Types (2)

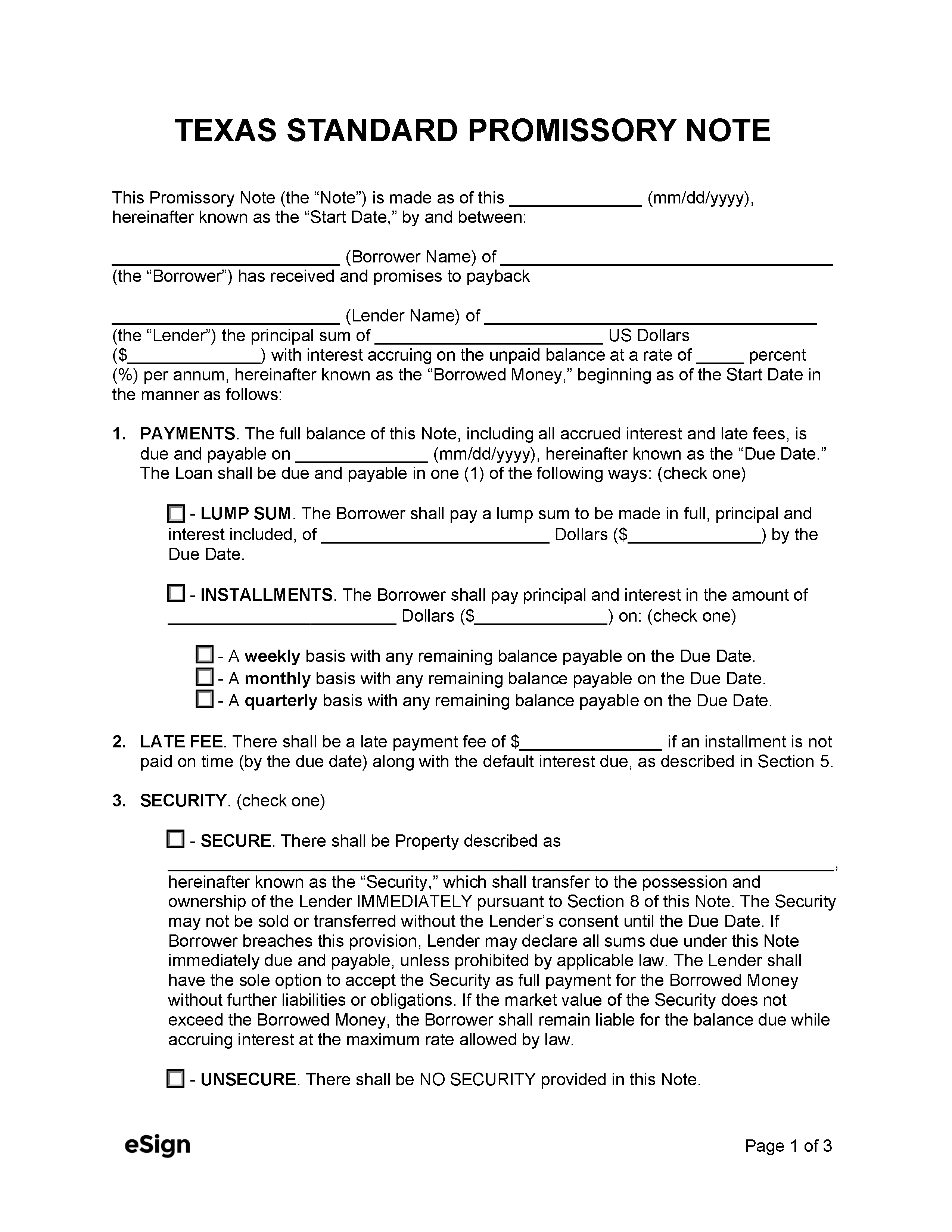

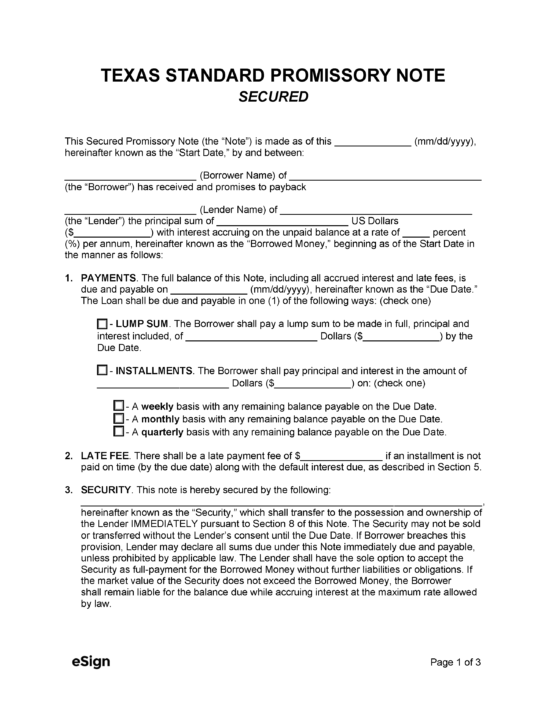

Secured Promissory Note – A personal loan with the borrower’s property promised as security on repayment.

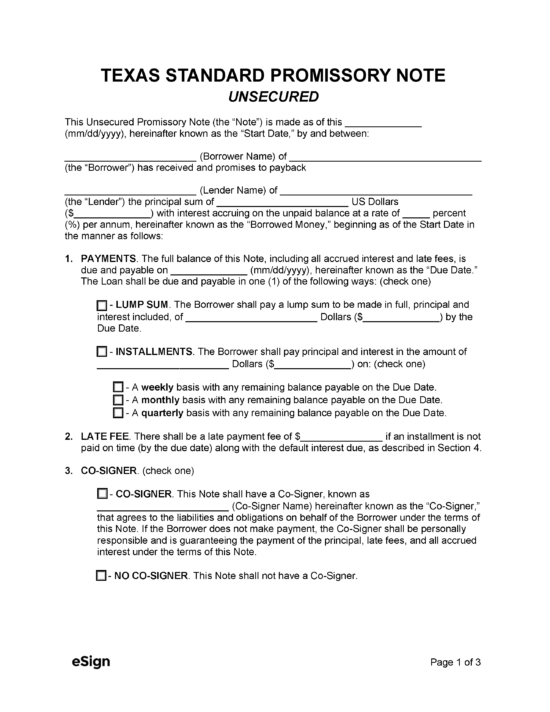

Secured Promissory Note – A personal loan with the borrower’s property promised as security on repayment.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Subtitle A – Interest

- Usury Rate with Contract (§ 302.001(b)): 10%

- Usury Rate without Contract (§ 302.002): 6%

- Usury Rate for Money Judgments with Contract (§ 304.002(2)): 18% or the amount specified in contract, whichever is lesser.

- Usury Rate Post Judgment (§ 304.003(c)):

- The federal prime rate if the prime rate published by the Board of Governors of the Federal Reserve System is between 5% and 15%.

- If the prime rate published by the Board of Governors of the Federal Reserve System is less than 5% – 5%

- If the prime rate published by the Board of Governors of the Federal Reserve System is more than 15% – 15%

- Periodic Usury Ceiling (§ 303.003, § 303.005, § 303.009, Texas Credit Letter): 18%

- Usury Ceiling for Credit Extensions (§ 303.009(c)): 28%

- Usury Ceiling for Open-End Account Credit Agreements (§ 303.009(d)): 21%