Types (2)

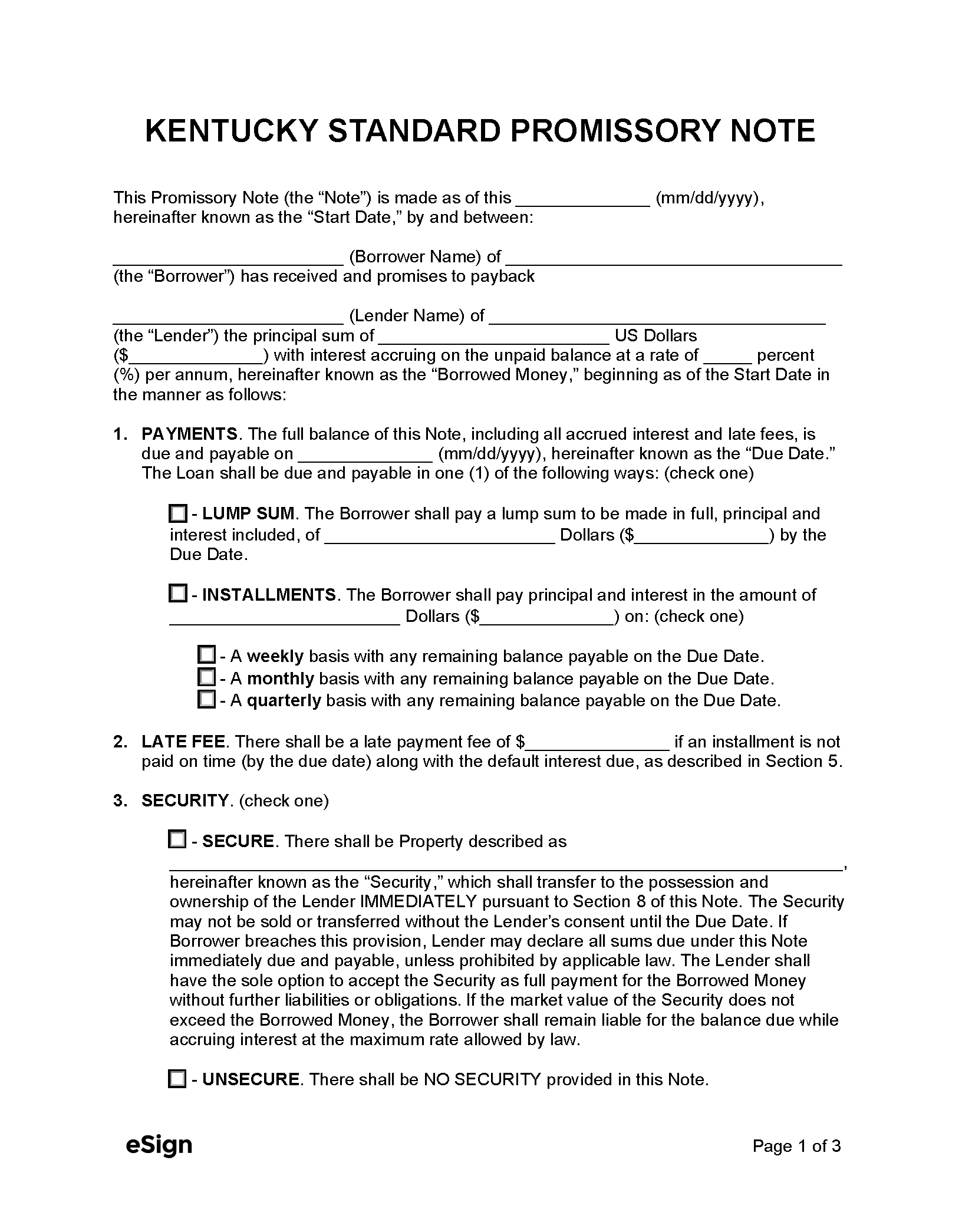

Secured Promissory Note – Contains a borrower’s written promise to pay back a loan that has been backed by collateral.

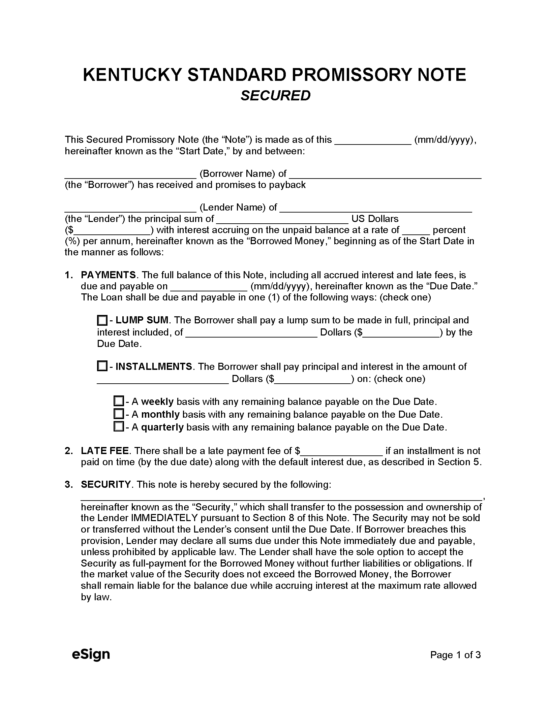

Secured Promissory Note – Contains a borrower’s written promise to pay back a loan that has been backed by collateral.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title XXIX, Ch. 360

- Usury Rate for Loans (§ 360.010(1)): *8%, unless another rate is agreed to in writing, in which case the interest rate cannot exceed the following:

- Loans of $15,000 or less – 19%, or 4% above the discount rate on 90-day commercial paper in effect at the Federal Reserve Bank, whichever is less.

- Loans over $15,000 – no maximum interest rate.

- Usury Rate for Judgments (§ 360.040): 6%, unless another rate is agreed to in writing, in which case the interest rate cannot exceed the contract rate.

- Usury Rate for High-Cost Home Loans (§ 360.100(2)): For home loans of more than $15,000 but less than $200,000, with closing fees of either $3,000 or 6% (whichever is greater), the prepayment penalty cannot exceed 3% for the first year, 2% for the second year, and 1% for the third year.

- Usury Rate for Credit Union Loans (§ 286.6-435 & § 286.6-465): 2% per month, and the interest rate on loans to any member cannot exceed 10% of the credit union’s capital.

- Usury Rate for Pawnbrokers (§ 226.080): 2% per month, and the fee cannot exceed one-fifth (1/5) of the loan amount.

- Usury Rate for Consumer Loan Companies (§ 286.4-530): 3% per month on loans less than $3,000; 2% per month on loans greater than $3,000.

*State and national banks can charge $10 for loans, even if the charge exceeds the interest rate allowed by law (§ 360.010(6)).