Recording Requirements

- The grantor must sign the document in the presence of a notary public.[1]

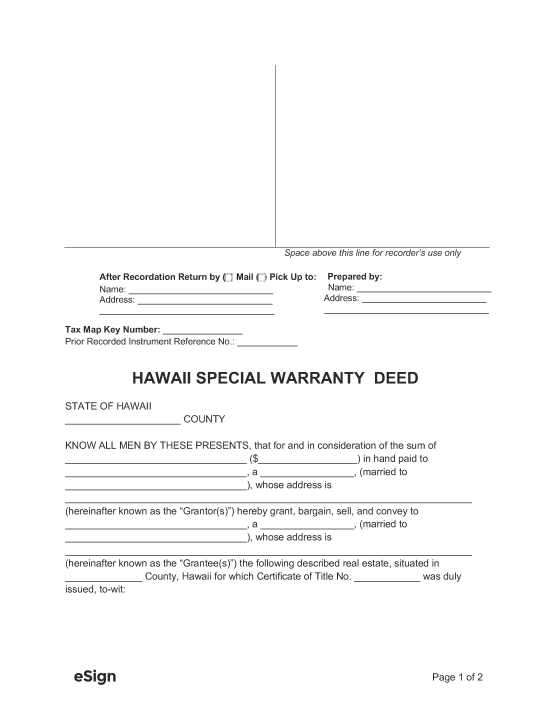

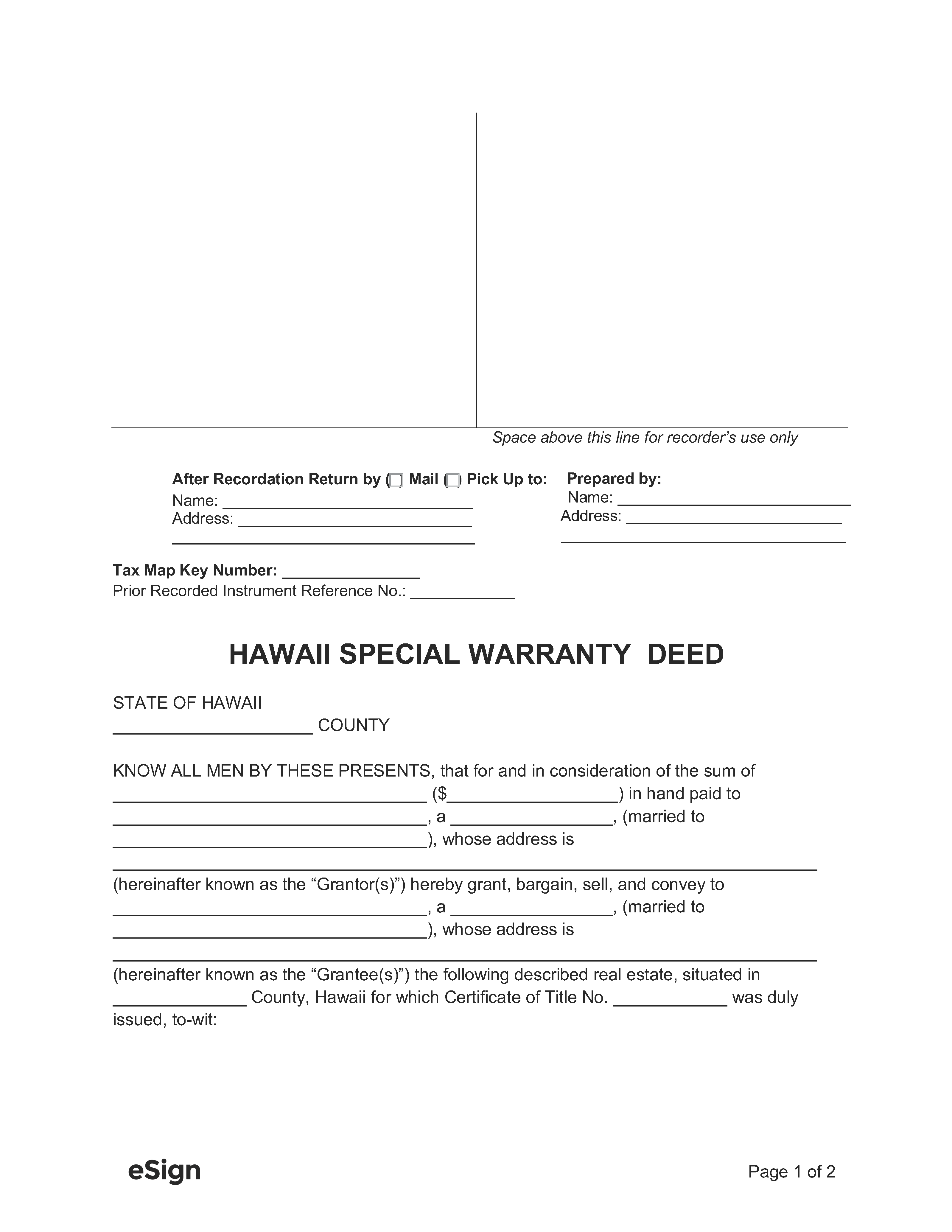

- A top margin of 3.5″ must be included on the first page. The return address must be placed an inch below the top margin and be 1.5 inches from the left margin.[2]

- The deed must be printed on paper not exceeding 8.5″ x 11″.

The Hawaii Bureau of Conveyances is where deeds are recorded.[3] The filing fee is $36 with the Land Court and $41 with the Regular System.[4]

Special Warranty Deed (Preview)

Additional Forms

Conveyance Tax Certificate (Form P-64A) – This form determines the conveyance tax to be imposed on the property transfer and must be filed with the deed.[5] If the transfer is exempt from conveyance tax, Form P-64B must be filed instead.