Laws

- Statute: §44-1A-2

- Maximum Estate Value (§44-1A-2(a)(5) & §44-1A-2(a)(6)): $50,000 in personal property; $100,000 in real property.

- Mandatory Waiting Period (§44-1A-2(a)(7)):

- Thirty (30) days if the affiant is the nominated executor or personal representative.

- Sixty (60) days if the affiant is not nominated as executor or personal representative.

- Where to File (§ 44-1A-2(c)): County Clerk’s Office

How to File (3 Steps)

Step 1 – Requirements

The Affidavit for Small Estate may be used if the following applies:

- The decedent’s estate consists of small assets with a total market value not exceeding $50,000 and real estate valued at $100,000 or less.

- If there is a will and the successor is the executor or personal representative, at least thirty (30) days have passed since the decedent’s death.

- If there is no will, or if there is a will but the successor is neither the executor nor the personal representative, at least sixty (60) days have passed since the decedent’s death.

- The original will (if any) and death certificate are attached to the affidavit.

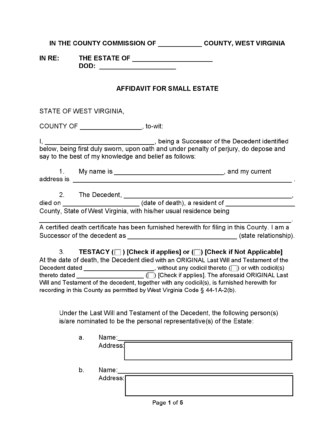

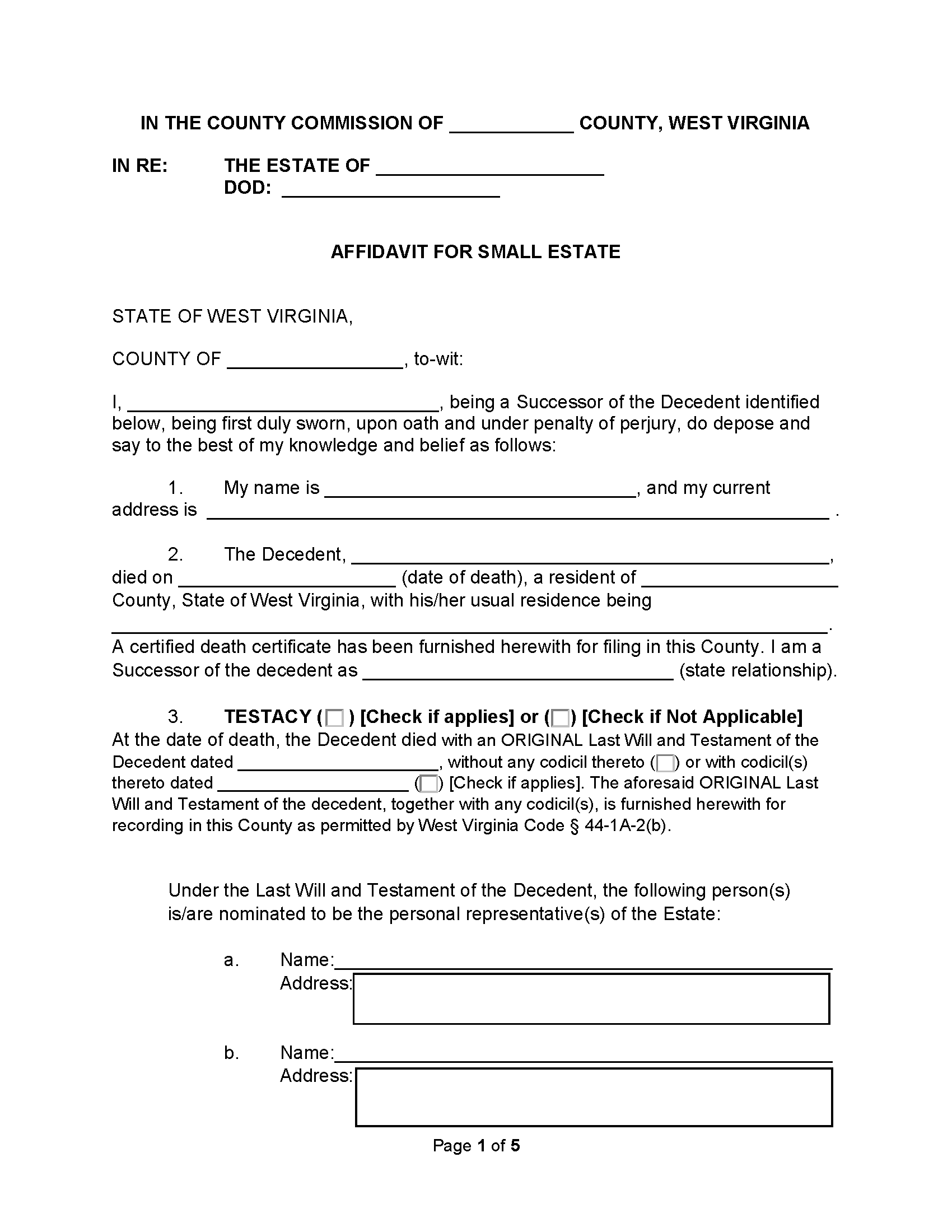

Step 2 – Complete and File Application

If the above-mentioned requirements have been met, the successor may complete and file the Affidavit for Small Estate with the County Clerk’s Office along with the original will, death certificate, and filing fees. The clerk of the county commission, or the fiduciary supervisor of the clerk, will review, inspect, record, and index the affidavit with the original will (if applicable). Any party with interest in the estate will have thirty (30) days after the filing of the affidavit to file a written objection with the clerk. The clerk with then pass on the objection to a fiduciary commissioner who will determine if the affidavit should be revoked.

Step 3 – Distribute Assets

Once the affidavit is approved, the clerk will issue a certification letter, and copies of the affidavit will be sent to all parties. The successor will then have six (6) months to administer the assets to the beneficiaries. In some cases, an extension may be granted with an application to the county clerk, but that extension may not be more than an additional six (6) months.