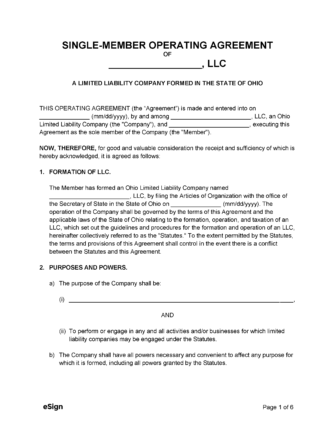

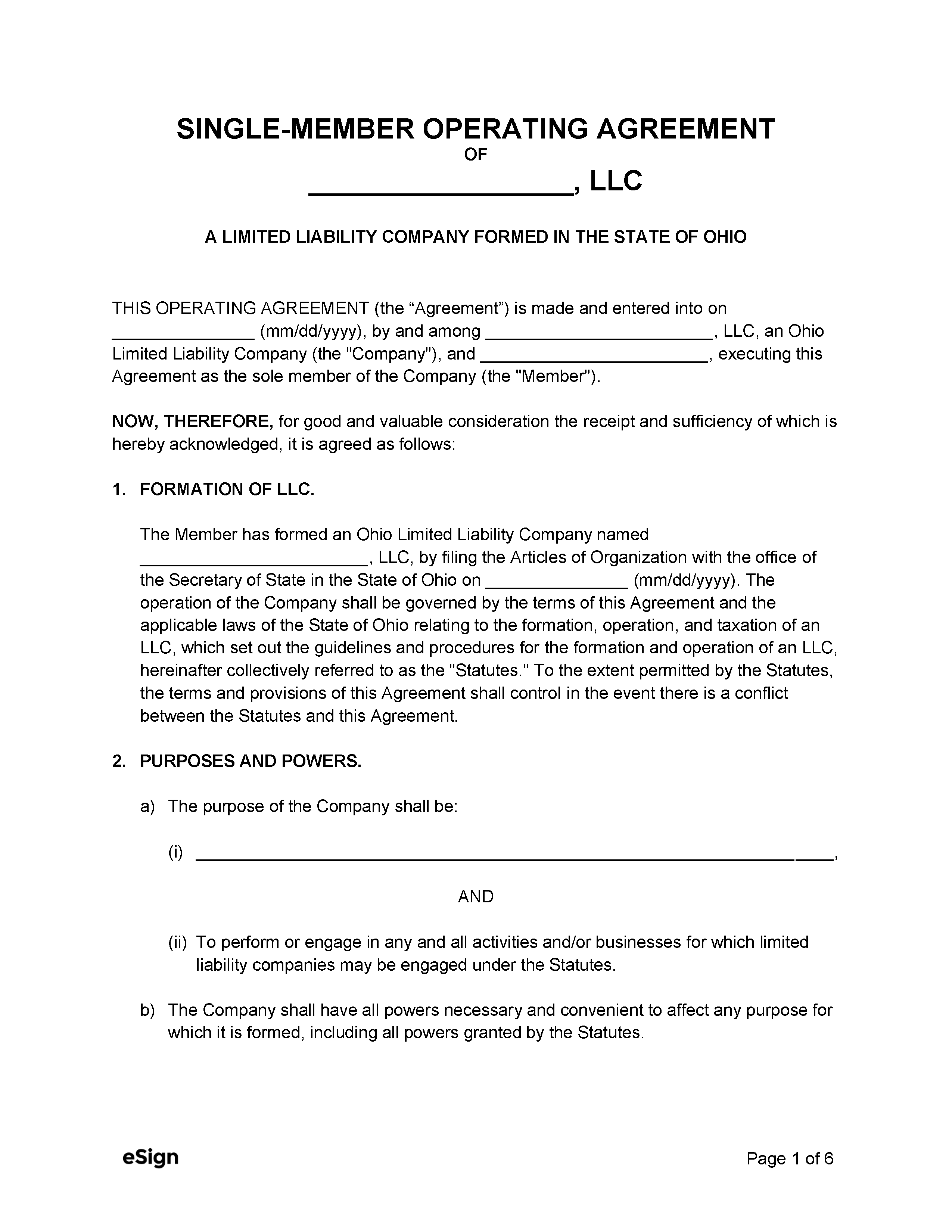

Ohio Single-Member LLC Operating Agreement

Last updated October 14th, 2025

An Ohio single-member LLC operating agreement enables the sole owner of a limited liability company to establish the rules that will govern their business. Since ownership is not shared among multiple members, the terms of a single-member agreement are simpler and can be tailored specifically to the individual’s needs.