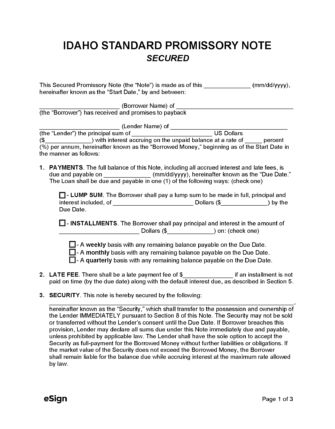

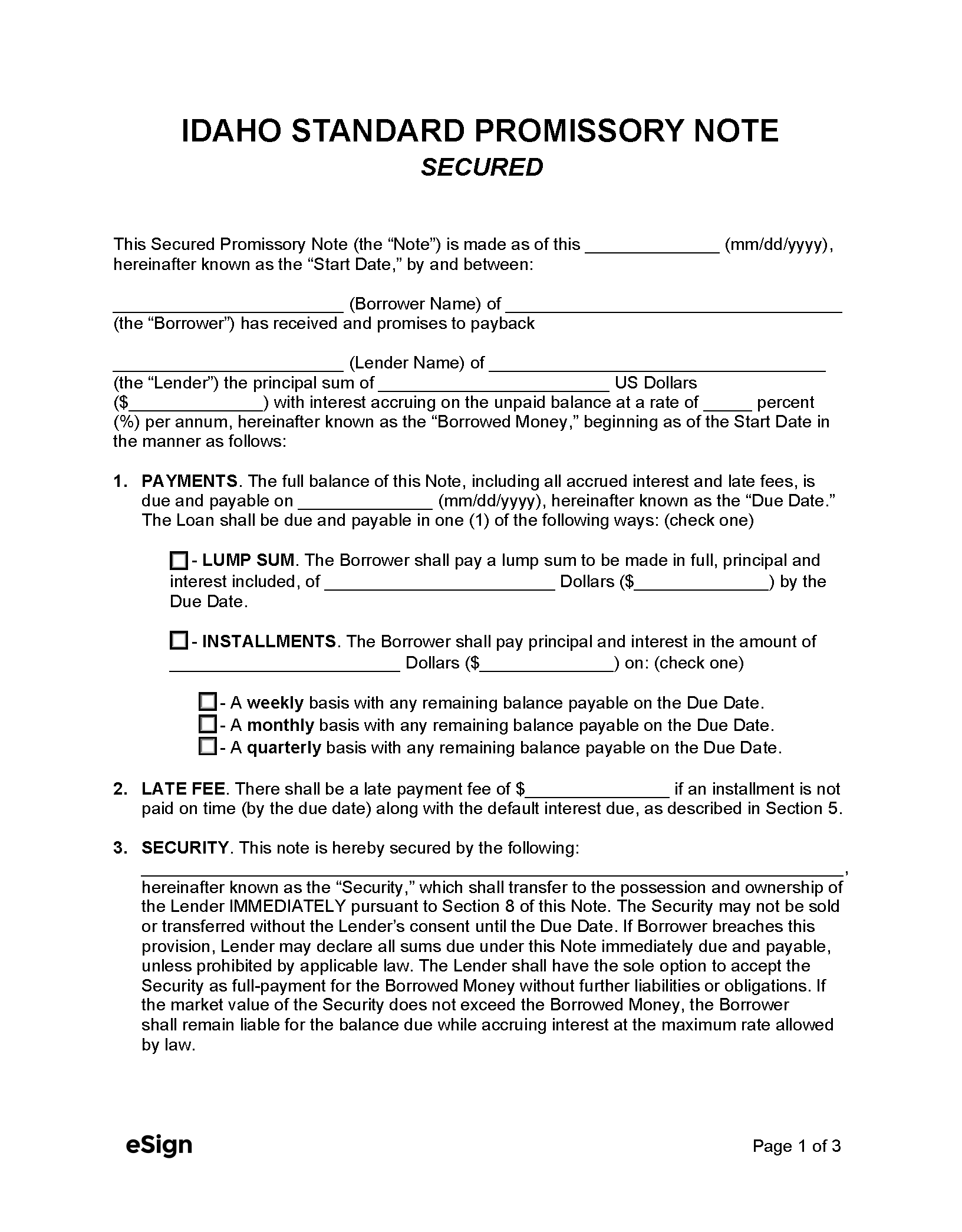

An Idaho secured promissory note is an agreement that specifies the payment terms of a loan that has been protected by the borrower with collateral. A secured note contains the same loan information as an unsecured note (e.g., payment due date, interest rate, late fees) but features a security provision in which the borrower pledges an asset as collateral. If the borrower cannot repay the loan on time, the lender would seize the borrower’s asset as compensation for the unpaid funds.

A secured promissory note may prove favorable to the lender, as it reduces the potential of a financial loss. However, secured notes typically have lower interest rates and require a more lengthy loan-approval process. Before granting a loan, the lender should verify the value of the collateral to determine whether it will cover the loan amount.

Related Forms

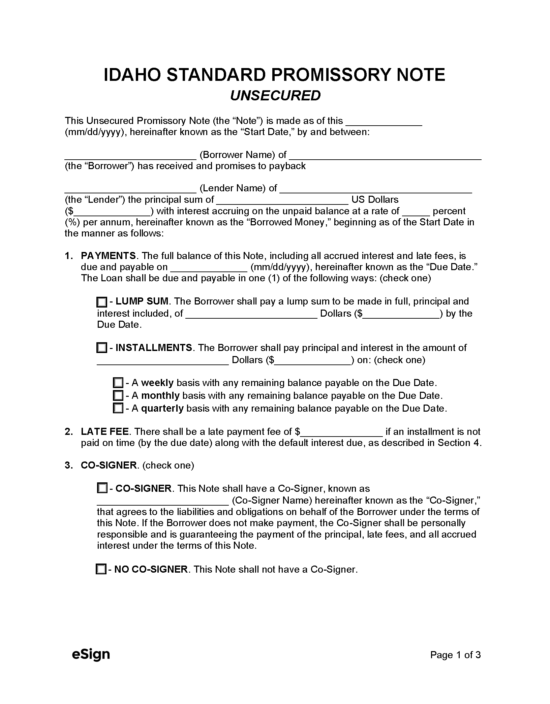

Unsecured Promissory Note – Defines the terms of reimbursement for a loan that doesn’t have collateral backing.

Unsecured Promissory Note – Defines the terms of reimbursement for a loan that doesn’t have collateral backing.

Download: PDF, Word (.docx), OpenDocument