Non-Reimbursable Expenses

Depending on company policy, employers may require employees to cover certain company-related expenses, such as uniforms, tools, or equipment. However, federal law prohibits employers from deducting these expenses from the employee’s wage if doing so would reduce their hourly rate below the federal minimum wage ($7.25 as of this writing).[1]

States With Employee Reimbursement Laws |

||

| State | Details | Statute |

| California |

|

§ 2802 |

| Illinois |

|

820 ILCS 115/9.5 |

| Iowa |

|

§ 91A.3(6) |

| Massachusetts |

|

§§ 454 CMR 27.04(4), 27.05(4) |

| Minnesota |

|

§ 177.24 (Subd. 5) |

| Montana |

|

§ 39-2-701 |

| New Hampshire |

|

§ 257:57 |

| New York |

|

§ 198-C |

| North Dakota |

|

§§ 34-02-01, 34-02-02 |

| Pennsylvania |

|

§ 260.3(b) |

| South Dakota |

|

§§ 60-2-1, 60-2-2 |

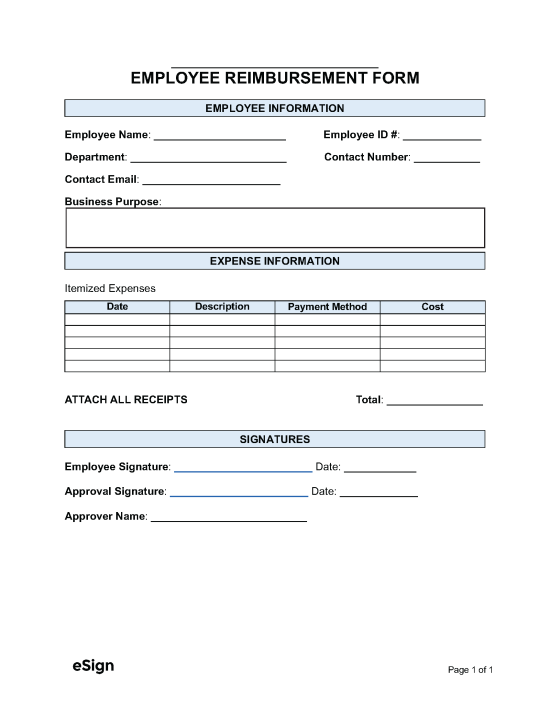

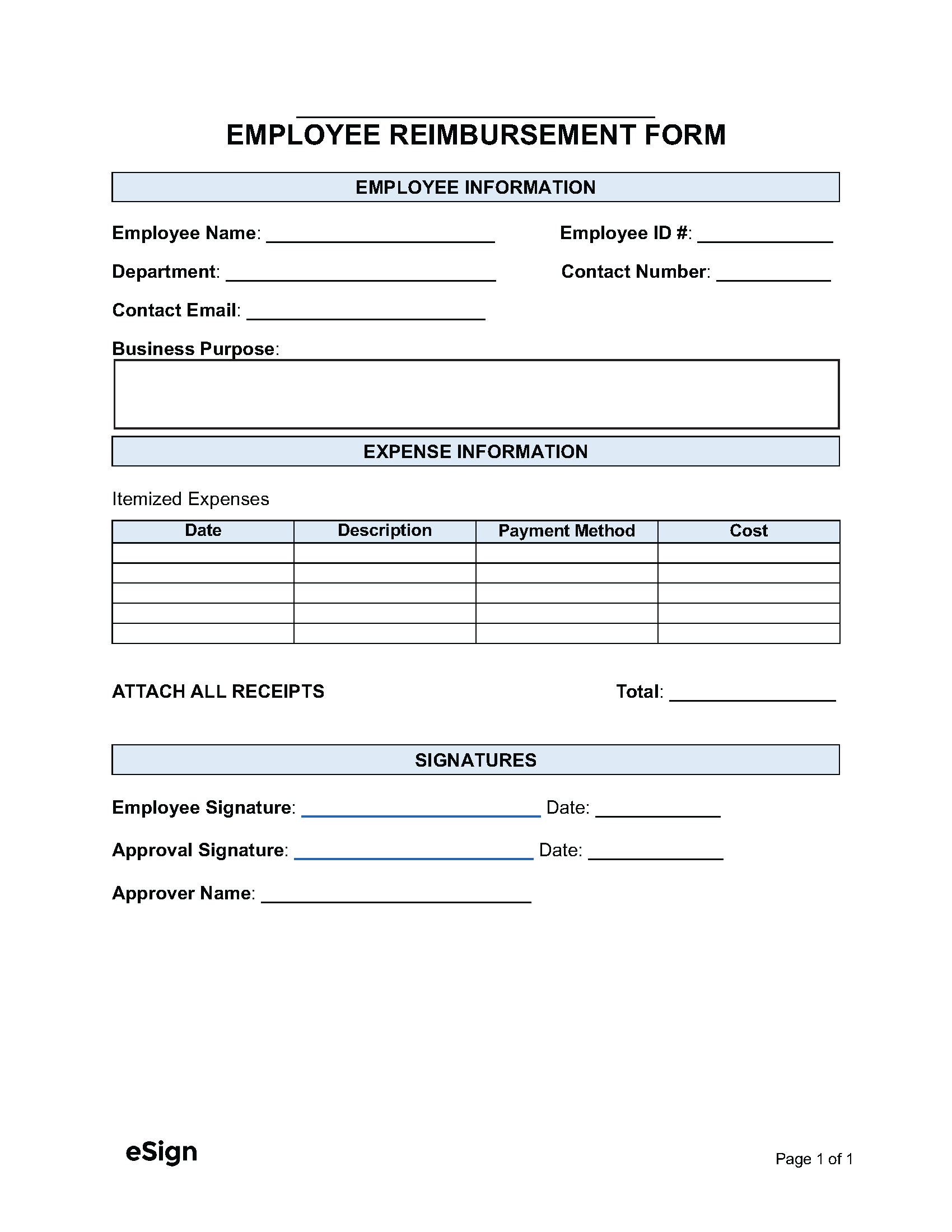

Sample

EMPLOYEE INFORMATION

Employee Name: [EMPLOYEE NAME] Employee ID #: [EMPLOYEE ID#]

Department: [EMPLOYEE DEPARTMENT] Contact Number: [EMPLOYEE PHONE #]

Contact email: [EMPLOYEE EMAIL] Business Purpose: [PURPOSE OF EXPENSE]

EXPENSE INFORMATION

Date: [DATE]

Description: [DESCRIPTION]

Payment Method: [PAYMENT METHOD]

Cost: [COST]

Date: [DATE]

Description: [DESCRIPTION]

Payment Method: [PAYMENT METHOD]

Cost: [COST]

Date: [DATE]

Description: [DESCRIPTION]

Payment Method: [PAYMENT METHOD]

Cost: [COST]

Total: [TOTAL AMOUNT $]

ATTACH ALL RECEIPTS

SIGNATURES

Employee Signature: ________________________ Date: ______________

Approval Signature: ________________________ Date: ______________

Approved by: [APPROVER NAME]