Types (2)

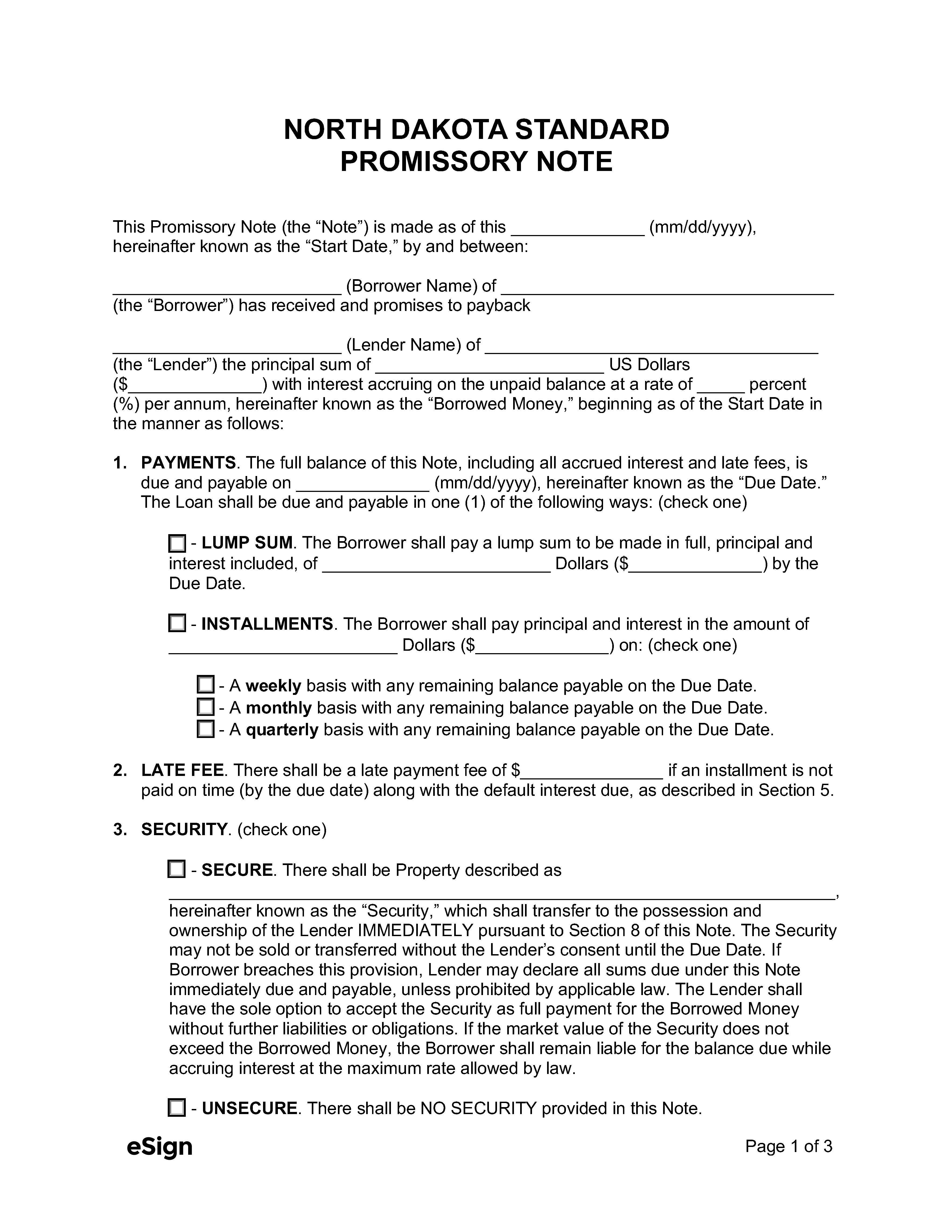

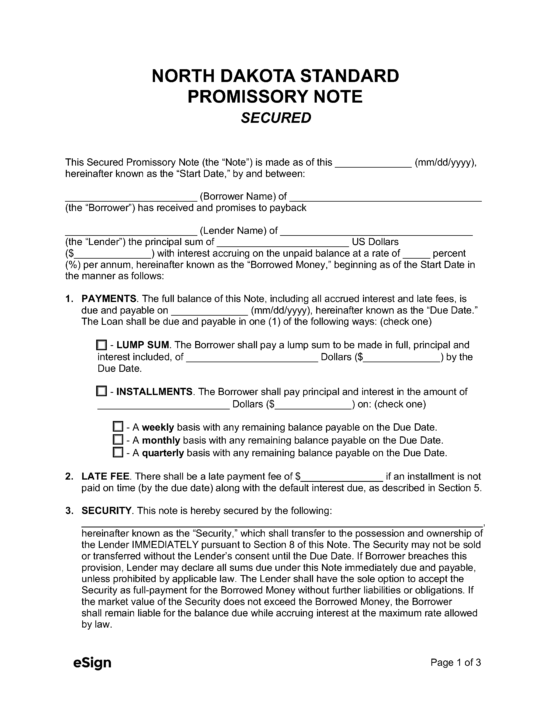

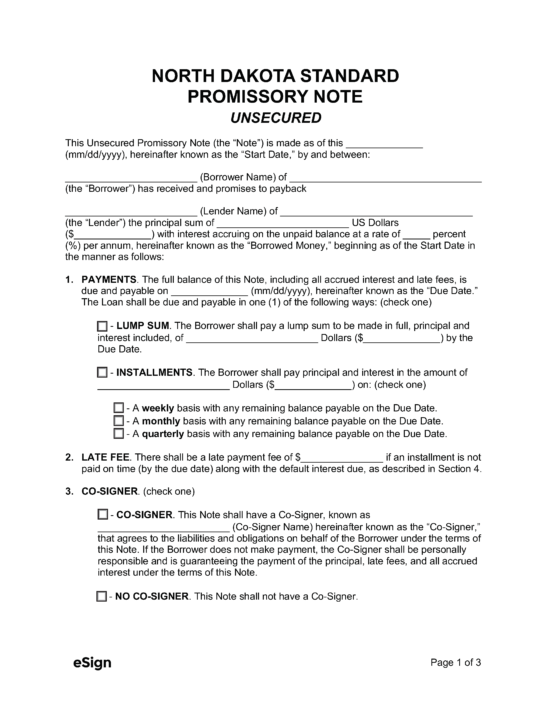

Secured Promissory Note – A lending agreement where a borrower pledges collateral to a lender.

Secured Promissory Note – A lending agreement where a borrower pledges collateral to a lender.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Chapter 47-14: Loans of Money

- Usury Rate with Contract (§ 47-14-09): The 6-month US Treasury Bills rate + 5.5%; however, the maximum rate ceiling cannot be less than 7%. The current rate through 2025 can be found here. The following exceptions apply:

- Loans exceeding $35,000

- A transaction under $10,000 with a licensed pawnbroker

- Loans made to a trust, foreign or domestic corporation or LLC, cooperative corporation, or association

- Loans made by a state or federally-regulated lending institution

- Loans made to a partnership, LLC, or association that files a state or federal income tax return

- Usury Rate without Contract (§ 47-14-05): 6%

- Usury Rate for Monetary Judgments (§ 28-20-34): The prime rate + 3%