Laws

- Statute: Chapter 11.62. Small Estates – Disposition of Property

- Maximum Estate Value (RCW 11.62.010(2)(c)): $100,000

- Mandatory Waiting Period (RCW 11.62.010(2)(d)): Forty (40) days

- Where to File (RCW 11.62.010(5)): A copy must be mailed to the State of Washington Department of Social and Health Services.

How to Record (3 Steps)

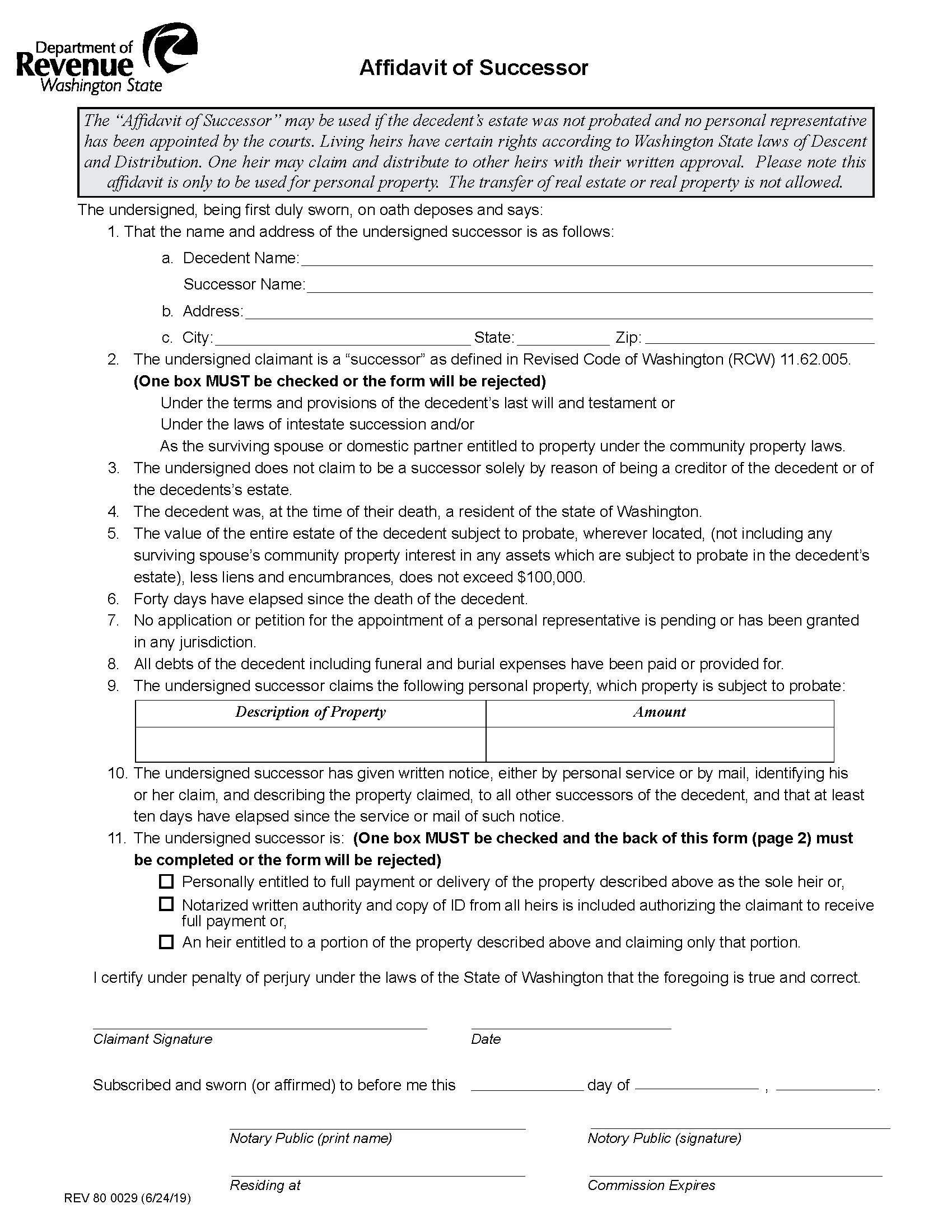

Step 1 – Requirements

Any successor (excluding creditors) may file the Affidavit of Successor. A successor is anyone entitled to claim the decedent’s property; this may include the State itself if the decedent had no heirs. Before the affidavit may be filed, the following requirements must be met:

- The decedent’s debts, including funeral and burial expenses, have been paid.

- At least forty (40) day’s have passed since the decedent’s death.

- The value of the estate does not exceed $100,000 and includes no real estate.

- No personal representative has been appointed or granted, and no application is pending.

- The successor filing the affidavit has provided written notice to all other successors that they intend to claim the property, and ten (10) days have passed since the notice was mailed or delivered.

Step 2 – Complete and File Application

As soon as the requirements in the first step have been met, the filing successor may complete the Affidavit of Successor. The successor must provide a description of the property and its value, and they must describe their claim to said property by stating that one of the following is true:

- They are the sole heir and are entitled to all payments and property,

- They have consent from all other heirs that allows the successor to collect the payments and property on their behalf; or,

- They are entitled to receive a portion of the estate and are only claiming that part.

Once complete, a notarized copy of the affidavit, the decedent’s will (if any), and the decedent’s social security number must be sent via certified mail to:

Department of Social and Health Services

Office of Financial Recovery

Box 9501

Olympia, WA 98507-9501

Note: To transfer registration of a motor vehicle, a beneficiary must submit Form TD-420-041: Affidavit of Inheritance/Litigation with the Washington State Department of Licensing.

Step 3 – Distribute Assets

The successor may provide a copy of the affidavit and the decedent’s death certificate to any transfer agent to retrieve the decedent’s property. The assets will then be distributed as detailed in the will. If there is no will, the property will be allocated based on Washington intestacy laws as stated in RCW 11.04.015.