Types (2)

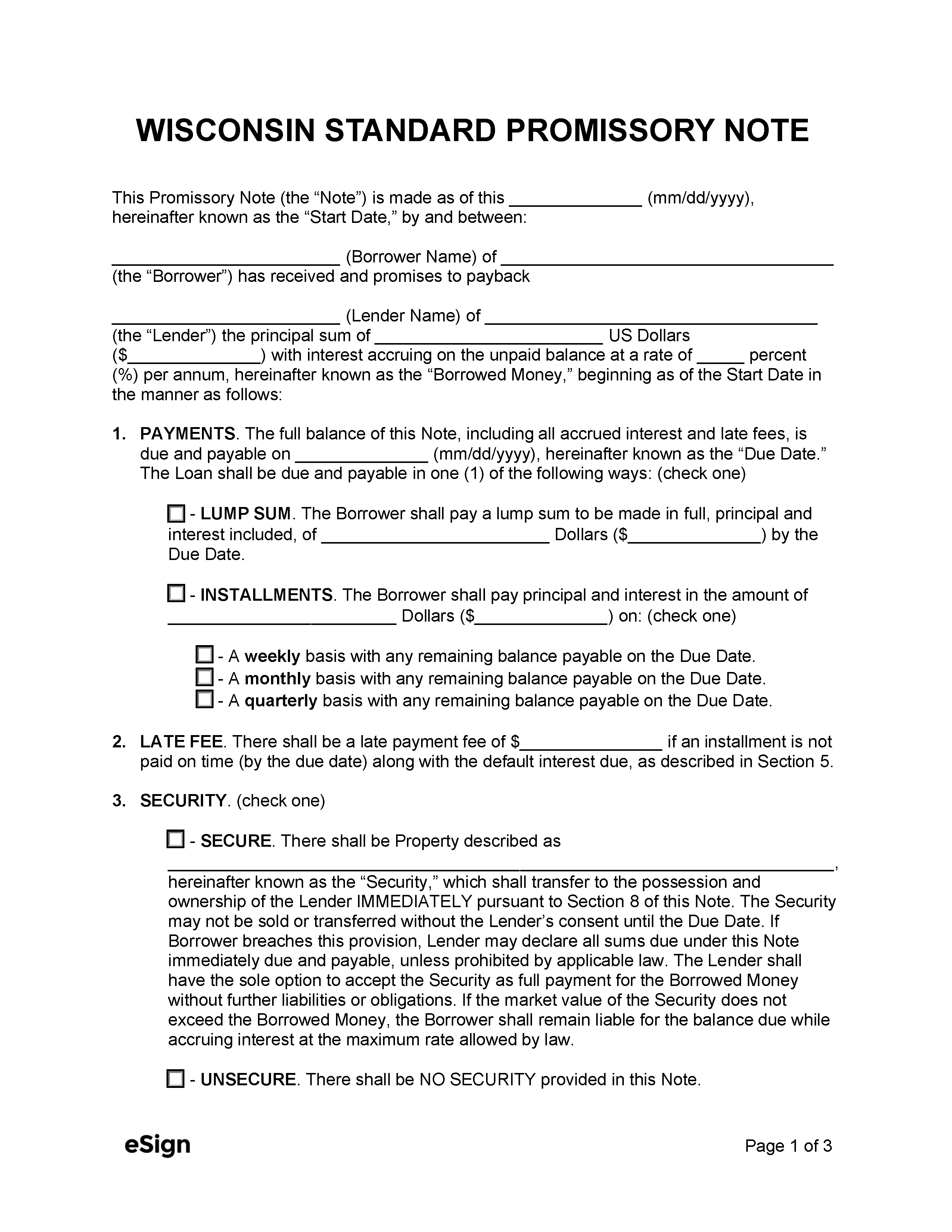

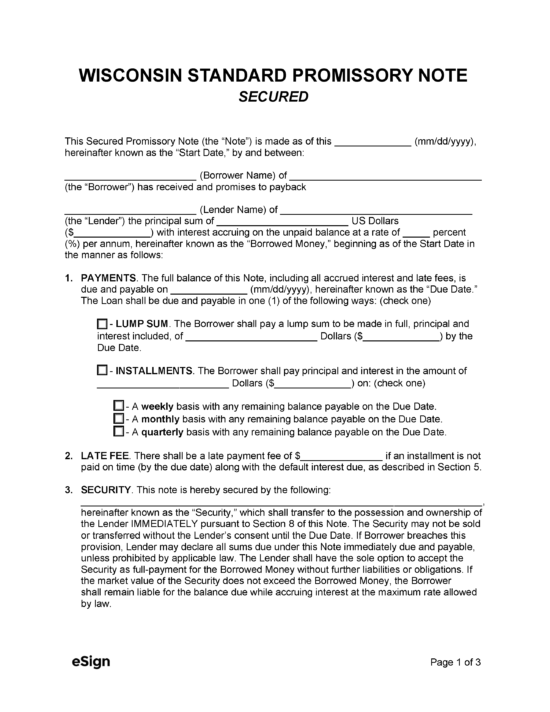

Secured Promissory Note – An agreement in which the borrower provides collateral as security on the loan.

Secured Promissory Note – An agreement in which the borrower provides collateral as security on the loan.

Download: PDF, Word (.docx), OpenDocument

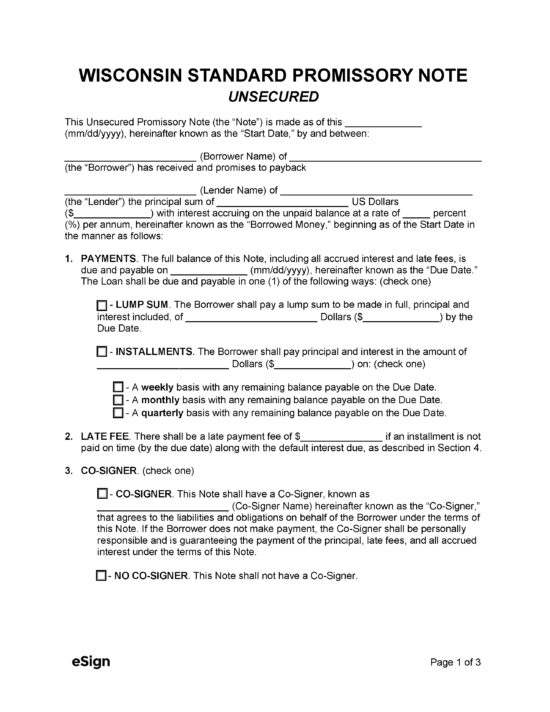

Unsecured Promissory Note – Used when the borrower does not provide any collateral.

Unsecured Promissory Note – Used when the borrower does not provide any collateral.

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Chapter 138 – Money and Rates of Interest

- Usury Rate with Contract (§ 138.05(1)(a)): 12%

- Usury Rate without Contract (§ 138.04): 5%

- Usury Rate for Loans Under $3000 by Licensees (§ 138.09(7)(bn)(1)): 23%, 6% over the 2-year U.S. treasury note rate, or 6% over the 6-month treasury bill rate, whichever is greater.

- Usury Rate for Loans Over $3000 by Licensees (§ 138.09(7)(bn)(2)): 21%, 6% over the 2-year U.S. treasury note rate, or 6% over the 6-month treasury bill rate, whichever is greater.

- Usury Rate for Payday Loans Before Maturity Date (§ 138.14(10)(a)): No limit

- Usury Rate for Payday Loans After Maturity Date (§ 138.14(10)(a)): 2.75%/month