Unlike the forms that are filed with the Secretary of State to create an LLC, the operating agreement relays the company’s management, taxation, distribution payments, and division of ownership. If an agreement isn’t executed by an LLC’s members, their company will be governed solely by state law, which may expose them to personal liability.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title 33, Chapter 44

- Definitions: § 33-44-101

- Formation: § 33-44-202

- Naming of LLCs: § 33-44-105

How to File (4 Steps)

- Step 1 – Verify Unique LLC Name

- Step 2 – File LLC Forms with Secretary of State

- Step 3 – Sign an Operating Agreement

- Step 4 – Obtain an EIN

Step 1 – Verify Unique LLC Name

At the time of its formation, an LLC must register a unique entity name that contains one (1) of the following designations:

- “Limited Liability Company”

- “Limited Company”

- “L.L.C.”

- “LLC”

- “LC”

- “L.C.”

“Limited” and “Company” can be abbreviated as “Ltd.” and “Co.”

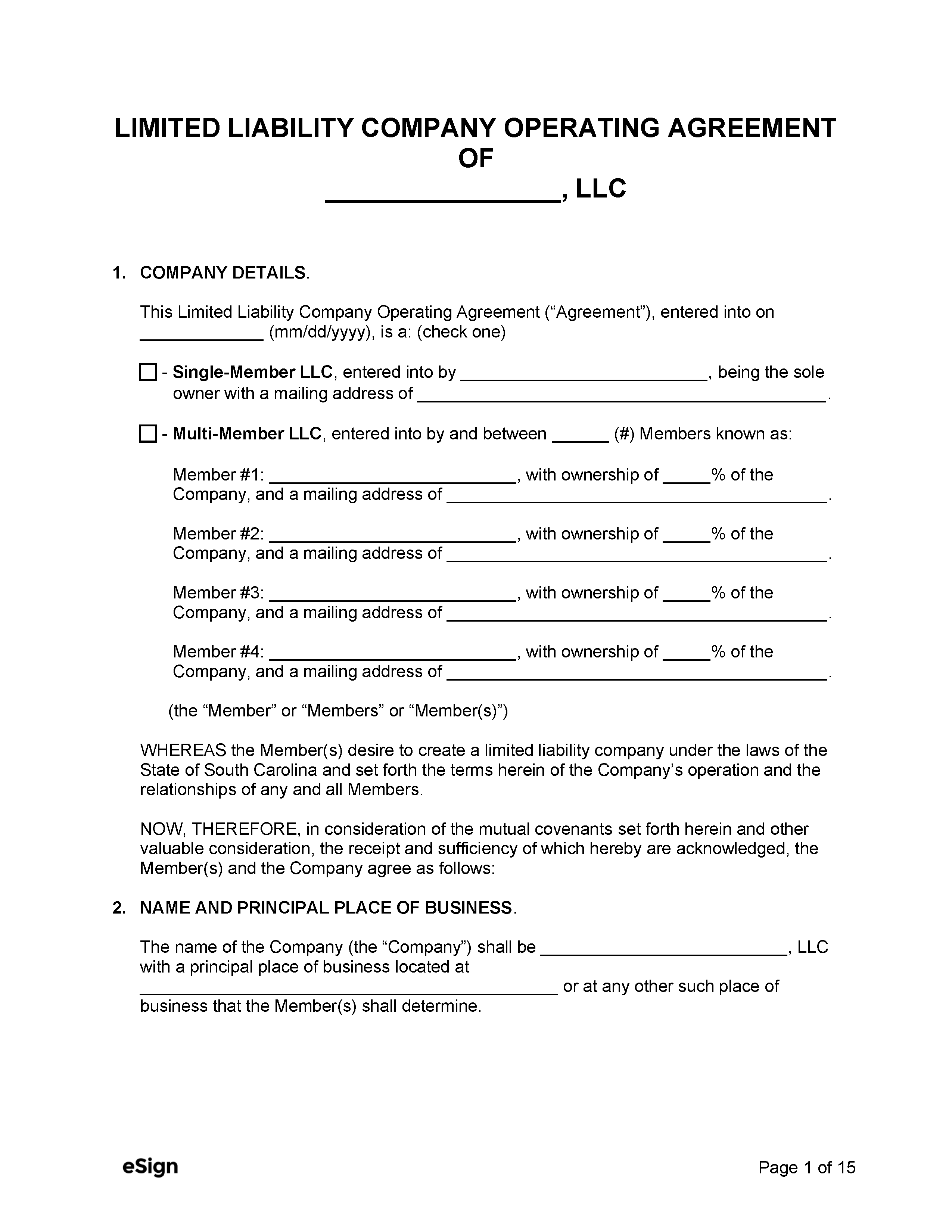

To verify whether an entity name is unique and not already registered in the state, search for the name’s availability using the Business Name Search webpage. If the search results show that another company is using the same name, repeat the search process until a unique name is found.

