Types (2)

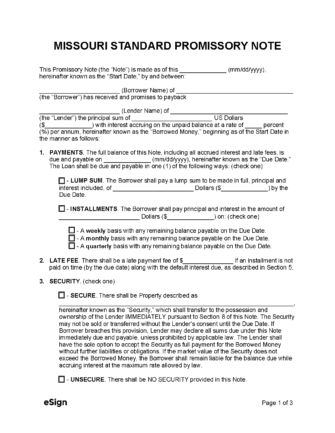

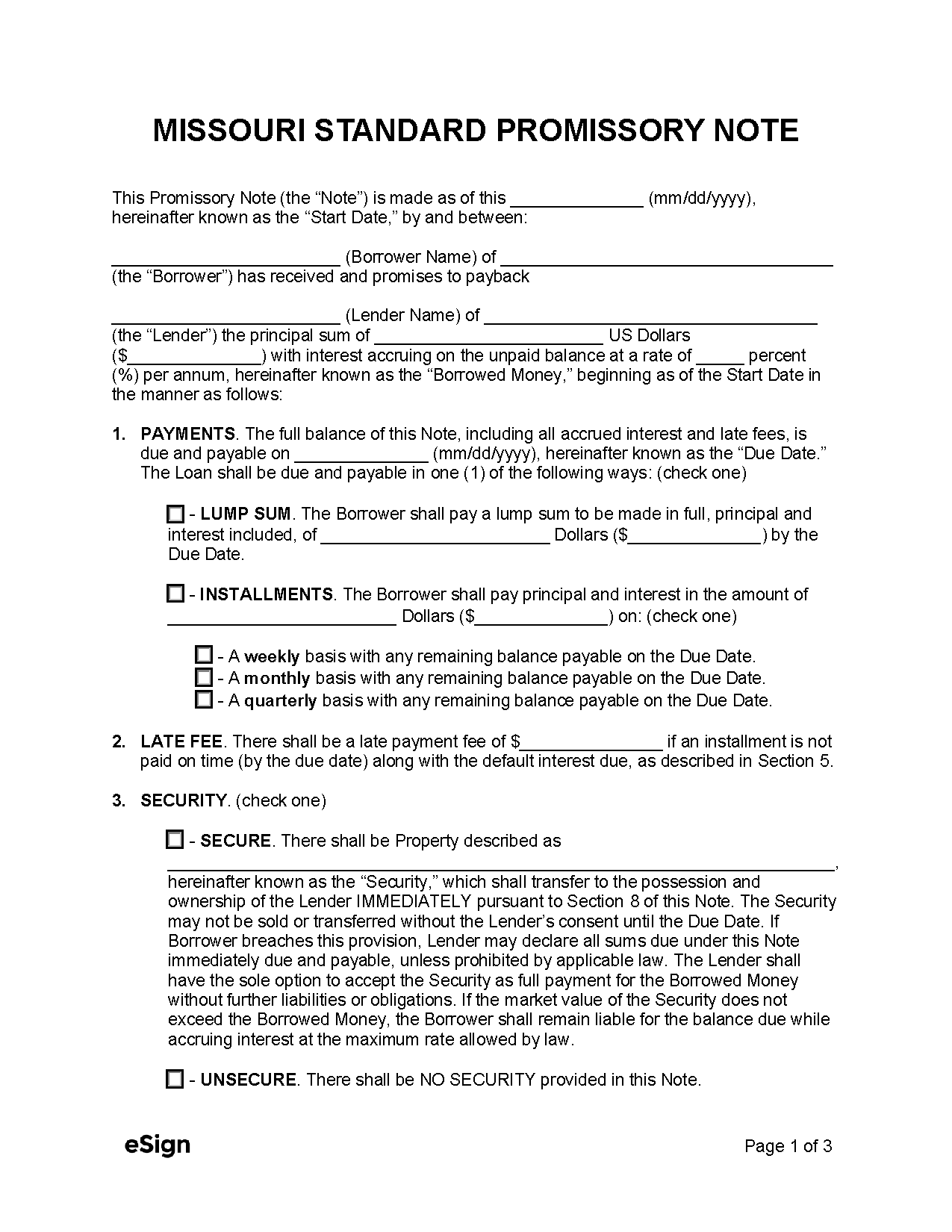

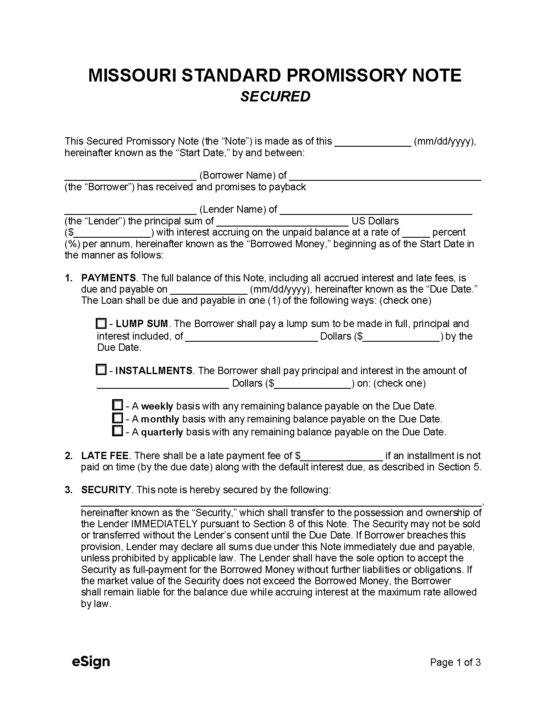

Secured Promissory Note – Used to record a loan in which the borrower forfeits certain assets if they fail to meet any contract terms.

Download: PDF, Word (.docx), OpenDocument

![]() Unsecured Promissory Note – Documents a loan transaction that is not insured by the borrower’s property.

Unsecured Promissory Note – Documents a loan transaction that is not insured by the borrower’s property.

Download: PDF, Word (.docx), OpenDocument

Laws

- Interest & Usury Laws: Title XXVI, Chapter 408

- Usury Rate with a Contract (§ 408.030): 10%, unless the market rate exceeds 10%, in which case the interest may not exceed the market rate. The parties may also agree to a $10 fee in lieu of interest (§ 408.031).

- Usury Rate without a Contract (§ 408.020): 9%

- Usury Rate for Judgements (§ 408.040(3)): Federal Funds Rate + 5%

- Usury Rate in General (misdemeanor) (§ 408.095): 2% per month

- Usury Rate for Secured Personal Credit Loans (§ 367.021(2)): 2% per month

- Loans without Interest Limit (§ 408.035):

- Loan to a corporation, GP, LP, LLC;

- Credit extensions for agricultural, business, or commercial purposes;

- Non-residential real estate loans; or

- Loans greater than $5,000 secured solely by certificates of stock, bonds, bills of exchange, certificates of deposit, warehouse receipts, or bills of lading.