By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

By Type (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Contents |

Sample

Download: PDF, Word (.docx), OpenDocument

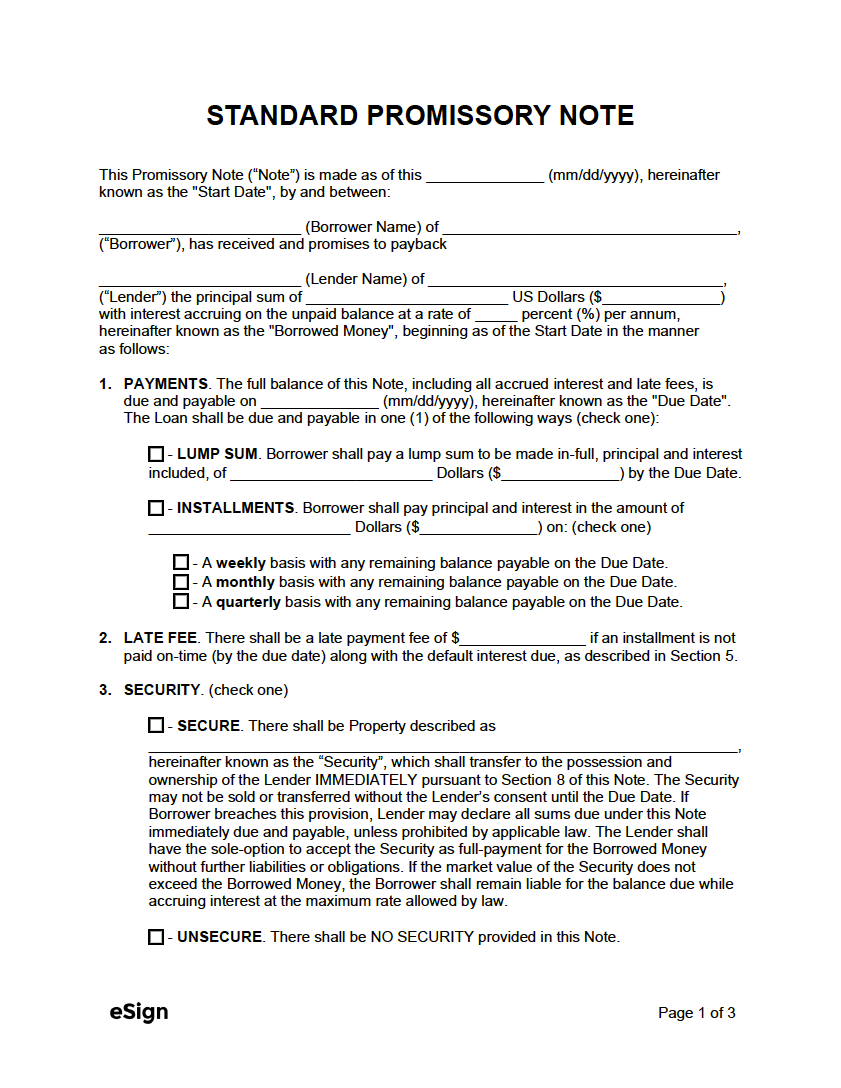

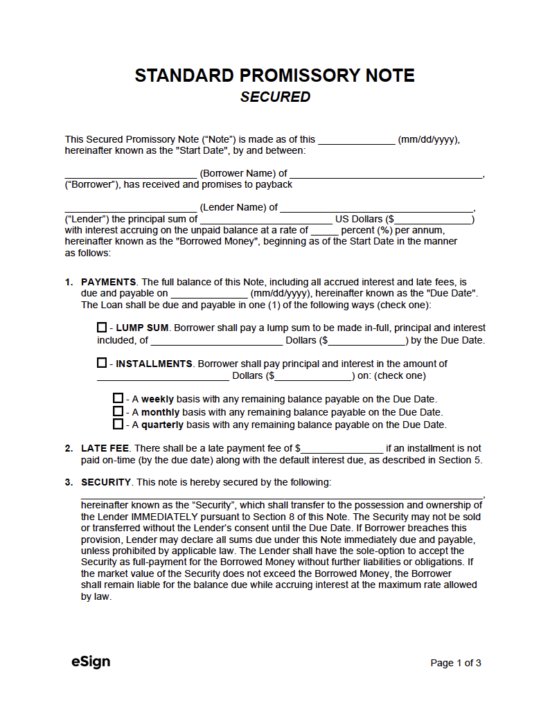

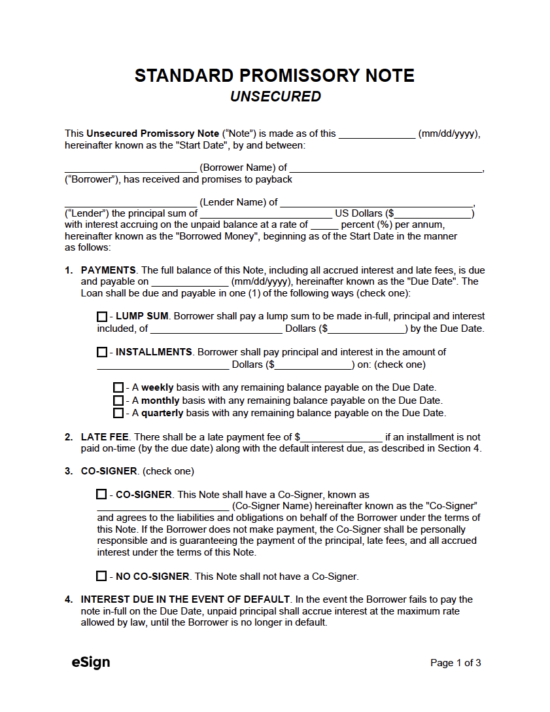

PROMISSORY NOTE

1. THE PARTIES. This Promissory Note (the “Note”) is made this [MM/DD/YYYY], (the “Start Date”), by and between [BORROWER NAME] of [BORROWER ADDRESS] (the “Borrower”), who has received and promises to payback [LENDER NAME] of [LENDER ADDRESS] (the “Lender”) the principal sum of $[AMOUNT] (the “Borrowed Money”) with interest accruing on the unpaid balance at a rate of [#]% percent per annum, beginning on the Start Date in the manner as follows:

2. PAYMENTS. The full balance of this Note is due and payable on [MM/DD/YYYY] (the “Due Date”). The Borrower shall pay principal and interest in installments of $[AMOUNT], payable on a [FREQUENCY (e.g., “Monthly”)] basis, with any remaining balance payable on the Due Date

3. LATE FEE. There shall be a late payment fee of $[AMOUNT] if an installment is not paid on time, along with the default interest due as described in Section 5.

4. SECURITY. (check one)

☐ – Secure. There shall be Property described as [DESCRIBE PROPERTY] (the “Security”), which shall transfer to the possession and ownership of the Lender immediately pursuant to Section 8 of this Note. The Security may not be sold or transferred without the Lender’s consent until the Due Date.

☐ – Unsecure. There shall be no security provided in this Note

5. INTEREST DUE IN THE EVENT OF DEFAULT. In the event the Borrower fails to pay the note in full on the Due Date, the unpaid principal shall accrue interest at the maximum rate allowed by law until the Borrower is no longer in default.

