Types (2)

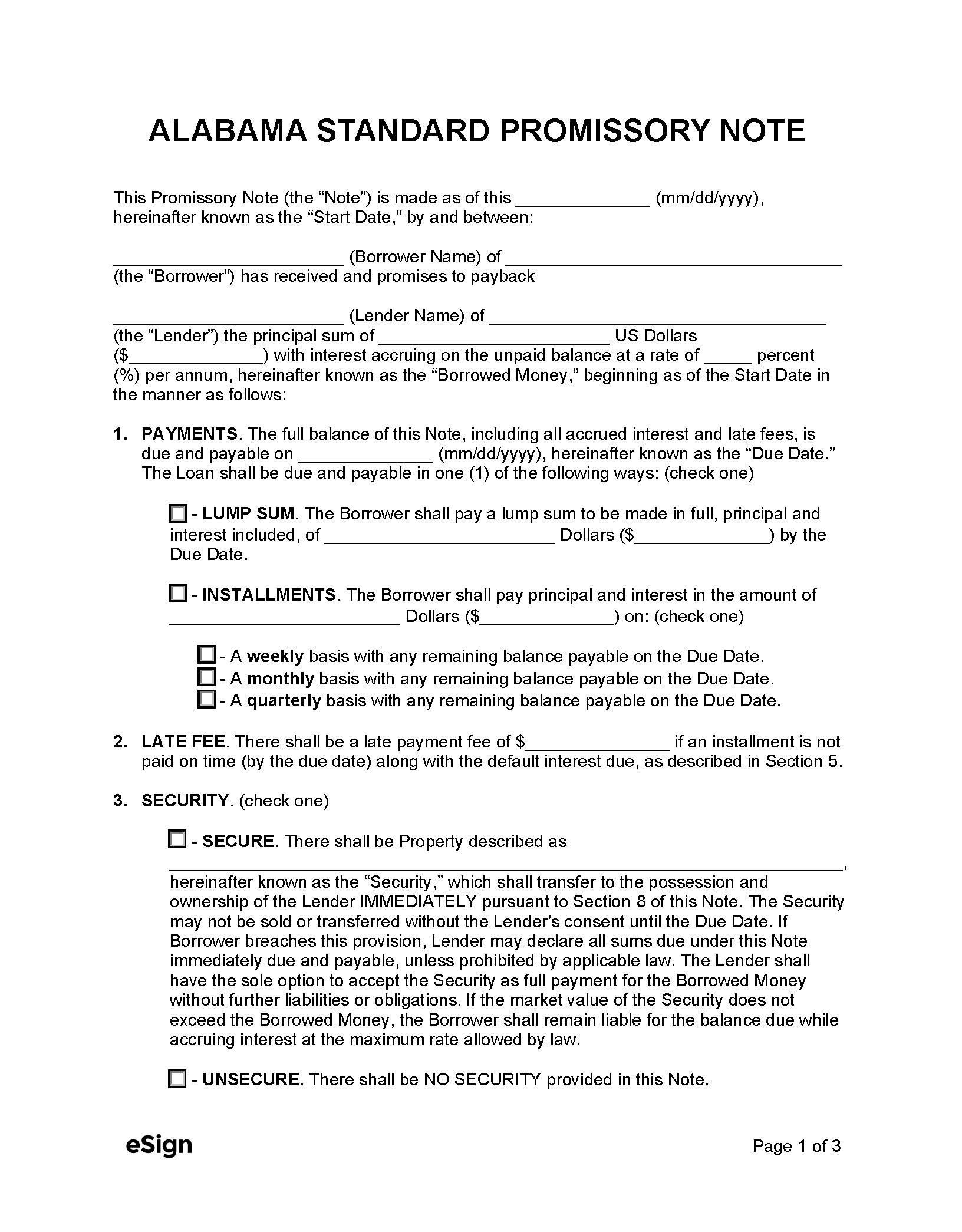

Download: PDF, Word (.docx), OpenDocument

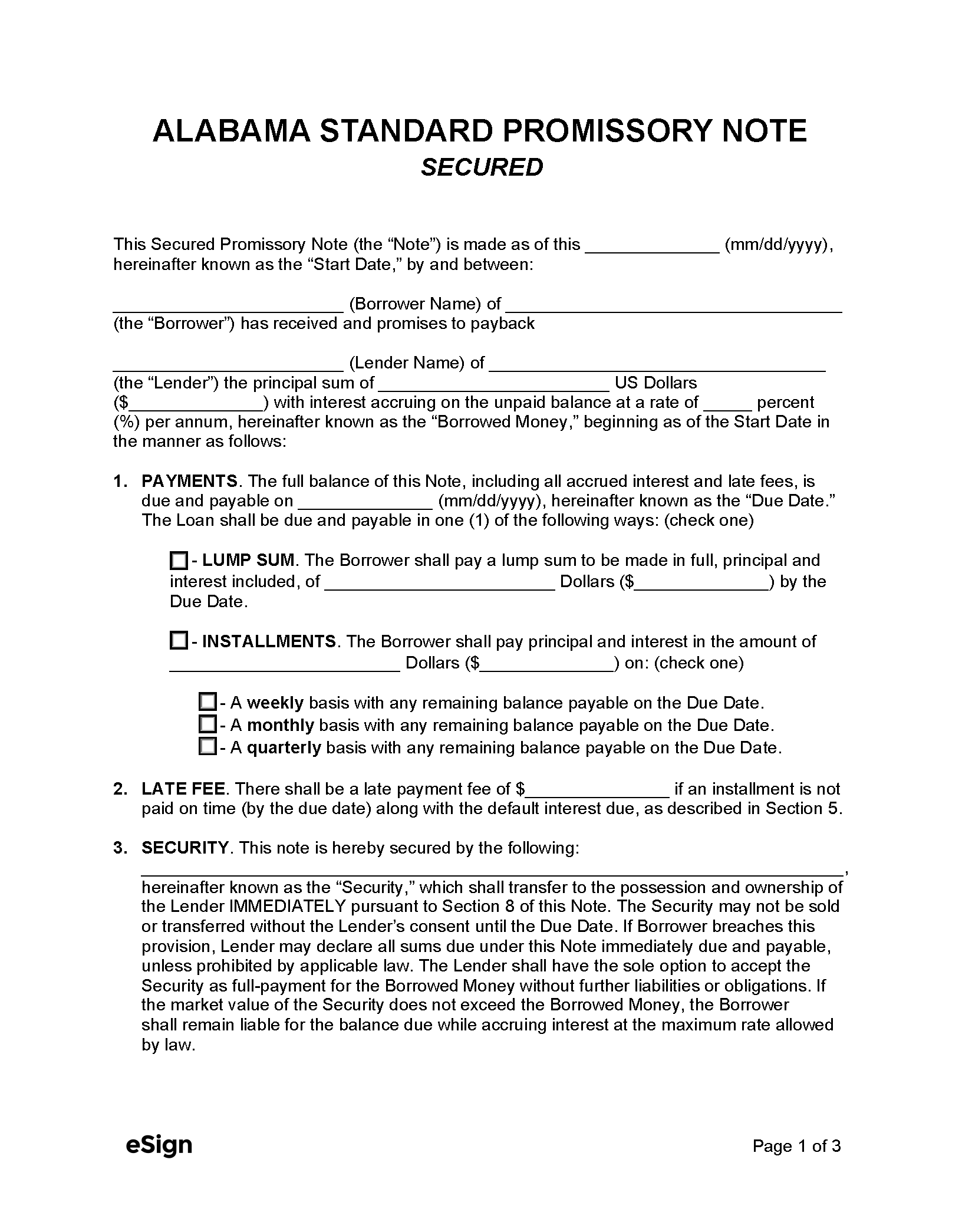

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title 8, Chapter 8

- Usury Rate With a Contract (§ 8-8-1): 8%

- Usury Rate Without a Contract (§ 8-8-1): 6%

- Usury Rate for Loans Secured by Savings Account (§ 8-8-1.2): 2% in excess of the interest rate (rate of return) applied to the account.

- Usury Rate for Loans ($2,000+) (§ 8-8-5): No maximum

- Usury Rate for Judgments (§ 8-8-10): 7.5% or rate agreed by contract.

- Usury Rate for Board of Education Loans ($100,000+) (§ 8-8-4): 15%