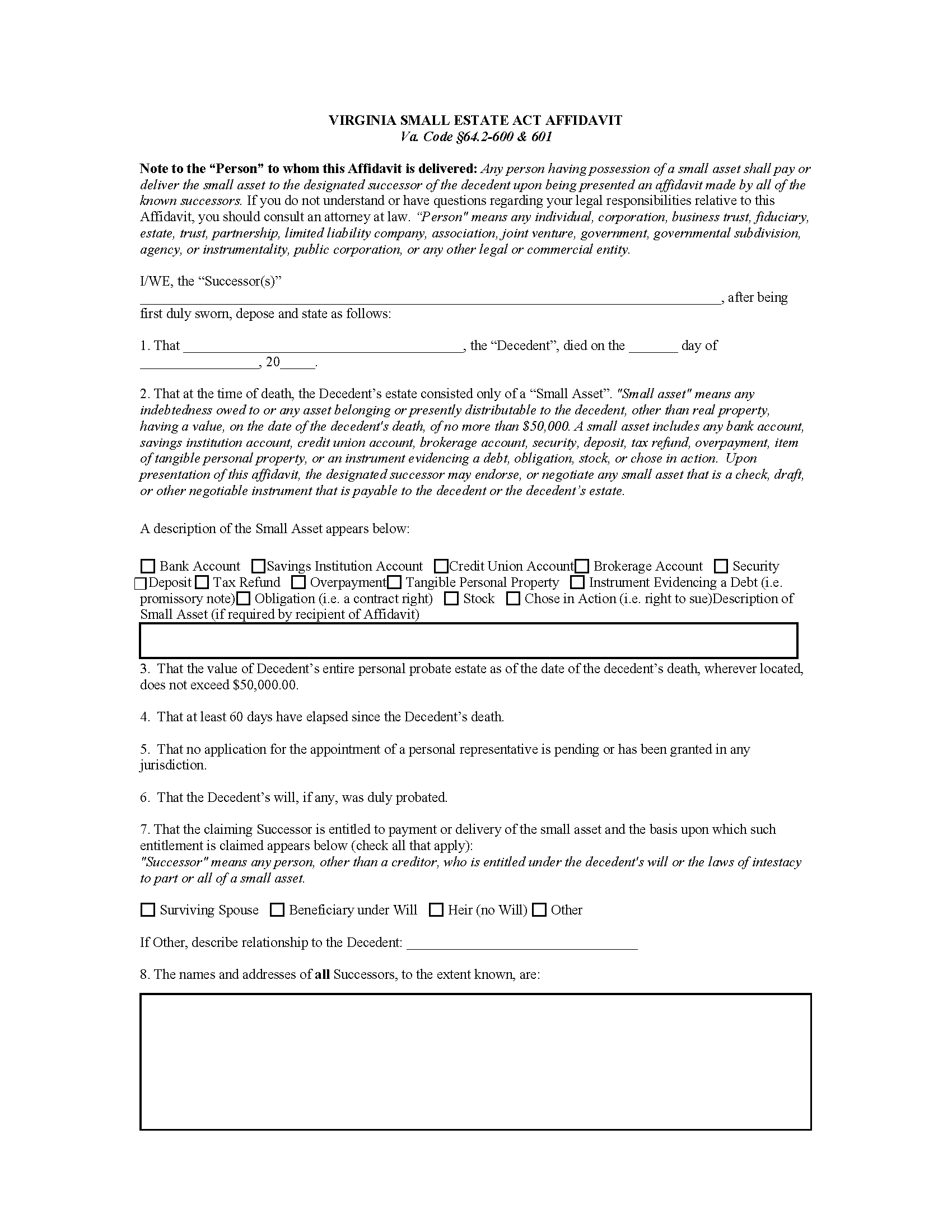

Step 2 – Complete Affidavit

The successor(s) of the decedent must complete the Virginia Small Estate Act Affidavit and have it notarized. The affidavit must state:

- That the claiming successor is entitled to the small asset.

- All names and addresses of any known successors.

- The name of each designated successor; i.e., a successor authorized to collect payment/assets on behalf of the other successors.

The affidavit must also state a description of the type of small asset the successor is entitled to, (e.g., bank account, personal property, stock, etc.). This document may be used to collect a single asset, and the designated successors may need to complete separate affidavits to collect all of the decedent’s assets.

The completed affidavit may be delivered to any party possessing a small asset that the successors are entitled to.

Step 3 – Distribute Assets

The designated successors receiving payment or assets have the duty to deliver, safeguard, or pay the asset to the successors in accordance with Virginia law. In accordance with § 64.2-601(B), a designated successor may manage the payment or delivery of a small asset to a disabled or incapacitated successor by paying it to said successor’s guardian, conservator, or custodian, or by managing it on their behalf.