6. ALLOCATION OF PAYMENTS. Payments shall be first credited to any late fees due, then to interest due, and any remainder will be credited to the principal balance.

7. PREPAYMENT. The Borrower may prepay this Note without penalty.

8. ACCELERATION. If the Borrower is in default under this Note or is in default under another provision of this Note, and such default is not cured within the minimum allotted time by law after written notice of such default, then Lender may, at its option, declare all outstanding sums owed on this Note to be immediately due and payable. This includes any rights of possession in relation to the Security described in Section 3.

9. ATTORNEYS’ FEES. The Borrower shall pay all costs incurred by the Lender in collecting sums due under this Note after a default, including reasonable attorneys’ fees.

10. WAIVER OF PRESENTMENTS. The Borrower waives presentment for payment, notice of dishonor, protest, and notice of protest.

11. NON-WAIVER. No failure or delay by the Lender in exercising the Lender’s rights under this Note shall be considered a waiver of such rights.

12. SEVERABILITY. In the event that any provision herein is determined to be void or unenforceable for any reason, such determination shall not affect the validity or enforceability of any other provision, all of which shall remain in full force and effect.

13. NOTICE. Any notices required or permitted to be given hereunder shall be given in writing and shall be delivered by certified mail to the parties at the addresses listed in Section 1.

14. GOVERNING LAW. This note shall be governed under the laws in the State of [STATE].

15. ADDITIONAL TERMS & CONDITIONS.

[ADD ANY ADDITIONAL TERMS AND CONDITIONS HERE].

