Laws

- Statute: Article 2

- Maximum Estate Value (§ 2-1-201(a)(i) & § 2-1-205(a)): $200,000

- Mandatory Waiting Period (§ 2-1-201(a)(ii) & § 2-1-205(a)): Thirty (30) days

- Where to File (No Real Property) (§ 2-1-201(c)): County Clerk’s Office

- Where to File (Real Property) (§ 2-1-208): District Court, or if not a resident of Wyoming, any county where part of the estate is located.

How to File (4 Steps)

- Step 1 – Requirements

- Step 2 – File Application

- Step 3 – Publish Notice (If Applicable)

- Step 4 – Summary Distribution

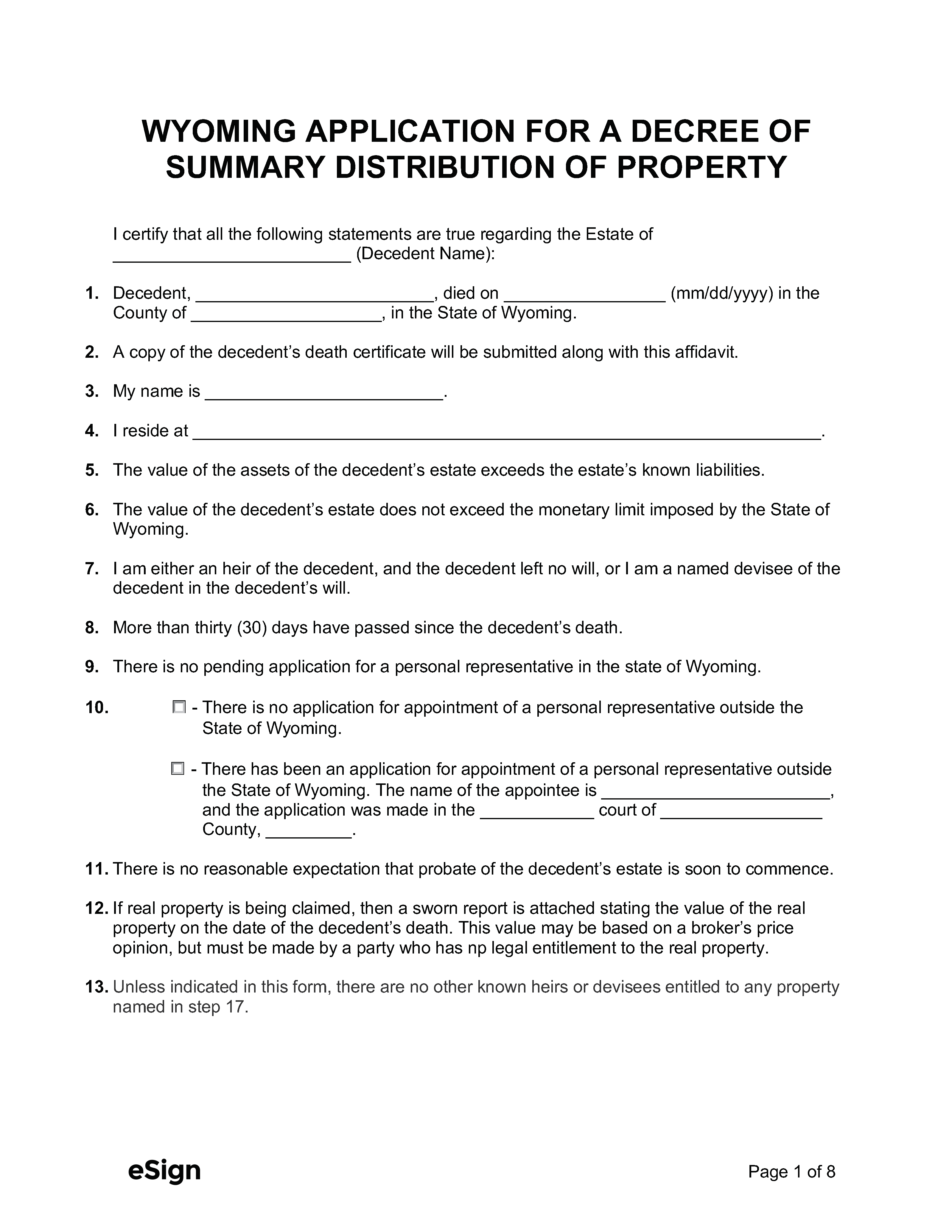

Step 1 – Requirements

The Application For a Decree of Summary Distribution of Property may be filed as long as these requirements are met:

- The entire estate (including real property) is valued at no more than $200,000 (less liens and encumbrances).

- At least thirty (30) days have passed since the decedent’s death.

- There is no application for the appointment of a personal representative pending or granted or:

- If an application for the appointment of a personal representative has been made outside the state of Wyoming, then the name and address of the appointee, date of application, name of the court, and jurisdiction that it was made in must be included in the document.

Step 2 – File Application

Once the above requirements have been met, the distributee(s) may complete the Application For a Decree of Summary Distribution of Property. The application must include a list of who the distributees are, their relationship to the decedent, the legal basis on which they claim entitlement to the property, and a statement detailing if there are other inheritors with rights to the property.

If any real property is being claimed, a description of the property (including mineral rights) should be noted on the document. A sworn statement reporting the value of the real property made by an individual with no legal interest must also be attached to the decree.

Once completed and notarized, the distributee may file the application with the local county clerk, or if there is real property claimed, the district court.

Step 3 – Publish Notice (If Applicable)

If real property is being claimed in the application and the application has been filed, notice must be published in a newspaper in the local county newspaper once a week for two (2) consecutive weeks. The newspaper must sign a sworn statement that it published the notice, which the distributee must file with the court.

Notice of application and a copy of the application must also be sent to the surviving spouse, all other distributees, and known creditors via first class mail within ten (10) days after the date of the first publication of the notice.

If the deceased party received Medicaid, the State Department of Health must be sent a copy of the application no later than ten (10) days after the first publication.

Note that notice is not required if no real property is being claimed in the application.

Step 4 – Asset Distribution

Once filed with the county clerk for estates with no real property, the distributee may provide a copy of the application to acquire the decedent’s belongings from its custodians and distribute it to the decedent’s heirs.

For estates with real property, if no objections have been filed twenty after (20) days after the mailing requirements stated above, or within thirty (30) days after the first publication date, then the court will issue a Decree of Summary Distribution detailing how the real property and assets will be distributed to each distributee.