How to Use the Verification Form

There are several ways dental offices use verification forms. One of the more common methods involves contacting the insurance provider by phone to request the policy information from a representative. During the conversation, a staff member at the dental office will record the coverage details in the verification form.

The verification form can also be sent to the insurance representative, who will input the necessary info and return the completed document. Some insurance providers offer web portals that allow access to their patients’ policy details.

Essential Information

The standard information that would be collected from a dental insurance verification form is as follows:

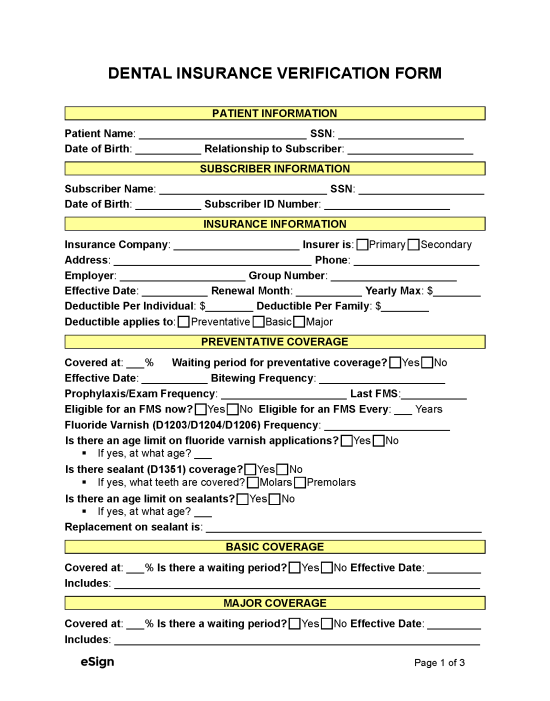

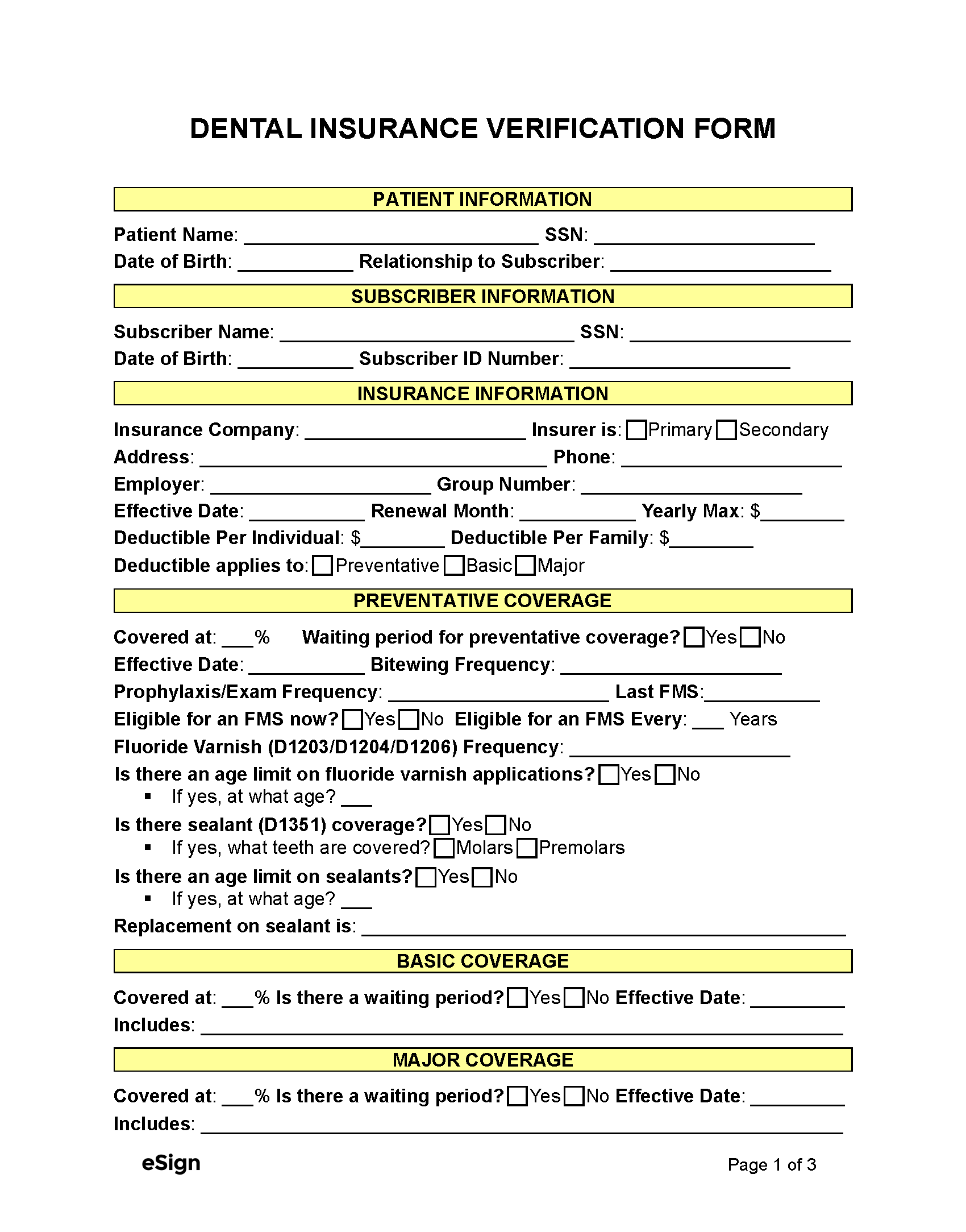

Patient and Subscriber Information

The form should include the patient’s name, date of birth, Social Security number, and insurance policy number. It should also relay the subscriber’s information; this person owns the insurance policy and provides benefits to the patient.

Basic Policy Terms

When communicating with the patient’s insurance provider, the office staff will need to request the following information:

- Effective dates of coverage (i.e., when the policy begins and ends)

- Deductibles

- Date of policy renewal

- Maximum annual coverage

Dental offices must also know whether the policy is the patient’s primary or secondary insurance. This detail is crucial, as claims sent to the secondary provider won’t be reimbursed until the primary insurer covers its portion of the costs.

Coverage and Limitations

Insurance verification requires an in-depth review of the patient’s coverage and policy limitations to determine whether the insurer will pay for the requested treatment. Some key policy details include:

- Coverage rates for preventative, basic, and major dental treatment

- Frequency limitations (e.g., how often X-rays can be performed)

- Waiting periods between treatments

- Age limits for fluoride application

- Whether previously missing or extracted teeth are covered

Importance of the Verification Form

A verification form plays an important in confirming a patient’s eligibility for coverage. Among others, dental offices can expect to see the following benefits from an insurance verification form:

- Determine Eligibility – Through a verification form, dental offices can understand the patient’s coverage and avoid recommending services for which they are not covered.

- Avoid Billing Issues – Documenting insurance details in a verification form reduces the potential for billing disputes by clarifying the estimated charges.

- Prevent Claim Denials – Verifying a patient’s dental coverage is an effective way to avoid claim denials from the insurance provider.

- Standardize Data Collection – The use of a verification form creates a standardized approach to gathering and keeping track of insurance details for new and existing patients.