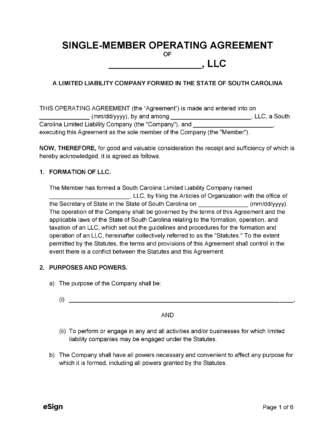

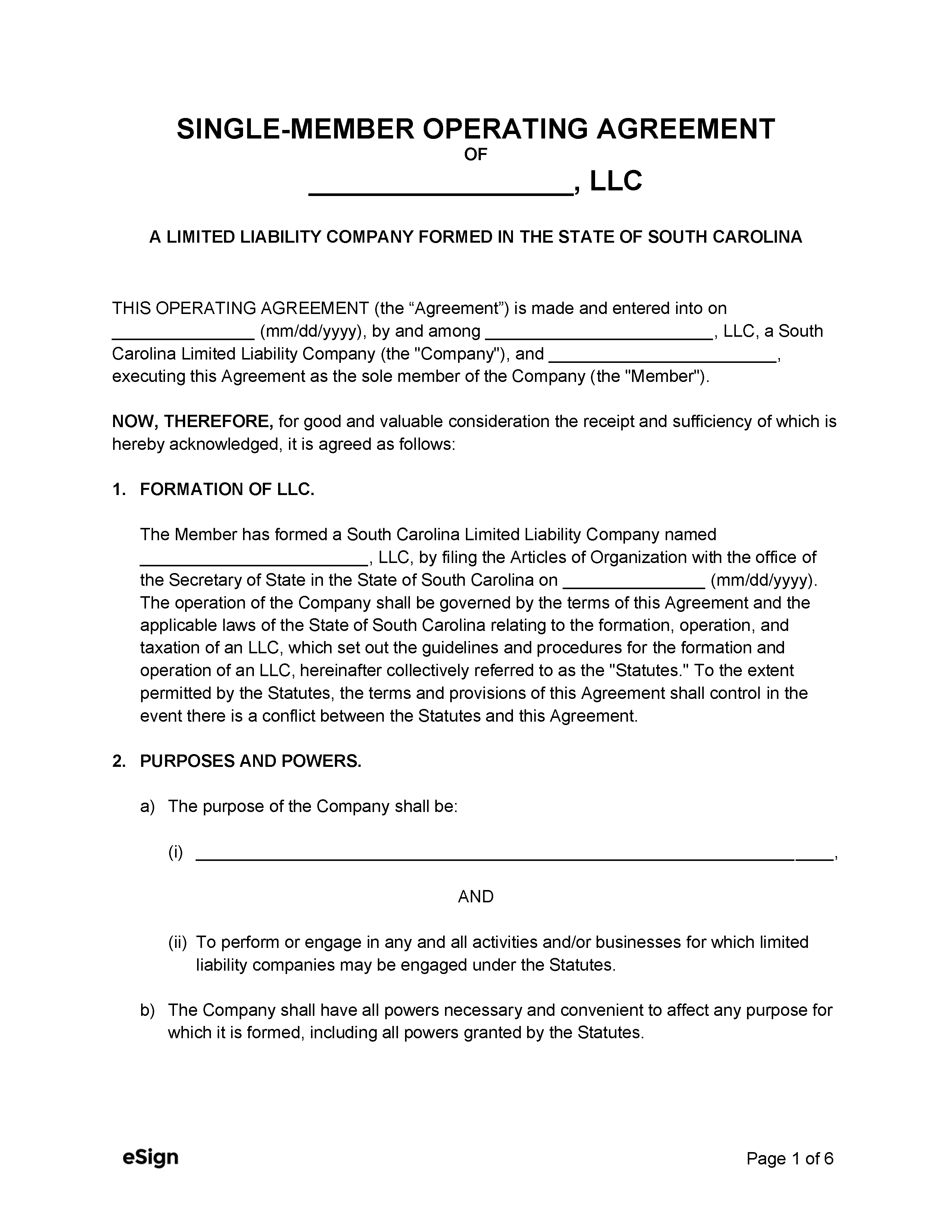

South Carolina Single-Member LLC Operating Agreement Form

Last updated October 14th, 2025

A South Carolina single-member LLC operating agreement is a contract that sets forth the purpose and operations of an LLC with one sole owner. The document also helps establish the separation of company from owner to further protect personal assets from liability. It also outlines the dissolution process if the owner becomes incapacitated.