Laws

- Statute: § 3102

- Maximum Estate Value (§ 3102): $50,000 (not including real property or property payable under § 3101).

- Mandatory Waiting Period: Not mentioned in state statutes.

- Where to File: Orphan’s Court

How to File (4 Steps)

- Step 1 – Estate Requirements

- Step 2 – File Petition

- Step 3 – Settle Estate

- Step 4 – File Inventory and Inheritance Tax Return

Step 1 – Estate Requirements

A Petition for Settlement of a Small Estate can be used for estates with a total value of $50,000 or less. Real estate and assets that the decedent’s heirs may collect under § 3101 do not need to be factored into the estate valuation.

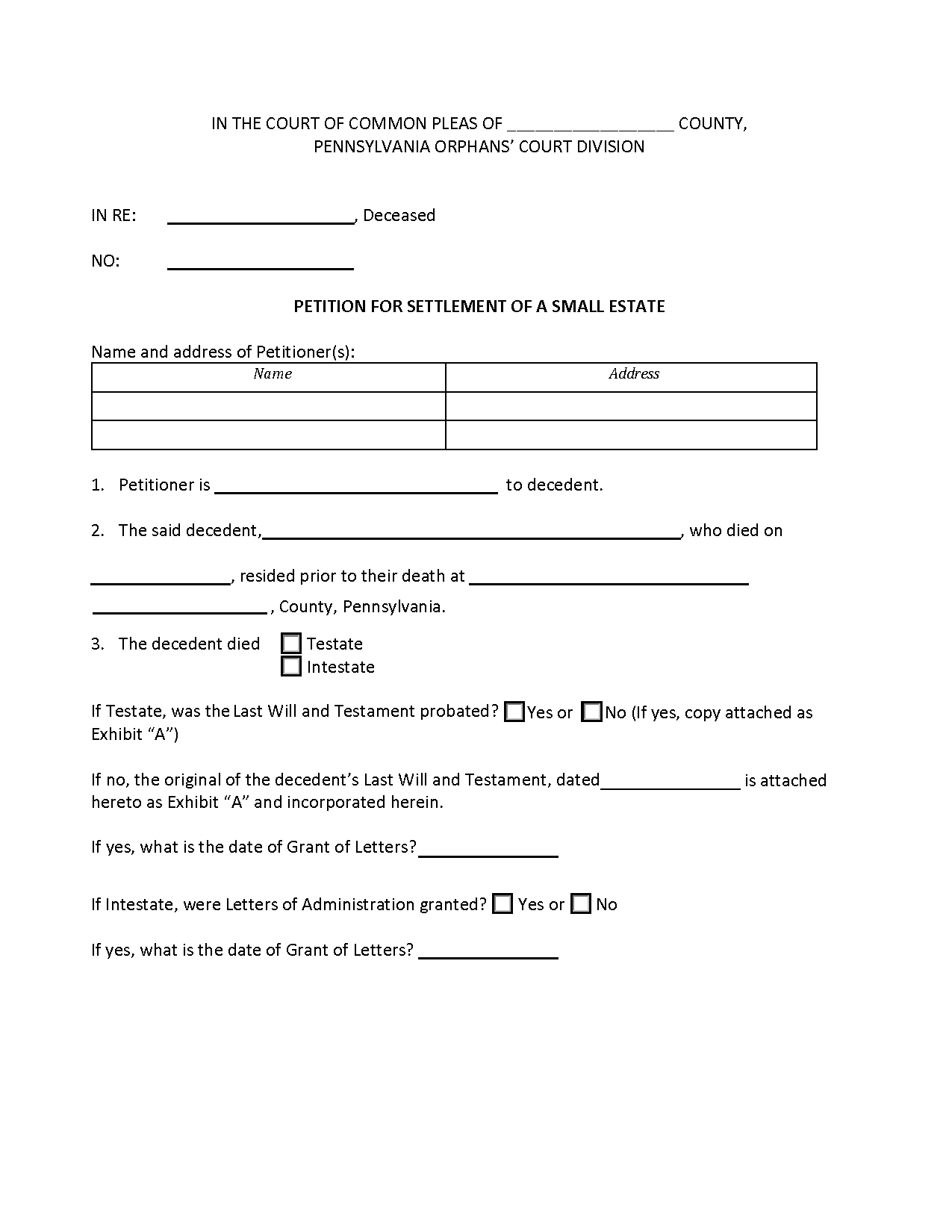

Step 2 – File Petition

The petition should be filled out and filed with the Orphan’s Court in the county wherein the decedent resided at the time of death. The document should be completed and signed in the presence of a notary public.

If the petition is accepted, the court will issue a Decree of Distribution entitling the person(s) named in the petition to receive the decedent’s property without further administration.

Step 3 – Settle Estate

The petitioner will need to identify and settle the decedent’s debts before distributing the estate. Certain assets, such as the decedent’s unpaid wages or deposit account (up to $10,000), can be directly transferred to the decedent’s spouse, child, parent(s), or siblings, in that order (§ 3101).

Step 4 – File Inventory and Inheritance Tax Return

To complete the estate settlement process, the petitioner must file the Inventory (Form RW-09) and Inheritance Tax Return (REV-1500) with the Register of Wills within nine (9) months of the decedent’s death. The Inheritance Tax may be prepaid within three (3) months of the decedent’s death for a 5% tax discount (§ 2142).

A schedule of inheritance tax rates can be found on the Pennsylvania Department of Revenue website.