Note on Name Reservations

A unique entity name can be reserved for one hundred and twenty (120) days by completing an Application to Reserve a LLC Name and mailing it to the Secretary of State at the below address. The filing fee is $25.

South Carolina Secretary of State’s Office

Attn: Corporate Filings

1205 Pendleton Street, Suite 525

Columbia, SC 29201

Step 2 – File LLC Forms with Secretary of State

To create an LLC in South Carolina, the company will need to file for approval by the Secretary of State. The required forms and filing fees vary depending on the type of LLC and whether the filing is completed by mail or online.

File Online

- Register a Business Entities Online account.

- Navigate to the Business Name Search webpage.

- Enter the LLC’s name in the indicated field.

- Click Search.

- If there are no exact matches to the LLC’s name, click Add New Entity to begin the online filing process for a new LLC.

- Follow the instructions and complete the necessary online forms to file for acceptance by the Secretary of State.

- A credit card will be required to pay the $125 online filing fee.

File By Mail

Domestic LLC

- Download and complete the Articles of Organization.

- Prepare payment for the $110 filing fee by making a check or money order payable to: “Secretary of State.”

- Mail the completed form and payment to the Secretary of State (address below).

Foreign LLC

- Obtain a Certificate of Existence or equivalent document from the company’s state of registration. The certificate must have been issued within thirty (30) days of filing in South Carolina.

- Download and complete the Application for a Certificate of Authority to Transact Business.

- Make a check or money order in the amount of $110 payable to: “Secretary of State.”

- Mail the certificate, application, and payment to the below address.

South Carolina Secretary of State’s Office

Attn: Corporate Filings

1205 Pendleton Street, Suite 525

Columbia, SC 29201

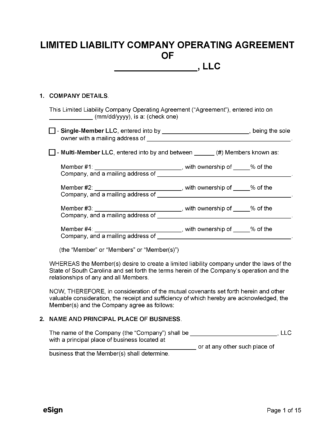

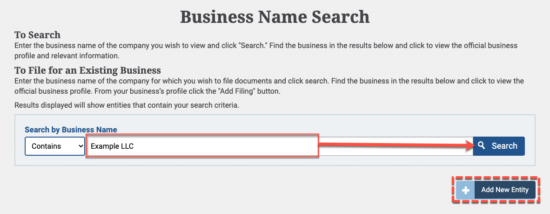

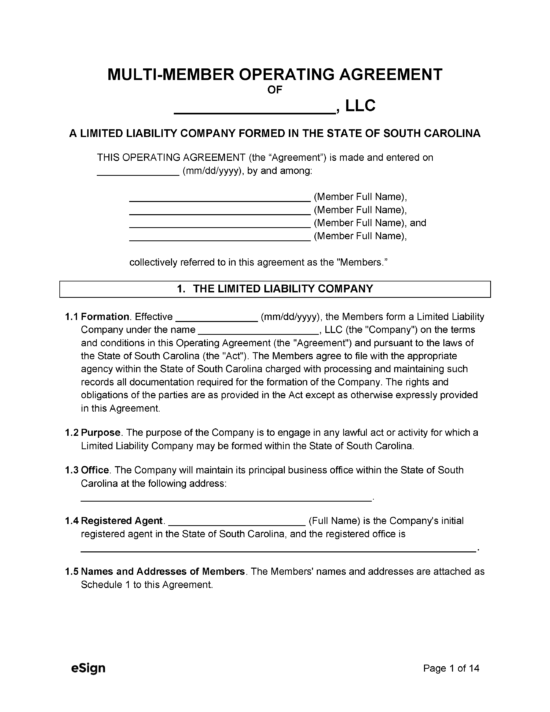

Step 3 – Sign an Operating Agreement

Following the LLC’s formation, the members should execute an operating agreement to form a binding agreement regarding their financial interest, share of ownership, and obligations in the company. The agreement is an internal document that isn’t legally required and doesn’t need to be filed with the Secretary of State.

Step 4 – Obtain an EIN

Any LLC that has two (2) or more members is legally required to obtain an Employer Identification Number (EIN) from the IRS. The EIN is a number that identifies the company for federal taxation of their business. Single-member LLCs only require an EIN if they plan on hiring employees or being taxed as a corporation.

An EIN can be applied for online or by completing an Application for EIN and mailing it to the below address. The IRS doesn’t charge an application fee for EINs.

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

ResourcesFiling Options: Online / By Mail Costs:

Forms:

Links:

|