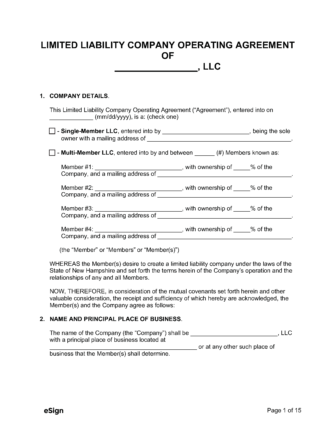

Is an Operating Agreement Required?

No – Though it is not legally required, LLC members are generally advised to draft an operating agreement to tailor the company’s management structure to their needs.

Types (2)

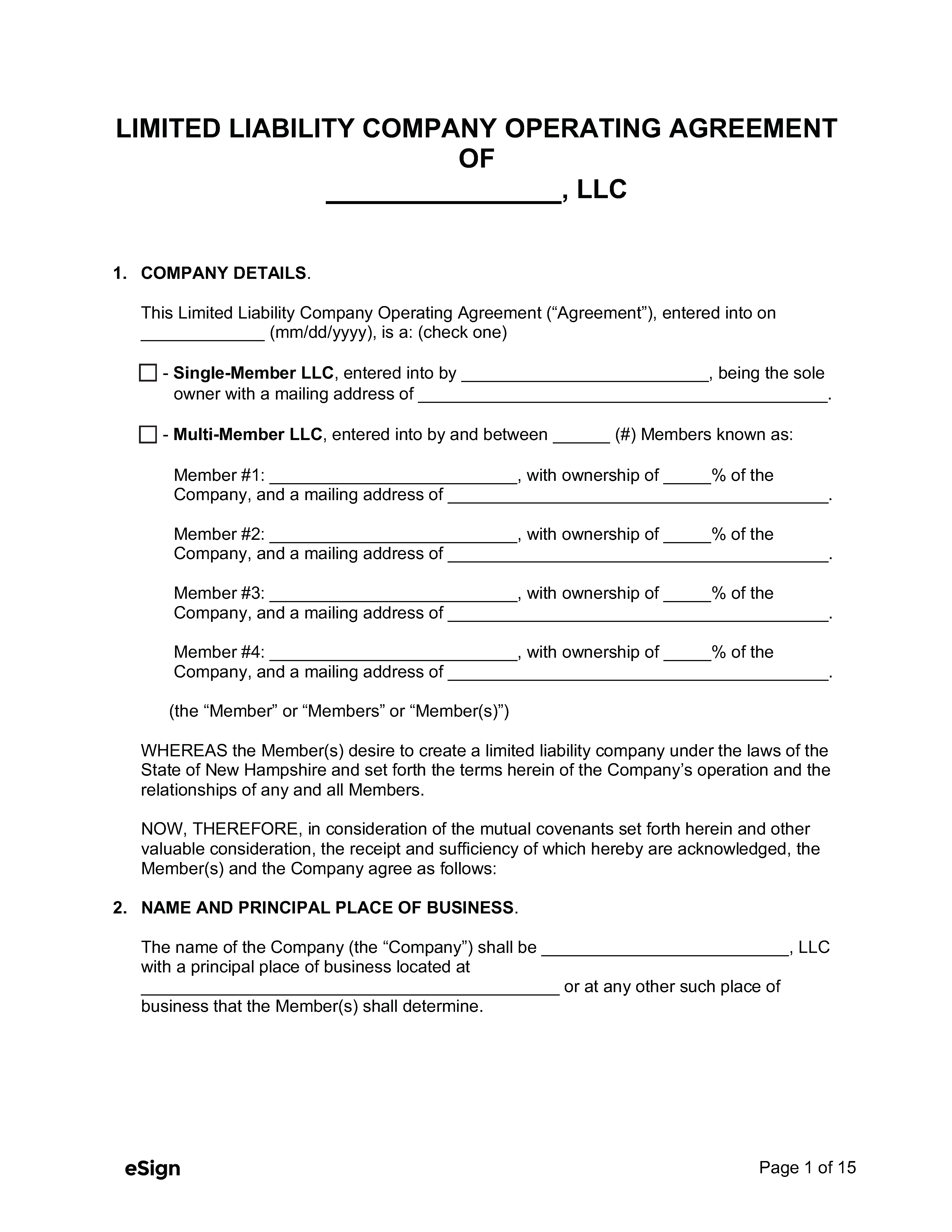

Single-Member LLC Operating Agreement – If an LLC only has one member, this form is used. Single-Member LLC Operating Agreement – If an LLC only has one member, this form is used.

|

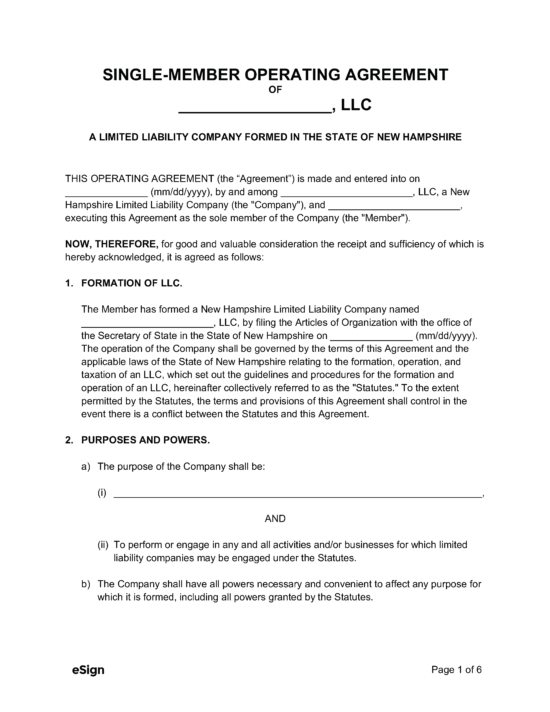

Multi-Member LLC Operating Agreement – This agreement is used when an LLC has two or more members. Multi-Member LLC Operating Agreement – This agreement is used when an LLC has two or more members.

|