Laws

- Statute: Ch. 30 § 30-24,125, 30-24,126, & 30-24,129

- Maximum Estate Value (§ 30-24,125(a)(1)): $100,000, less liens and encumbrances

- Mandatory Waiting Period (§ 30-24,125(a)(2)): Thirty (30) days

- Where to File: Not mentioned in state statutes.

How to Record (3 Steps)

Step 1 – Requirements for Small Estate

Certain legal factors determine whether an estate can be transferred to heirs and other successors without a formal probate action. According to Nebraska statute § 30-24,125, probate is not required if the estate meets the following requirements:

- The value of the estate is $100,000 or less, not counting any liens and encumbrances.

- Thirty (30) days have passed from the date of death.

- No real property is being transferred.

- No application or petition to appoint a personal representative has been issued or is pending.

- The claiming party is entitled to the property being transferred.

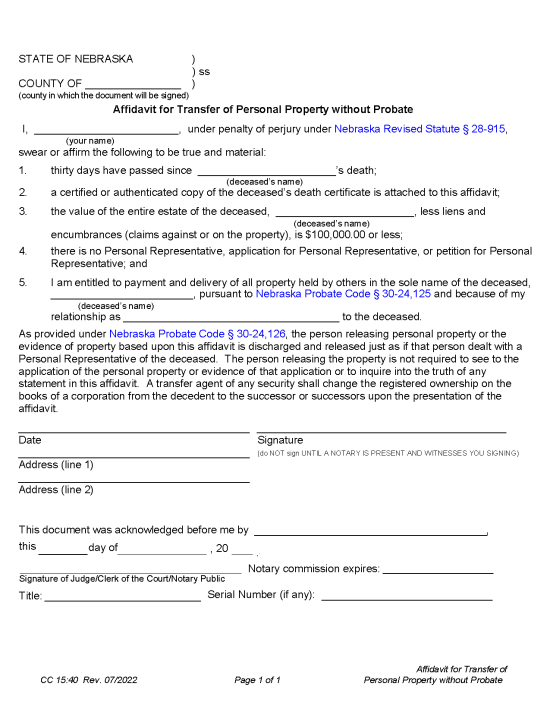

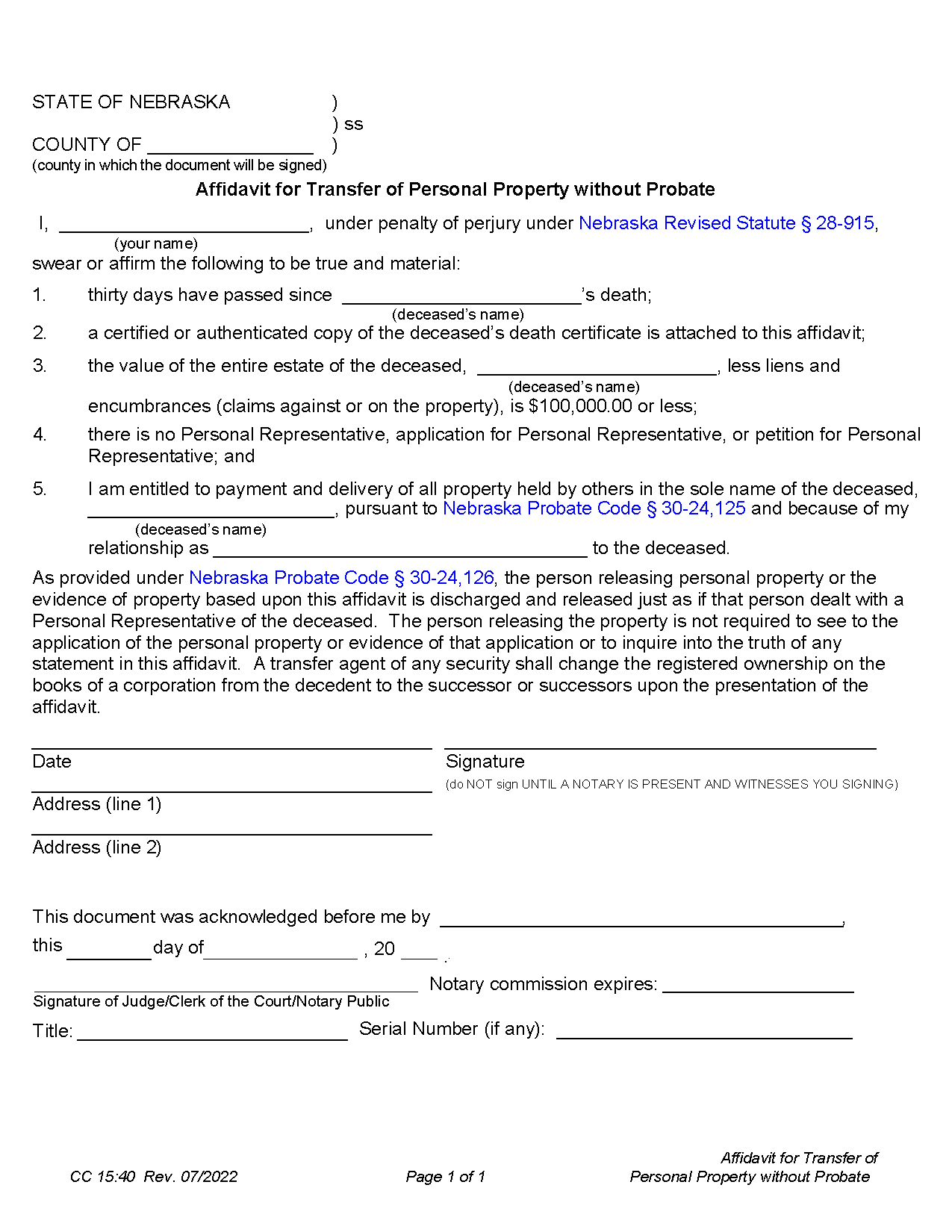

Step 2 – Complete the Affidavit

A successor to the decedent’s property will need to draft the Affidavit for Transfer of Personal Property without Probate. The person completing the form, the “affiant,” must wait until a notary public is present before signing. After the document has been signed and authenticated by the notary, a copy of the decedent’s death certificate must be attached.

Step 3 – Obtain Property

A signed and notarized affidavit must be given to each party currently possessing or controlling the decedent’s property. The property holder is then obligated under § 30-24,126 to deliver the property to the affiant or, in the case of money owed, make payment to the affiant for the amount of indebtedness.

When claiming real property distributed under the decedent’s will, a copy of the will must be attached to the affidavit (§ 30-24,129(a)(4)).

Note: If transferring ownership of a vehicle titled in the decedent’s name alone, the affiant must complete an Affidavit for Transfer of Decedent’s Vehicle/Motorboat and file it with the Department of Motor Vehicles.