Contents |

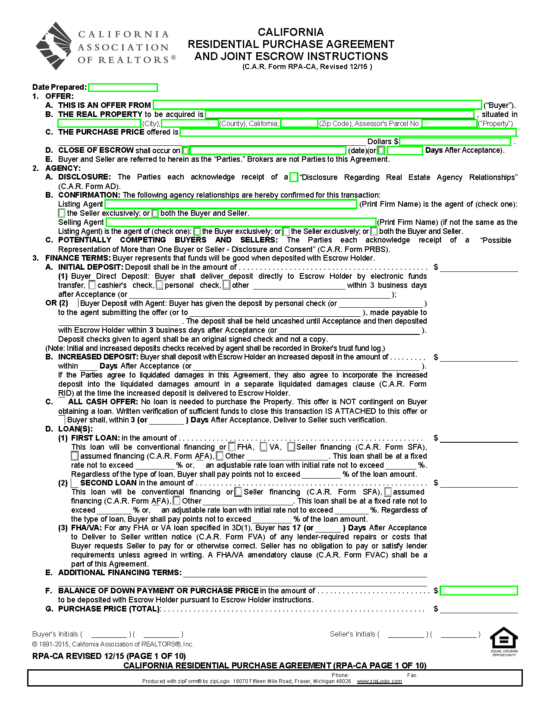

Realtor Version

Download: PDF

Required Disclosures (17)

|

| 1) Environmental Hazards Pamphlet

A seller may provide this pamphlet to a buyer, which by law relieves them of any further duty to disclose environmental hazards to prospective buyers.

|

| 2) Industrial Uses

When the seller has knowledge that the property is adjacent to or zoned to allow industrial use, they must disclose this fact to the buyer before the transfer of the title.

|

| 3) Homeowner’s Guide to Earthquake Safety

Sellers may deliver this earthquake safety guide to potential buyers and will be exempt from providing additional information concerning geologic and seismic hazards.

|

| 4) Lead-Based Paint

In accordance with federal law, seller’s must provide a lead-based paint disclosure statement to potential buyers if the property being sold was built prior to 1978.

|

| 5) Local Option Property Disclosure Statement

Depending on the city/town in which the real estate transaction is being conducted, a local transfer disclosure statement comprised of specific community and neighborhood information may be required.

|

| 6) Megan’s Law

Any purchase agreement entered into on or after April 1, 2006, must contain the notice written out in § 2079.10a(a)(3) of the civil code notifying potential buyers that they may research the area around the property for registered sex offenders by using the website linked above.

|

| 7) Mello-Roos Districts

A “Notice of Special Lien” must be obtained and delivered to the buyer from each local agency that levies a special tax in accordance with the Mello-Roos Community Facilities Act. This only applies if the seller or the seller’s agent are aware of any special tax levied against the real property.

|

| 8) Methamphetamine Contamination

A prospective buyer must receive a copy of any order provided to the seller by a health officer that prohibits the use or habitation of the premises due to potential contamination of methamphetamine. This only applies if the seller has received such an order and the health officer has yet to provide notice to the seller that the order requires no further action (i.e., the premises is now safe to inhabit).

|

| 9) Natural Hazard Disclosure Statement

Pursuant to the previously mentioned statutes, sellers of real property located within a special flood hazard area, a potential flood area, a high fire hazard zone, a designated wildland area, an earthquake fault zone, or a seismic hazard zone must provide prospective buyers with a Natural Hazard Disclosure Statement (NHDS).

|

| 10) Ordnance Locations

If they are aware of it, the seller must give the buyer written notice of the fact that the property being sold is within one (1) mile of an area that was once used for military training and which may contain live ammunition.

|

| 11) Property Disclosure Statement

A seller must complete this disclosure statement which details the condition of the premises. It is not a warranty made by the seller; the buyer must still complete inspections, but they may refer to the information in the statement to negotiate the terms of the purchase agreement.

|

| 12) Property Taxes

The property tax disclosure outlined in the previously mentioned statute must be included in a written notice and distributed to any prospective buyer.

|

13) Seller Property Questionnaire – When the parties to a real estate transaction use the California Residential Purchase Agreement and Joint Escrow Instructions form to execute the sale of the property, the seller is obligated by contract to complete this SPQ document and deliver it to the buyer in addition to the property disclosure statement.

|

| 14) Title Insurance

If the parties are completing a real estate transaction with an escrow where no title insurance is issued, the buyer must receive in a separate document the notice detailed in the previously mentioned statute. (This duty would most likely fall under the assignment of the escrow holder, or real estate broker conducting the escrow.)

|

| 15) Water-Conserving Plumbing Fixtures and Carbon Monoxide Detector Notice

This disclosure notice is provided to the buyer from the seller to confirm that the property is in compliance with state laws with regard to water-conserving plumbing fixtures and carbon monoxide detectors.

|

| 16) Water Heater and Smoke Detector Statement of Compliance

This California Association of Realtors disclosure statement enables the seller to remain in compliance with state law by confirming to the buyer that the water heater on the property is braced in case of an earthquake, and that the premises contains the appropriate number of operable smoke detectors.

|

| 17) Wood-Destroying Pests and Organisms Inspection Report

Although not required by state law, if it is a condition of the purchase agreement or a requirement to obtain financing, the seller must provide the buyer with a copy of an inspection report by a registered structural pest control company that indicates whether or not the property contains wood-destroying organisms.

|