Types (2)

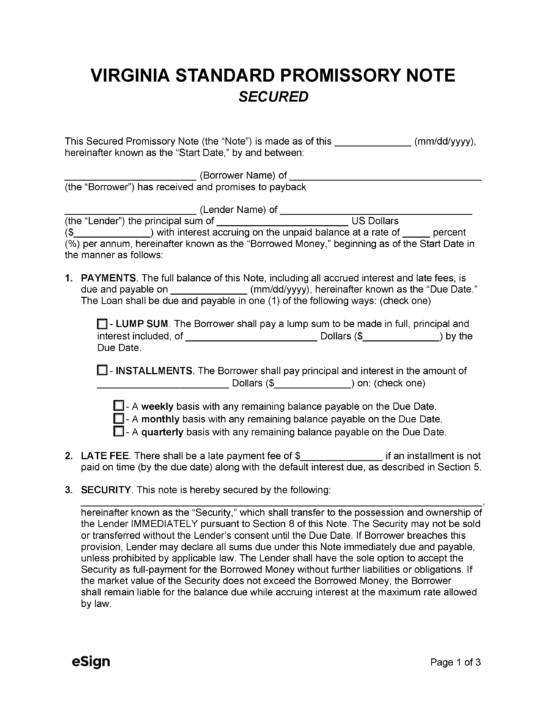

Download: PDF, Word (.docx), OpenDocument

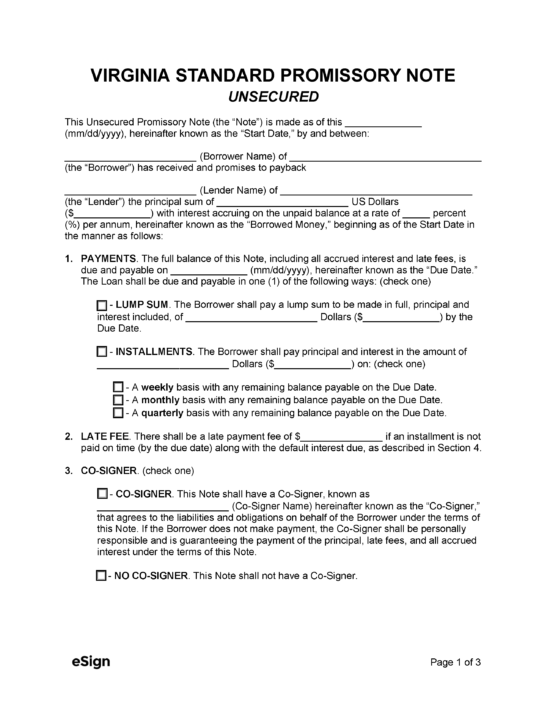

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Chapter 3 – Interest and Usury

- Usury Rate with Contract (§ 6.2-303(A)): 12%

- Usury Rate Generally (§ 6.2-301(A)): 6%

- Usury Rate with Bankruptcy Proceeding (§ 6.2-1522): 6%

- Usury Rate for Insurance Premiums (§ 38.2-1806(A)): 1.5%/month

- Usury Rate for Pawnbrokers (§ 54.1-4008(A)):

- Loans of $25 or less – 10%/month

- Loans of $100 or less – 7%/month

- Loans of more than $100 – 5%/month

- Usury Rate for Third Party Tax Payments (§ 58.1-3018(B)(2)): 16%