Is an Operating Agreement Required?

No – The Vermont statutes imply that LLC operating agreements are optional. However, most LLCs do establish an operating agreement to allow for customization of their management and structure.

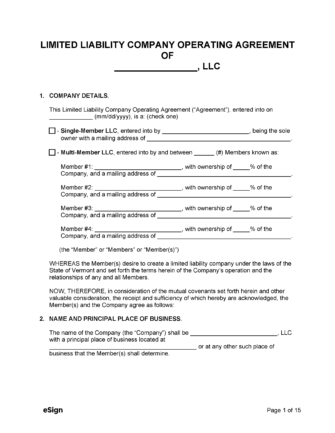

Types (2)

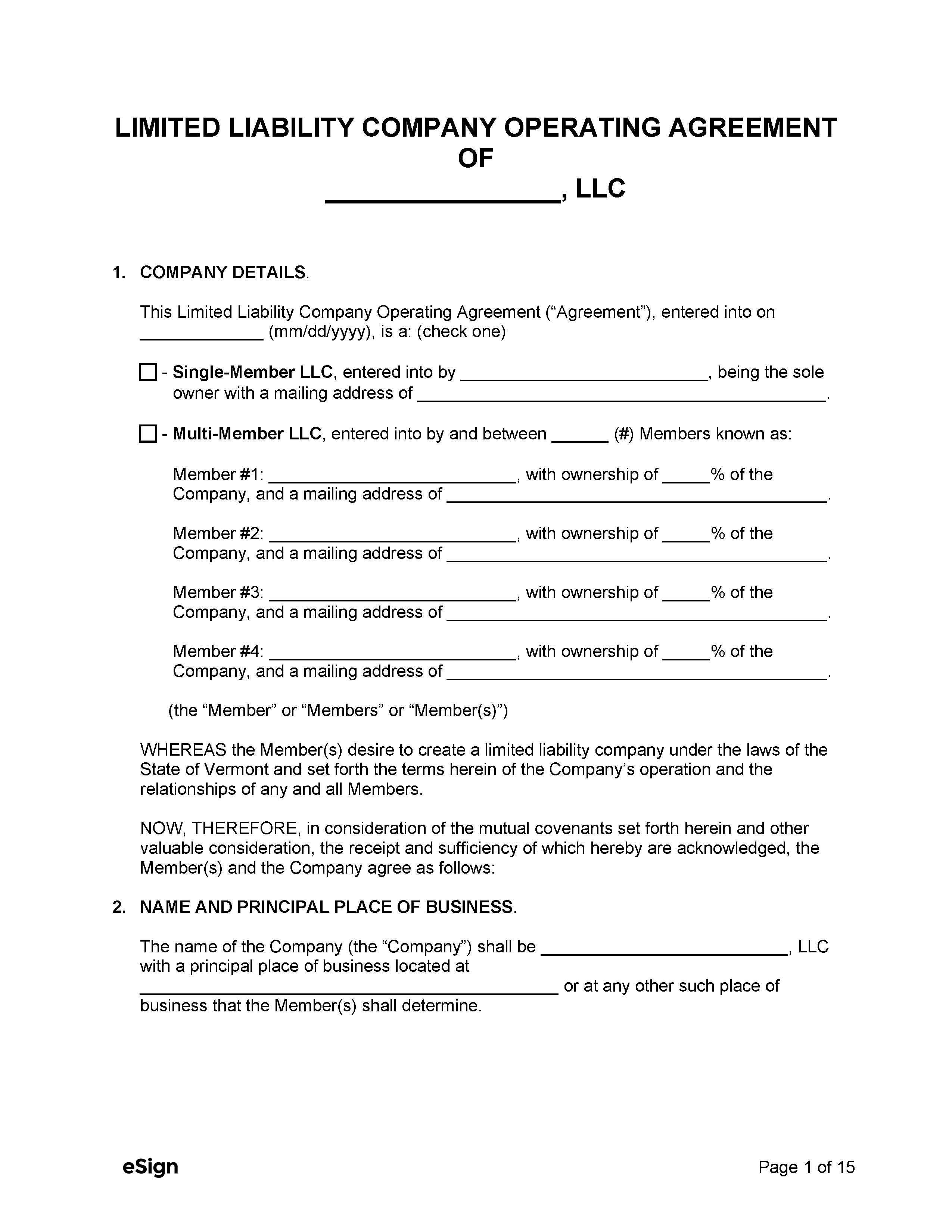

Single-Member LLC Operating Agreement – Written terms of governance for a limited liability company comprised of a single member. Single-Member LLC Operating Agreement – Written terms of governance for a limited liability company comprised of a single member.

|

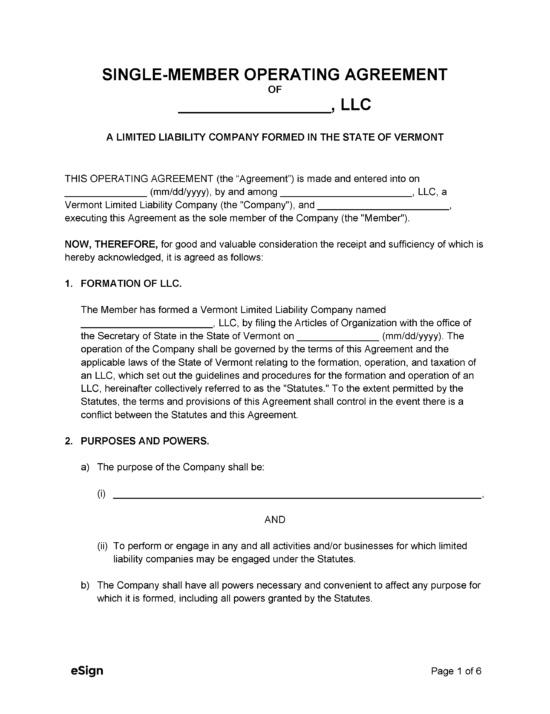

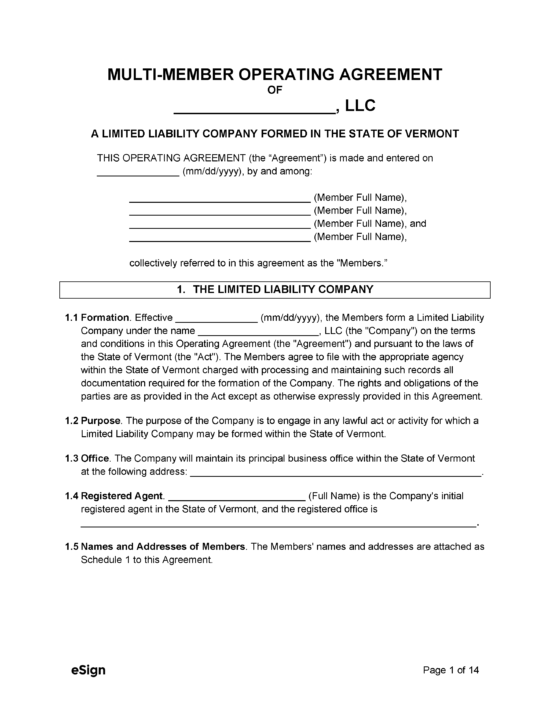

Multi-Member LLC Operating Agreement – Written terms of governance of a limited liability company comprised of multiple members. Multi-Member LLC Operating Agreement – Written terms of governance of a limited liability company comprised of multiple members.

|