Laws

- Statute: NRS 146.080

- Maximum Estate Value (NRS 146.080(7)): $25,000, or $100,000 if the claimant is the surviving spouse (Motor vehicles are not factored into the total estate value.)

- Mandatory Waiting Period (NRS 146.080(2)(d)): Forty (40) days

- Where to File: Not mentioned in state statutes.

How to Record (4 Steps)

- Step 1 – Small Estate Criteria

- Step 2 – Deliver Notice to Claimants

- Step 3 – Fill in Affidavit

- Step 4 – Transfer Property

Step 1 – Small Estate Criteria

A Small Estate Affidavit can be used if the total value of the decedent’s property, excluding the value of any vehicles, does not exceed $100,000 (if the claimant is the surviving spouse) or $25,000 (for all other claimants). In addition, the following statements must apply (NRS 146.080(2)):

- The decedent left no real property.

- The decedent has been deceased for at least forty (40) days.

- The claimant has a legal right to succeed the property.

- The claimant is unaware of any existing claims for personal injury or tort damages against the decedent.

- No petition to appoint a personal representative has been made or is pending in any jurisdiction.

- The decedent’s debts have been paid, including funeral/burial expenses and any money owed to the Department of Health and Human Services in consequence of the payment of Medicaid benefits.

Step 2 – Deliver Notice to Claimants

The claimant must deliver, either by personal service or certified mail, a notice to each individual who has an equal or higher claim to the decedent’s property. This notice shall state the claimant’s intention to use the affidavit and inform the other individuals of the property being claimed.

Note: The claimant must give the other individuals at least fourteen (14) days to respond to the notice.

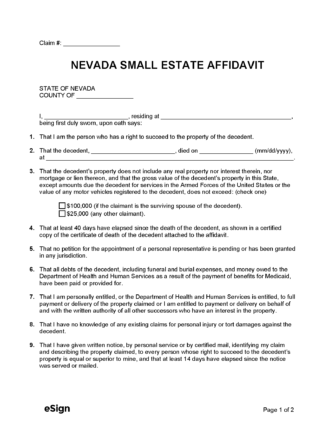

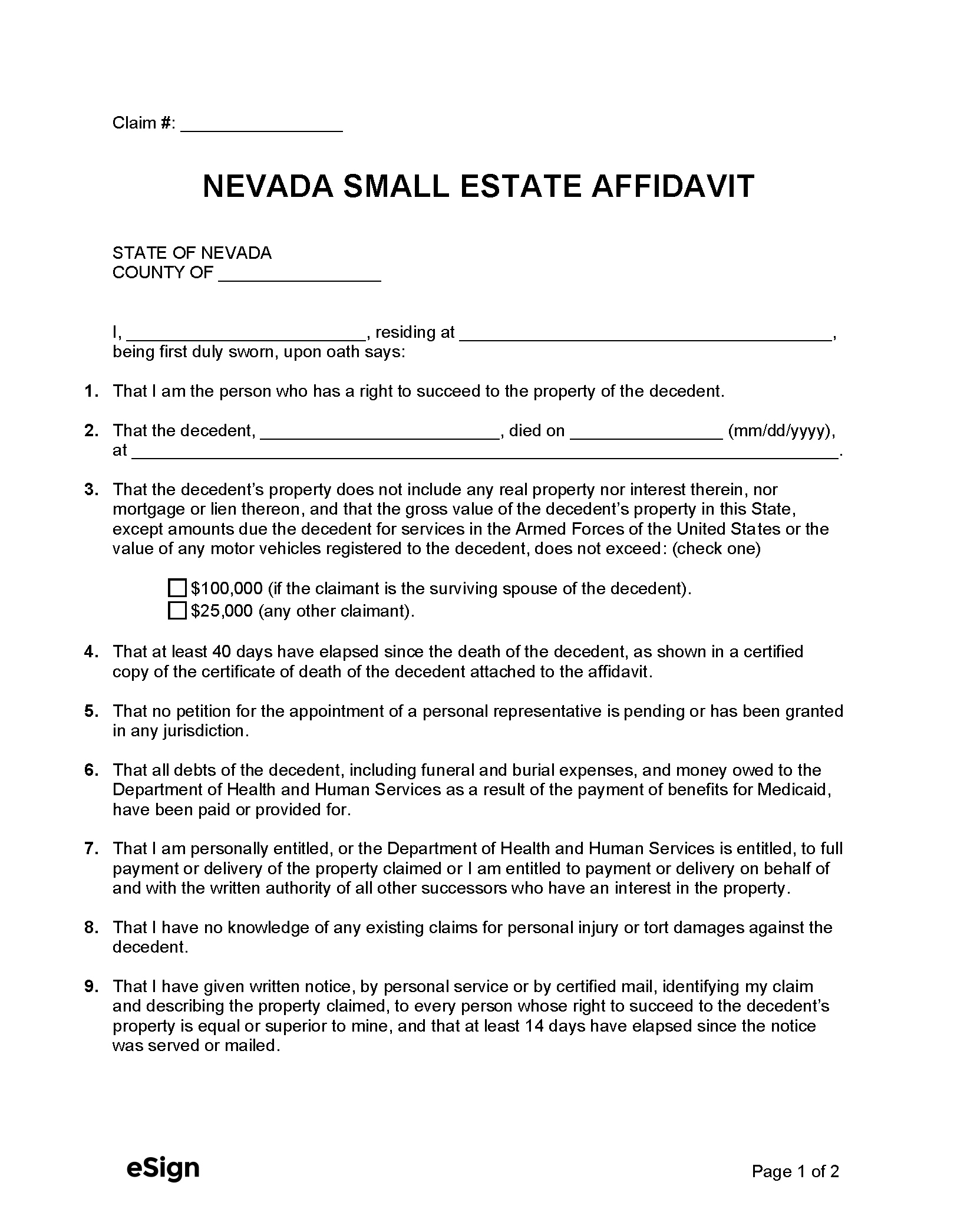

Step 3 – Fill in Affidavit

Claimants will need to prepare a small estate affidavit (download in PDF, Word (.docx), or OpenDocument). Once the requisite information has been entered into the document, the claimant must sign the affidavit in the presence of a notary public and attach a certified copy of the death certificate. If the decedent left a will, a copy of the will must be attached to the affidavit along with a signed and notarized Affidavit of Heirship.

If transferring a motor vehicle registered under the decedent’s name, the claimant must file an Affidavit for Transfer of Title for Estates without Probate with the Nevada Department of Motor Vehicles.

Step 4 – Transfer Property

The claimant may deliver the notarized affidavit (with the death certificate attached) to whoever currently possesses the decedent’s personal property, money, or other estate assets. The asset holder will then relinquish possession of the property to the claimant and promptly transfer any ownership documents, titles, or certificates to the claimant’s name.