Contents |

Types (2)

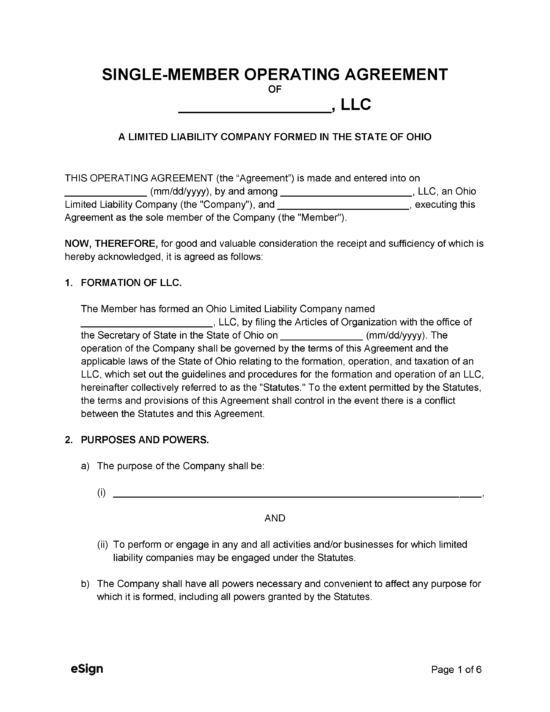

Single-Member LLC Operating Agreement – An operating agreement for LLCs that have only one (1) member.

Single-Member LLC Operating Agreement – An operating agreement for LLCs that have only one (1) member.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Chapter 1706 (Ohio Revised Limited Liability Company Act)

- Definitions: § 1706.01

- Formation: § 1706.16

- Naming of LLCs: § 1706.07

How to File (4 Steps)

- Step 1 – Select a Business Name

- Step 2 – Appoint a Statutory Agent

- Step 3 – File Documents with Secretary of State

- Step 4 – Execute an Operating Agreement

- Step 5 – Register Company for Taxation

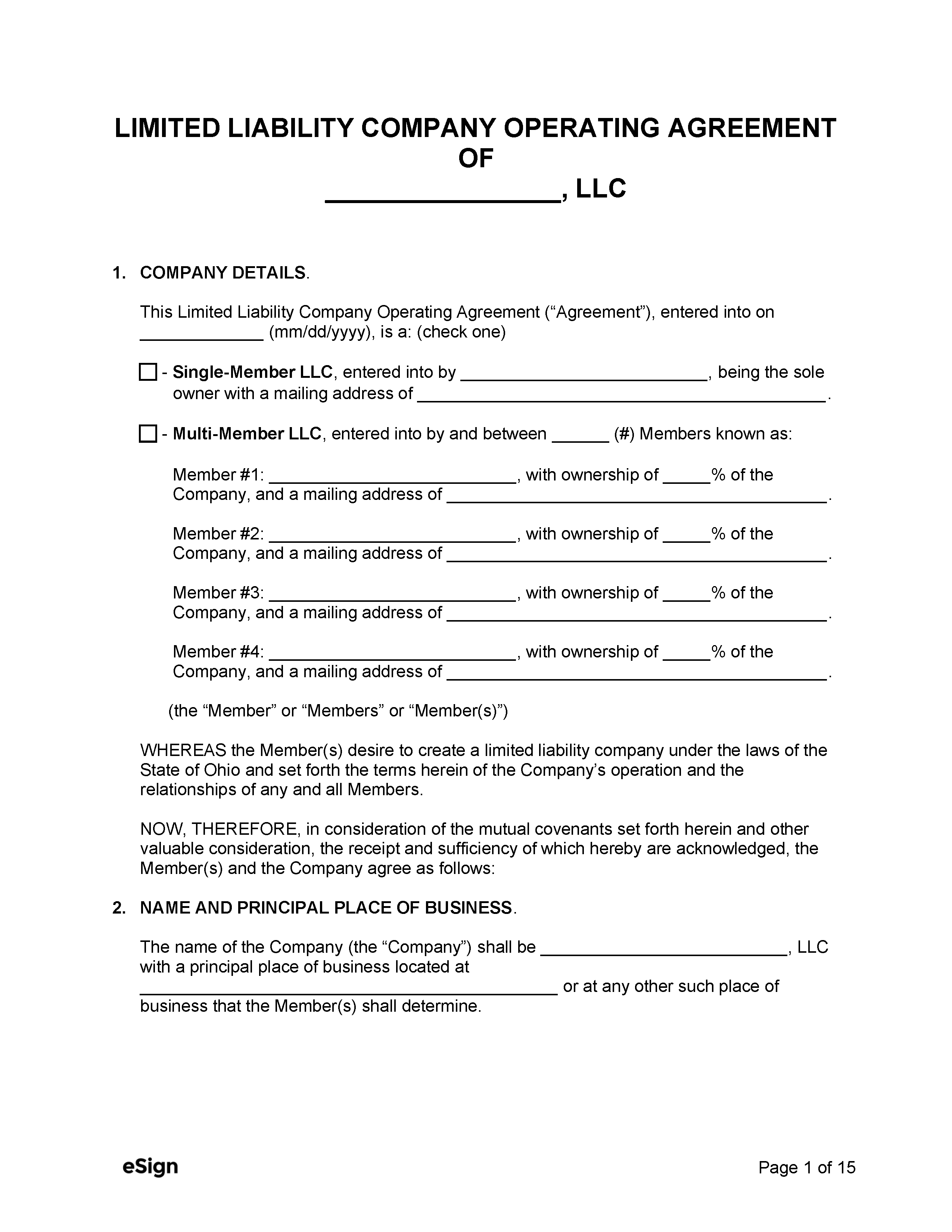

Step 1 – Select a Business Name

All companies are required to register a unique name when they found an LLC. To ascertain whether or not a name is currently registered in Ohio, enter it in the “Business Name” field of the Secretary of State Business Search webpage and click Search to see the results. If the same name is already in use, the process will need to be repeated until a unique name is found.

