By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Contents |

Types of Collateral

The types of assets the borrower can use as collateral are wide-ranging. As long as the lender can sell the asset to cover all (or a portion of) the loan, it will most likely be accepted. Common items used as collateral include:

- Motor vehicles

- Real estate

- Boats

- Savings accounts

- Paychecks

- Investment accounts

- Jewelry

- Art / collectibles

Secured vs. Unsecured Notes

While secured and unsecured notes have more in common than not, it’s important to understand their differences.

| Factor | Secured Note | Unsecured Note |

| Collateral | Requires the borrower to set aside one (1) or more assets that the lender can legally acquire should the loan go unpaid. | Does not require the borrower to provide collateral. |

| Interest Rates | Lower rates compared to unsecured notes due to the asset(s) placed as collateral. | Standard interest rates. |

| Credit Score | While an applicant’s credit score is an essential tool for those that lend money, lenders are more likely to lend to a person with a less-than-favorable score due to the added security the collateral provides. | A major influence as to whether or not the borrower will be approved for a loan due. |

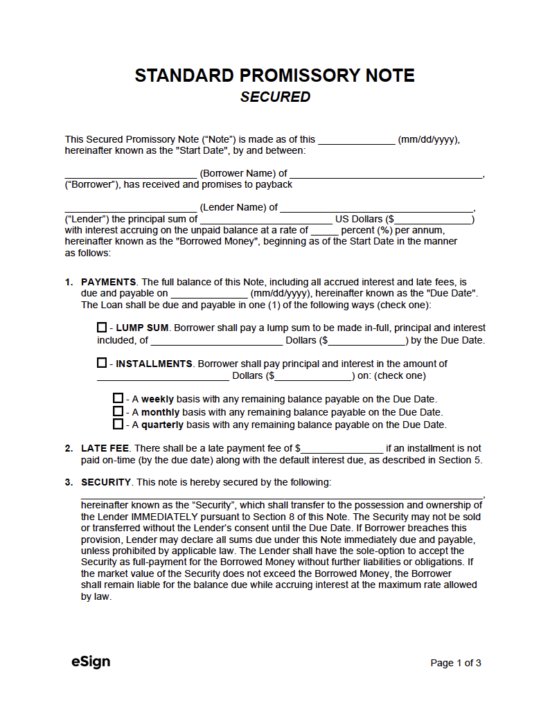

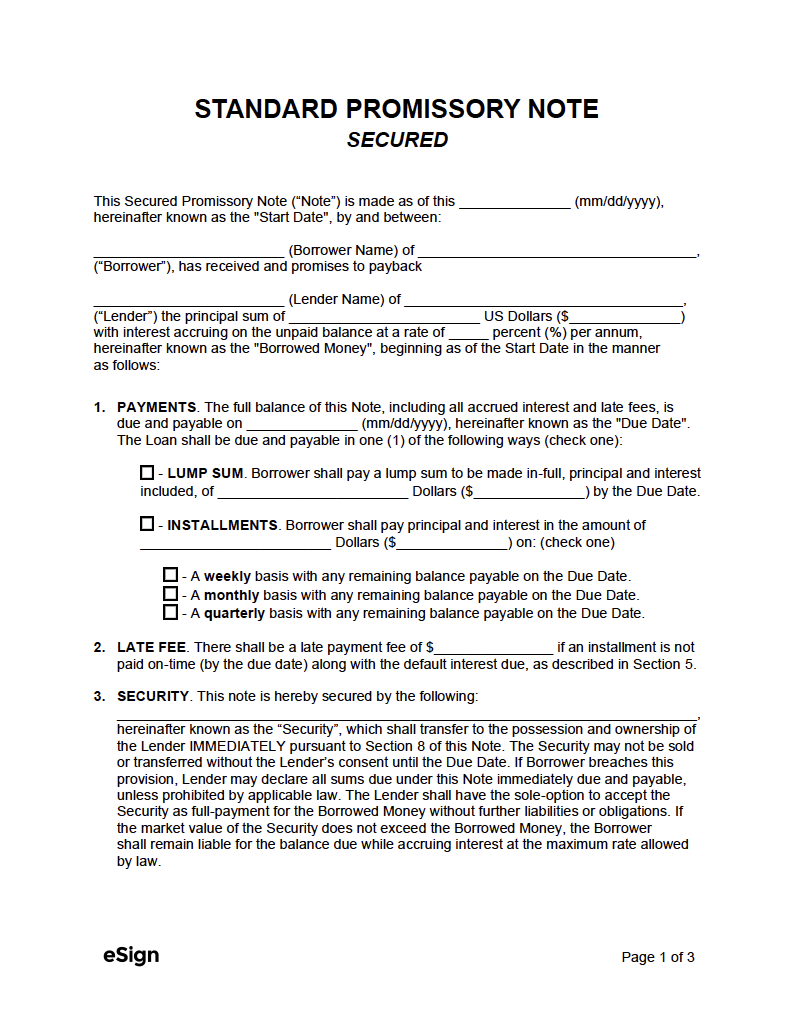

What’s Included?

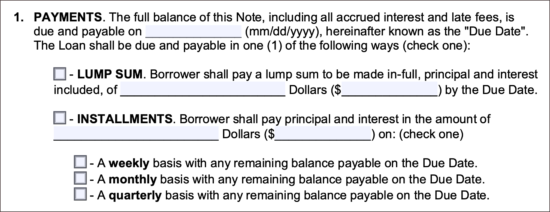

1. Payments

Arguably one of the most important sections, the payment section is where the lender specifies the due date of the note and the payment plan the borrower will have to follow. They have the option of making the borrower provide a single lump-sum payment or paying in weekly, monthly, or quarterly increments.

