Is an Operating Agreement Required in Maine?

Yes – Maine is one of the few states that requires an LLC operating agreement.[1] Since it’s an internal document, the agreement doesn’t need to be filed with the Secretary of State.

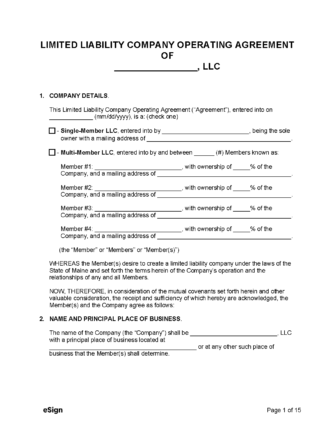

Types (2)

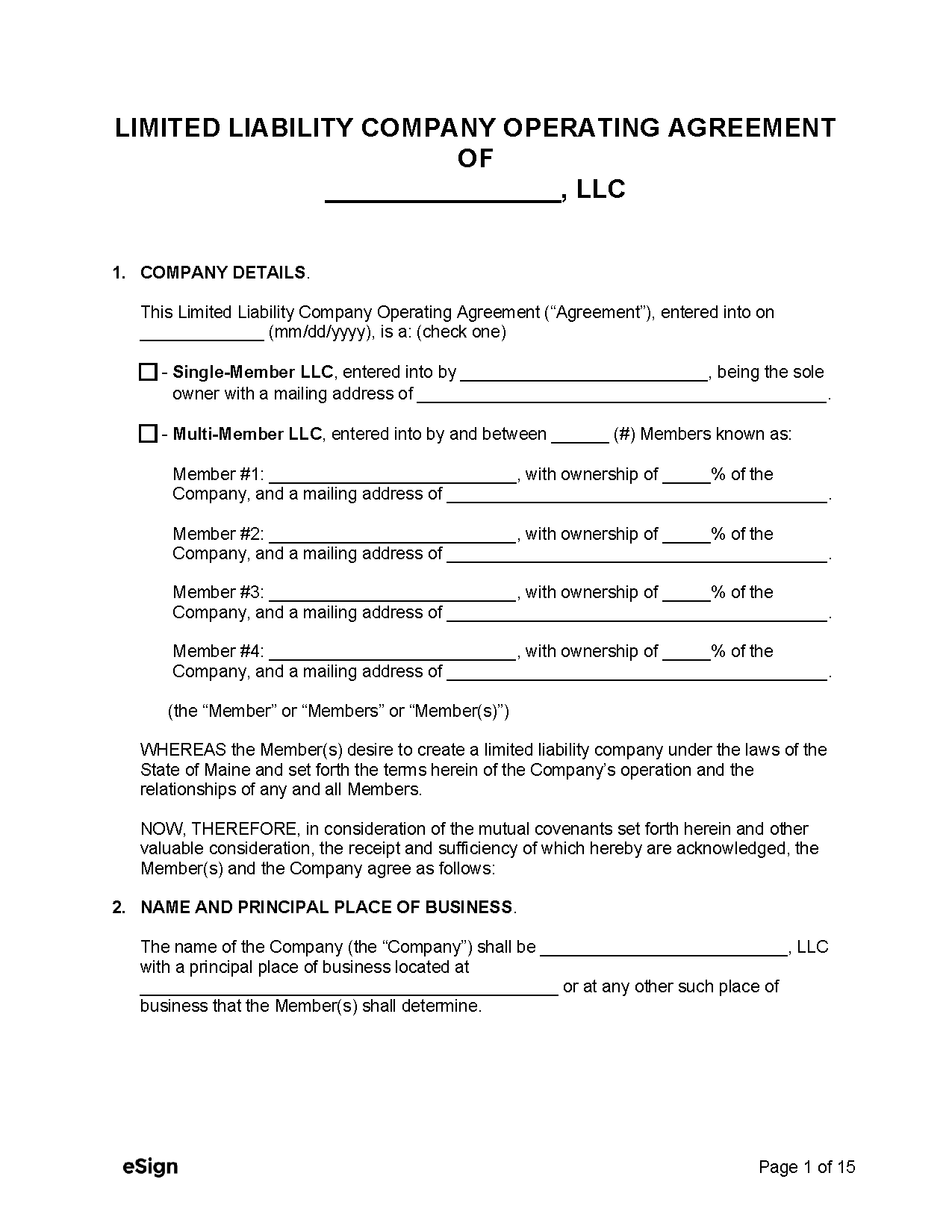

Single-Member LLC Operating Agreement – An operating agreement for LLCs created with one member. Single-Member LLC Operating Agreement – An operating agreement for LLCs created with one member.

