Recording and Resources

Formatting

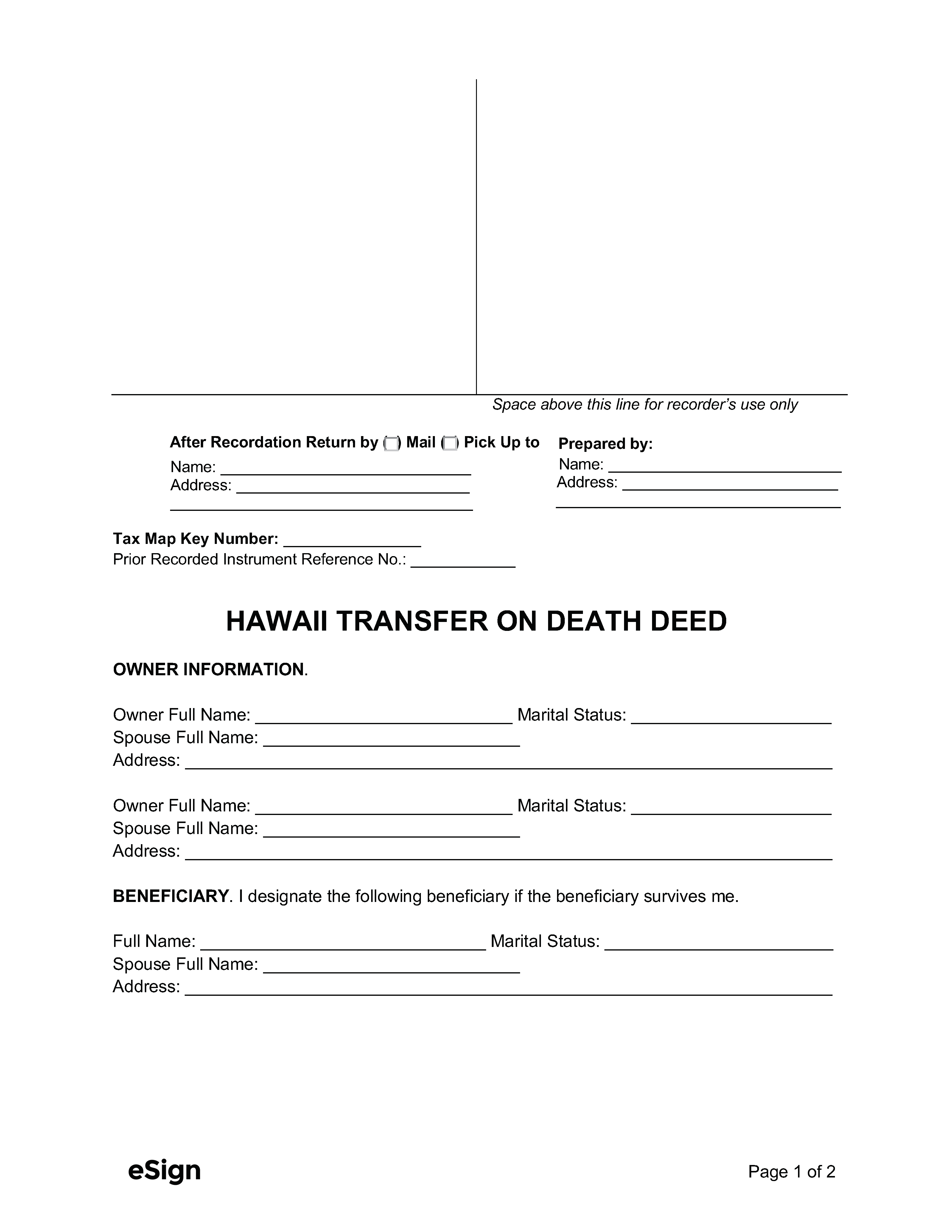

- Paper: 8.5″ x 11″

- Margins: 3.5” top of first page for recording info. The 1” below top margin is for return address (must be 1.5” from left side)[1]

Signing and Recording

- Signing Requirements: Notary public[2]

- Where to Record: Hawaii Bureau of Conveyances[3]

- Recording fees: $36 – Land Court, $41 – Regular System (as of this writing)[4]

Resources

Receiving Property

It should be noted that in Hawaii, to receive the property, the beneficiary must outlive the deceased by at least 120 hours.