2. Late Fee

A late fee is a penalty that the borrower must pay to the lender if they are late on a payment. The lender can forego the requirement of a late fee by leaving the section blank. Additionally, if the borrower has a good reason for being late on payment, the lender can decide to waive the fee (for that single instance) if they wish.

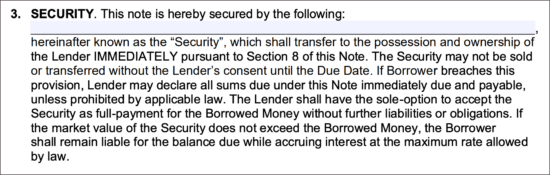

3. Security

This section is what makes the note a “secured” note. The lender will need to write the asset(s) the borrower will be providing as collateral for the loan. It’s best to be as descriptive as possible when listing the asset(s). For example, instead of writing “Motor vehicle,” write “2015 Ford F-150 XLT, White, 122,650 miles” etc. Be as descriptive as possible.

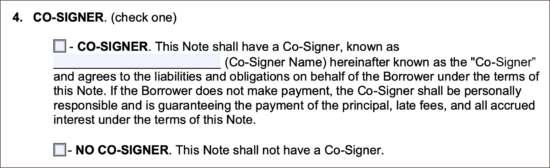

4. Co-Signer

A co-signer is a person that agrees to take on responsibility for the full outstanding balance of the note if the borrower stops making payments. While having a co-signer is optional, it reduces the lender’s risk substantially and can lead to having a lower interest rate on the note.

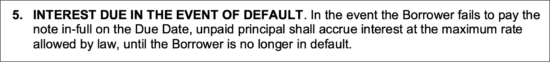

5. Interest Due in the Event of Default

In the event the borrower doesn’t pay off the note by the due date (defaults), this section confirms that the unpaid balance will accrue interest at the same rate as before.

6. Allocation of Payments

Affirms the order of allocation of the borrower’s payments (i.e., 1) late fees –> 2) interest –> 3) principal amount).

7. Prepayment

Gives the borrower permission to pay the note in full without penalty. This section can be altered by the lender if they want to the borrower to be required to pay an additional fee should they pay the loan off before the due date.

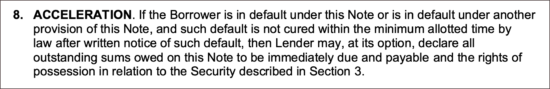

8. Acceleration

If the borrower defaults on the note, this section provides the lender with the right to require all outstanding loan balance (and the security as stated in Section 3) due immediately.

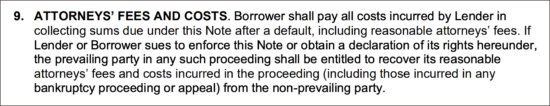

9. Attorneys’ Fees and Costs

This section states that the borrower will be required to pay the lender’s attorneys’ fees (and other legal fees) if they default on the note. Additionally, it says if either the lender or borrower sues the other (and wins) the losing (“non-prevailing”) party will be required to cover the costs.

10. Waiver of Presentments

Waives the borrower’s right to receive notice for the items described in the condition.

11. Non-waiver

Establishes that even if the lender does not use a right as stated in the note, it doesn’t mean they can’t use it at another time later on. For example, if the lender lets the borrower make a payment a few days late without issuing them a late fee, it doesn’t mean they can’t issue a late fee if the borrower is late on a payment again.

12. Severability

If, for any reason, a section (or part of a section) of the note becomes unusable or is no longer legally binding, it doesn’t affect the validity of all of the other sections within the contract.

13. Integration

As the section states, the note cannot be affected or modified by any outside documents, and if the parties wish to make changes to the note, they must both agree to the proposed changes.

14. Conflicting Terms

Ensures that the main promissory note itself supersedes any other terms (even if they are similar or identical) in any other agreement relating to the promissory note.

15. Notice

States the four (4) methods by which the borrower can send a notice to the lender.

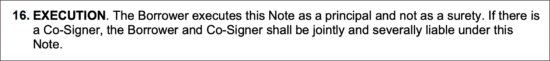

16. Execution

A “surety” is a person that takes on the responsibility of the loan if the borrower can’t (or chooses not to) repay the loan. In essence, the “Execution” section decrees that the responsibility of paying the loan is on the borrower, not the co-signer (if any).

17. Governing Law

This section establishes the state where the loan is being made. Due to each state having its own usury laws, it’s important the lender abides by this state’s statutes when setting the terms of the contract.

18. Additional Terms & Conditions

An optional area the lender can use to add additional clauses or notes to the agreement. This can also be used for writing the reference numbers of any supplemental documents attached.

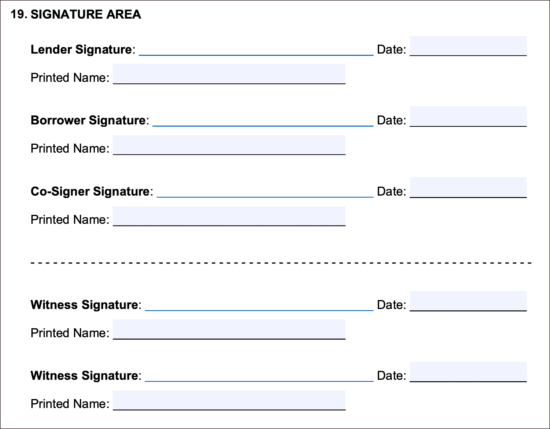

19. Signature Area

Provides space for the lender, borrower, co-signer (if any), and witnesses (if any) to sign the note. At a minimum, the lender and borrower will need to both print and sign their names, as well as enter the date they signed the form. Signing can be done through eSign or by printing the form and signing by hand.