|

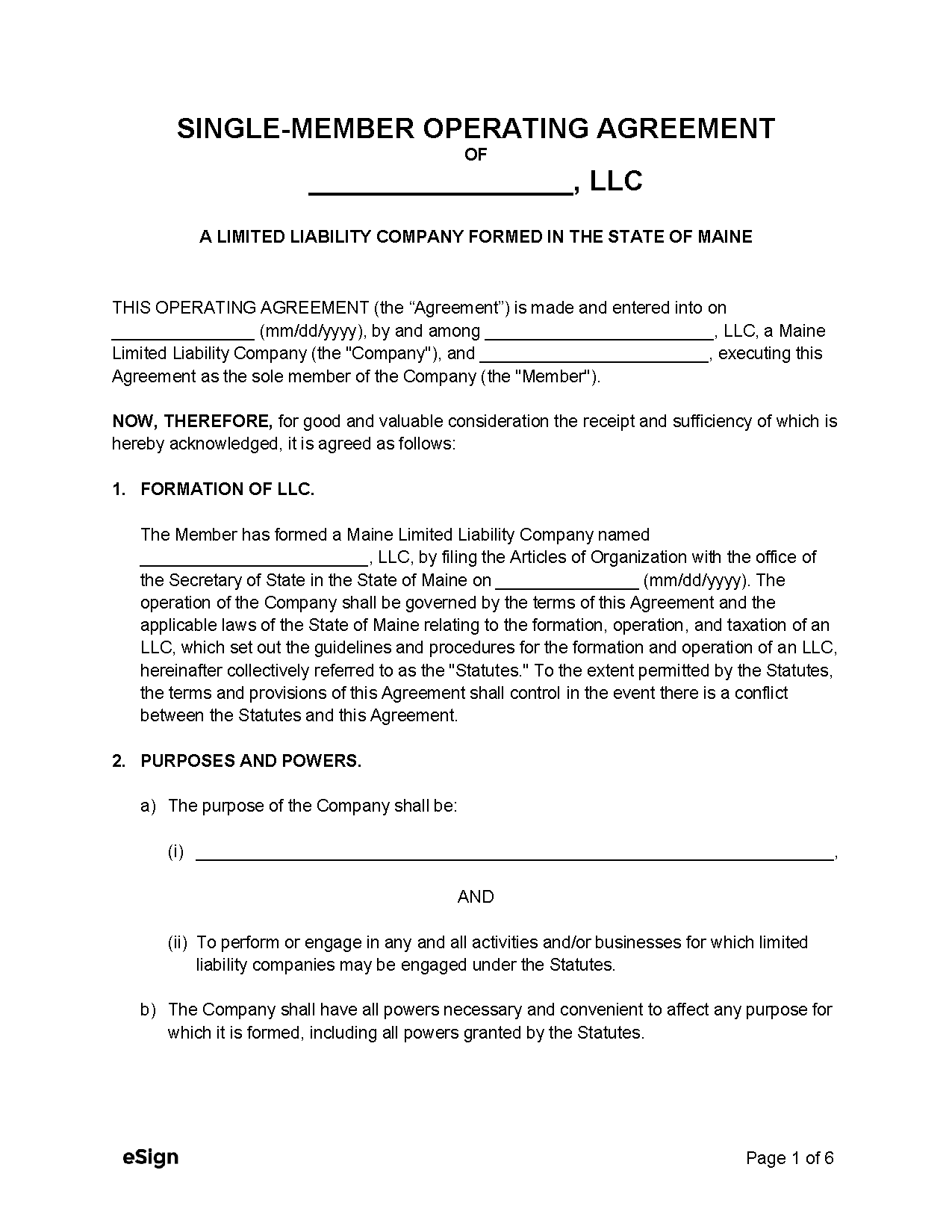

Multi-Member LLC Operating Agreement – A document used by multi-member LLCs to structure their company and operations. Multi-Member LLC Operating Agreement – A document used by multi-member LLCs to structure their company and operations.

|