The company name can be reserved for one hundred eighty (180) days by filing a Name Reservation (Form 534b) with the Secretary of State (address below) or through the online business portal. The filing fee is $39.

Regular Filing (non expedite)

P.O. Box 670 Columbus

OH 43216

Step 2 – Appoint a Statutory Agent

LLCs are required to appoint a statutory agent to accept service of process on the company’s behalf. The agent must be an Ohio resident or an entity with a business address in the state. The agent will be required to sign an Acceptance of Appointment when the LLC applies for registration with the Secretary of State.

Step 3 – File Documents with Secretary of State

Before an LLC can legally operate in the state, the company must complete and file Form 533A – Articles of Organization with the Secretary of State. If the company is already registered in another state and is expanding into Ohio, Form 533B – Registration of a Foreign LLC must be filed along with proof of authenticity from their domestic state.

File Online

Navigate to the Ohio Online Business Central and click Submit a Business Filing. On the next page, the user will be asked to log in or register a profile by clicking Click here to Create Profile. Once logged in, complete and submit the Articles of Organization/Registration of Foreign Organization and pay the $99 filing fee (via credit card).

File By Mail

To file by mail, the following form(s) must be downloaded and completed:

- Domestic LLC

- Articles of Organization (Form 533a) – PDF

- Foreign LLC

- Registration of a Foreign LLC (Form 533b) – PDF

- Certificate of Existence (issued by state of origin)

Prepare a check or money order payable to “Ohio Secretary of State” for $99 to pay the filing fee. Mail the completed documents and payment to the address below.

Regular Filing (non expedite)

P.O. Box 670 Columbus

OH 43216

Note on Expedited Filing (Optional)

For an additional fee, filing may be processed at a faster rate as follows:

- Expedite Service 1 – Filing processed within two (2) business days: $100 (mailed to Expedite Filing, P.O. Box 1390 Columbus, OH 43216)

- Expedite Service 2 – Filing processed within one (1) business day: $200 (only available to walk-in customers)

- Expedite Service 3 – Filing processed within four (4) hours: $300 (only available to walk-in customers)

Client Service Center address: 22 North Fourth Street, Columbus, OH 43215

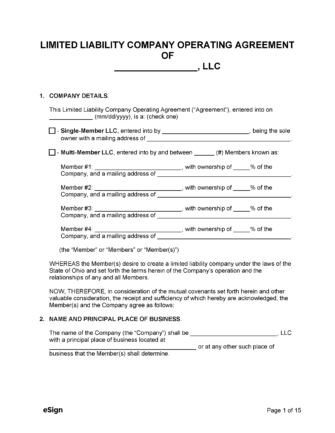

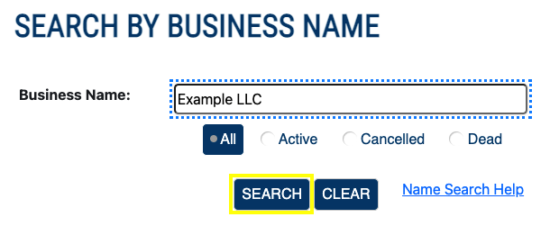

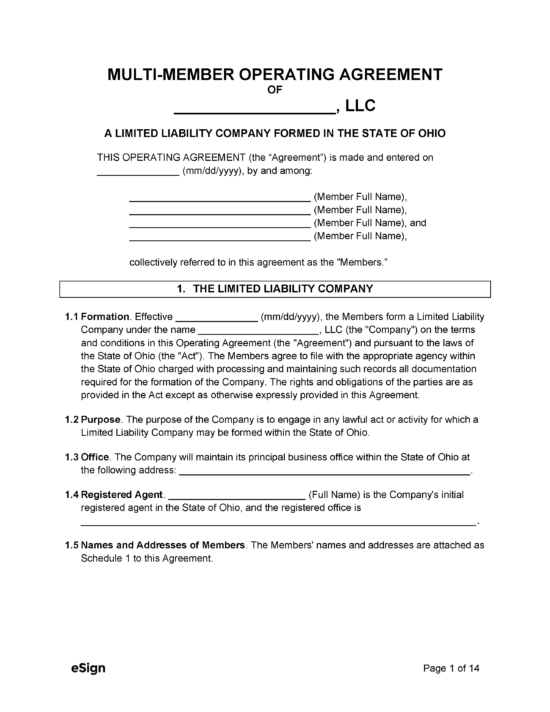

Step 4 – Execute an Operating Agreement

Separate from the Articles of Organization, an operating agreement sets forth an LLC’s financial and operational framework and procedures. It is not technically required to create an operating agreement for an LLC. However, it should be considered a requirement for multi-member LLCs because it establishes each member’s ownership percentage, as well as their rights and responsibilities in a contract that binds them to its terms.

Step 5 – Register for Taxation

After an LLC’s foundation, it will need to be registered for state taxes. Registration can be completed through the Ohio Business Gateway portal. It is recommended that a CPA is hired to ensure that the business is properly registered to pay state taxes.

If the company has more than one (1) member, the LLC must also apply for an employer ID number (EIN) from the IRS. An EIN can be applied for online at no cost. Single-member LLCs also require an EIN if they plan to have employees or be taxed as a corporation.

ResourcesFiling Options: Online / By Mail Costs:

Forms:

Links:

|