16. SIGNATURES.

Lender Signature: ___________________ Date: [MM/DD/YYYY]

Printed Name: [LENDER NAME]

Borrower Signature: ___________________ Date: [MM/DD/YYYY]

Printed Name: [BORROWER NAME]

How to Use a Promissory Note

Step 1 – Set the Terms

The agreement should be completed by the person or company lending the money. If the loan is being provided by an official financial institution (such as a bank), they will decide the terms based upon your credit report and other factors. While the borrower can set the term they prefer, the rate and agreement rules are up to the bank to decide.

For agreements formed between friends, family, and acquaintances, the parties should come together to identify the terms and conditions that work best for them. The topics they will need to cover and mutually agree upon include the following:

- How much money is being lent?

- What interest rate will be charged?

- When will the full balance be due?

- What date must the first payment be made?

- How will the borrower make payments?

- Will there be a late fee?

- Will the note be secured?

- Will there be a co-signer?

Step 2 – Secured or Unsecured?

A major decision the parties will need to make is whether or not to secure the loan. A “secured” loan is one that is backed by an asset such as a person’s home, car, or other valuable property or tangible asset. Should the borrower be unable to pay the loan in full, the lender can put a lien on the property which gives them the legal right to claim the property. If the borrower pays off the loan, the lender will lift the lien. Secured loans are often used when money is being lent from a financial institution for large amounts or when lending to borrowers with below-average credit scores.

Step 3 – Complete + Sign the Form

The promissory note can be downloaded and customized, or completed as-is. Regardless of what the lender does with the form, they will need to ensure the agreement answers the basic questions listed in Step 1. See the “How to Write” section below for detailed information on completing the template.

At a minimum, the note needs to be signed by the borrower. This is unlike a loan agreement, which needs to be signed by both the lender and borrower. Having said that, it is highly recommended that the note be signed by both the lender and borrower. To further legitimize the note, the parties can have their signatures notarized or witnessed by up to two (2) witnesses (who must also sign the form).

Signatures can be recorded by hand or by uploading the completed promissory note to eSign and signing digitally.

Step 4 – Collect Payments

The borrower will be obligated to make payments as stated in the promissory note. If the funds were provided by an official entity such as a bank or credit union, they often provide borrowers with the means to make payments online. Furthermore, many online lending platforms offer auto-pay, which if approved by the borrower makes automatic deductions from the borrower’s bank account on a regular basis (i.e., weekly, bi-weekly, monthly or whatever frequency was established in the note). For simpler person-to-person notes, the borrower can make payments via cash, check, or an online payment processor such as Paypal.

The lender should keep a detailed record of every payment they receive. Once the borrower pays off the loan in full, the borrower will be absolved from their obligations.

Should the borrower be late on a payment, they should be sent an official payment demand letter. For arrangements between friends, family, or acquaintances, the lender may want to contact the borrower personally so they can try to understand their reasons for not making payments.

If the borrower defaults (is over 30 days late on payments), the lender can acquire the property put up as security (if any), or they can take legal action, known as “judgment,” to receive compensation for the unpaid loan.

Maximum Usury Rates: By State

| STATE | USURY RATE | SOURCE |

| Alabama | Not in writing: 6% Written agreement: 8% |

§ 8-8-1 |

| Alaska | Loans above $25,000: 10.5% Loans below $25,000: 5%+ Federal Reserve interest rate |

§ 45.45.010 |

| Arizona | Not in writing: 10% Written agreement: No limit |

§ 44-1201 |

| Arkansas | Non-consumer notes: 5% + Federal Reserve interest rate Consumer notes: 17% |

§ 4-57-104 |

| California | Personal/Family Loans: 10% Other Loans: 10% OR 5% + Federal Reserve Bank of San Francisco interest rate |

Article XV “Usury” |

| Colorado | Not in writing: 8% Consumer loans: 12% Max. usury limit: 45% |

§§ 5-12-103 & 5-2-201 |

| Connecticut | Limit: 12% | § 37-4 |

| Delaware | Limit: 5%+ Federal Reserve rate | § 2301 |

| Florida | Less than $500k: 18% Greater than $500k: 25% |

§§ 687.03 & 687.071 |

| Georgia | Not in writing: 7% $3k or less: 16% $3k – $250k: No limit |

§ 7-4-2 |

| Hawaii | Not in writing: 10% Written agreement: 12% |

§ 478-2 & § 478-4 |

| Idaho | Max. rate: 12% Judgment rate: 5% + annual avg. yield of U.S. Treasury securities |

