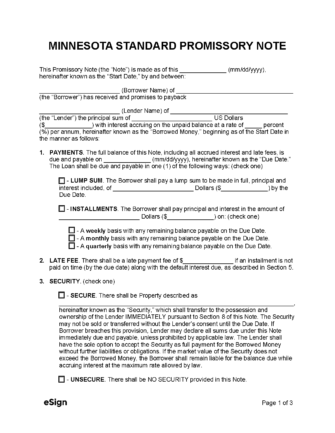

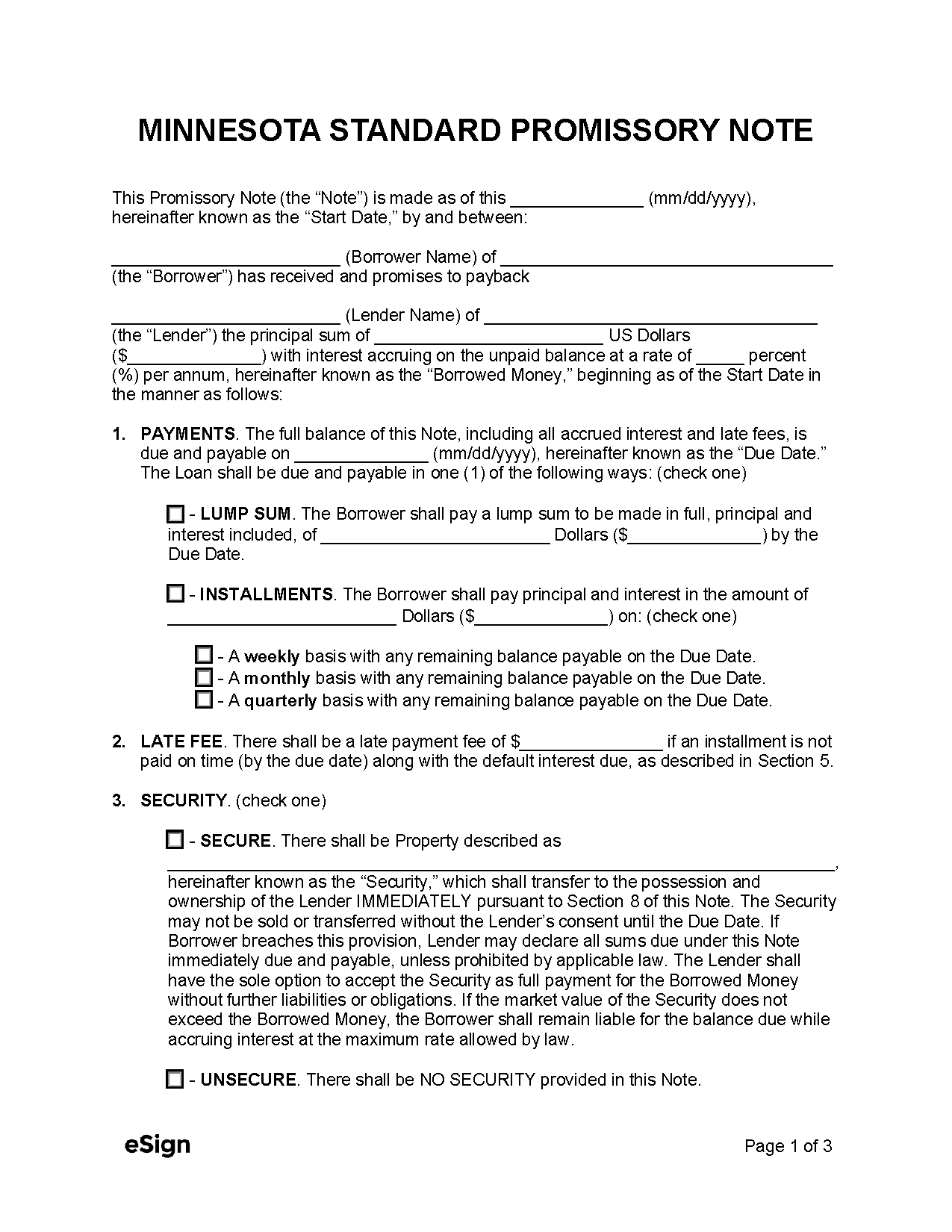

Types (2)

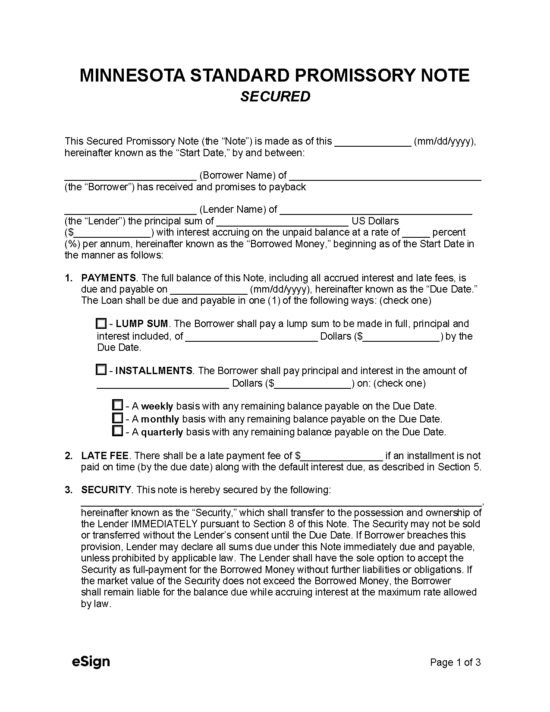

Secured Promissory Note – Provides parties involved in a loan transaction a means to relay loan terms and secure financing with collateral.

Download: PDF, Word (.docx), OpenDocument

![]() Unsecured Promissory Note – The details of a loan agreement that does not involve collateral are outlined in this agreement.

Unsecured Promissory Note – The details of a loan agreement that does not involve collateral are outlined in this agreement.

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Chapter 334

- Usury Rate in General (§ 334.01): 6% per year, unless a different rate is agreed to in writing, in which case the interest rate cannot exceed 8%.

- Usury Rate for Contracts Over $100,000 (§ 334.01 Subd. 2): No maximum, except for mortgage loans (§ 47.20 Subd. 4a.(a)) and mortgage prepayment penalties (§ 58.137 Subd. 2(a)(4)).

- Usury Rate for Business or Agricultural Loans (less than $100,000) (§ 334.011 Subd. 1): 4.5% above the 90-day commercial paper discount rate.

- Usury Rate for Loans by Charitable Organizations (less than $10,000) (§ 334.011 Subd. 5): 16%

- Usury Rate for Loans Secured by Savings Account (§ 334.012): 2% in excess of the interest rate payable on the account.

- Usury Rate for Monetary Judgments* (§ 549.09):

- Judgments under $50,000 – Interest will be calculated according to the secondary market yield of one (1) year US Treasury bills, calculated on the bank discount basis as provided in 549.09(c)(1)(i).

- Judgments over $50,000 – 10%

*Not applicable to judgments in family court actions (except for child support awards in judgments of less than $50,000).