§ 28-22-104 |

| Illinois | General Usury & Judgment rate: 9% | 815 ILCS 205/4 |

| Indiana | Not in writing: 8% Consumer loans: 25% |

§§ 24-4.6-1-101, 24-4.6-1-201, 24-4.5-3-201 |

| Iowa | Not in writing: 5% Max rate: 2% + Avg. 10-yr maturity interest rate of US bonds & notes |

§ 535.2 |

| Kansas | Legal interest rate: 10% Usury limit: 15% |

§§ 16-201 & 16-207 |

| Kentucky | Legal interest rate: 8% Usury limit: 4% + Federal Reserve rate OR 19% (whichever is less) Greater than $15k: No limit |

§ 360.010 |

| Louisiana | Usury limit: 12% | § 3500 |

| Maine | Legal interest rate: 6% | § 432 |

| Maryland | Not in writing: 6% With contract: 8% Usury limit: 24% |

§§ 12-102 & 12-103 |

| Massachusetts | Not in writing: 6% Usury limit: 20% |

§§ 107.3 & 271.49 |

| Michigan | Not in writing: 5% With contract: 7% Usury limit: 25% |

§§ 438.31 & § 438.41 |

| Minnesota | Legal interest rate: 6% Written agreement: 8% |

§ 334.01 |

| Mississippi | Legal interest rate: 6% Contract rate: 10% OR 5% + Federal Reserve rate (whichever is greater) |

§ 75-17-1 |

| Missouri | Not in writing: 9% Written agreement: 10% |

§§ 408.020 & 408.030 |

| Montana | Not in writing: 10% Written agreement: 15% OR 6% + Prime rate published by Federal Reserve |

§§ 31-1-106 & 31-1-107 |

| Nebraska | Legal interest rate: 6% Max rate: 16% |

§ 45-101.03 |

| Nevada | Not in writing: Equal to the prime rate of largest bank in Nevada Written agreement: No limit |

§ NRS 99.040 |

| New Hampshire | Max rate: 10% (unless stated otherwise in contract) | § 336:1 |

| New Jersey | Not in writing: 6% Written agreement: 16% |

§ 31:1-1 |

| New Mexico | Not in writing: 15% | § 56-8-3 |

| New York | Legal interest rate: 6% Usury limit: 16% |

GOB § 5-501 |

| North Carolina | Legal interest rate: 8% | § 24-1 |

| North Dakota | Max interest rate: 6% Max contract rate: 5.5% + current cost of money (cannot be less than 7%) |

§§ 47-14-05 & 47-14-09 |

| Ohio | Legal interest rate: 8% | § 1343.01 |

| Oklahoma | Not in writing: 6% Written agreement: No limit |

15 OK Stat § 15-266 |

| Oregon | Not in writing: 9% Business/agric. loans less than $50k: 12% |

ORS 82.010 |

| Pennsylvania | Legal interest rate: 6% | 41 P.S § 201 |

| Rhode Island | Max rate: 21% OR 9% + domestic prime rate | § 6-26-2 |

| South Carolina | Legal interest rate: 8.75% Written agreement: No limit |

§ 34-31-20 |

| South Dakota | Not in writing: 12% Written agreement: No limit |

§§ 54-3-4 & 54-3-16(3) |

| Tennessee | Legal interest rate: 10% (unless stated otherwise in contract) | § 47-14-103 |

| Texas | Legal interest rate: 10% (unless stated otherwise in contract) | § 302.001 |

| Utah | Not in writing: 10% Written agreement: No limit |

§ 15-1-1 |

| Vermont | Legal interest rate: 12% Other rates: See statute |

9 V.S.A. § 41a |

| Virginia | Legal interest rate: 6% Written agreement: 12% |

§§ 6.2-301 & 6.2-303 |

| Washington | Legal interest rate: 12% OR 4% + Avg. rate for 26-week treasury bills | § 19.52.020 |

| West Virginia | Not in writing: 6% Written agreement: 8% |

§ 47-6-5 |

| Wisconsin | Legal interest rate: 5% | § 138.04 |

| Wyoming | Not in writing: 7% | § 40-14-106 |