Deed Requirements

Deeds of trust must be notarized and recorded with the Registry of Deeds Office.[1] The office accepts deeds that meet the following requirements[2]:

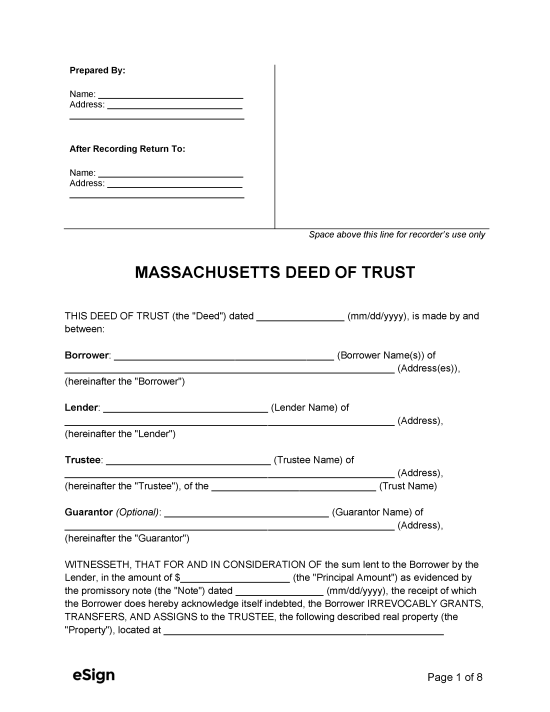

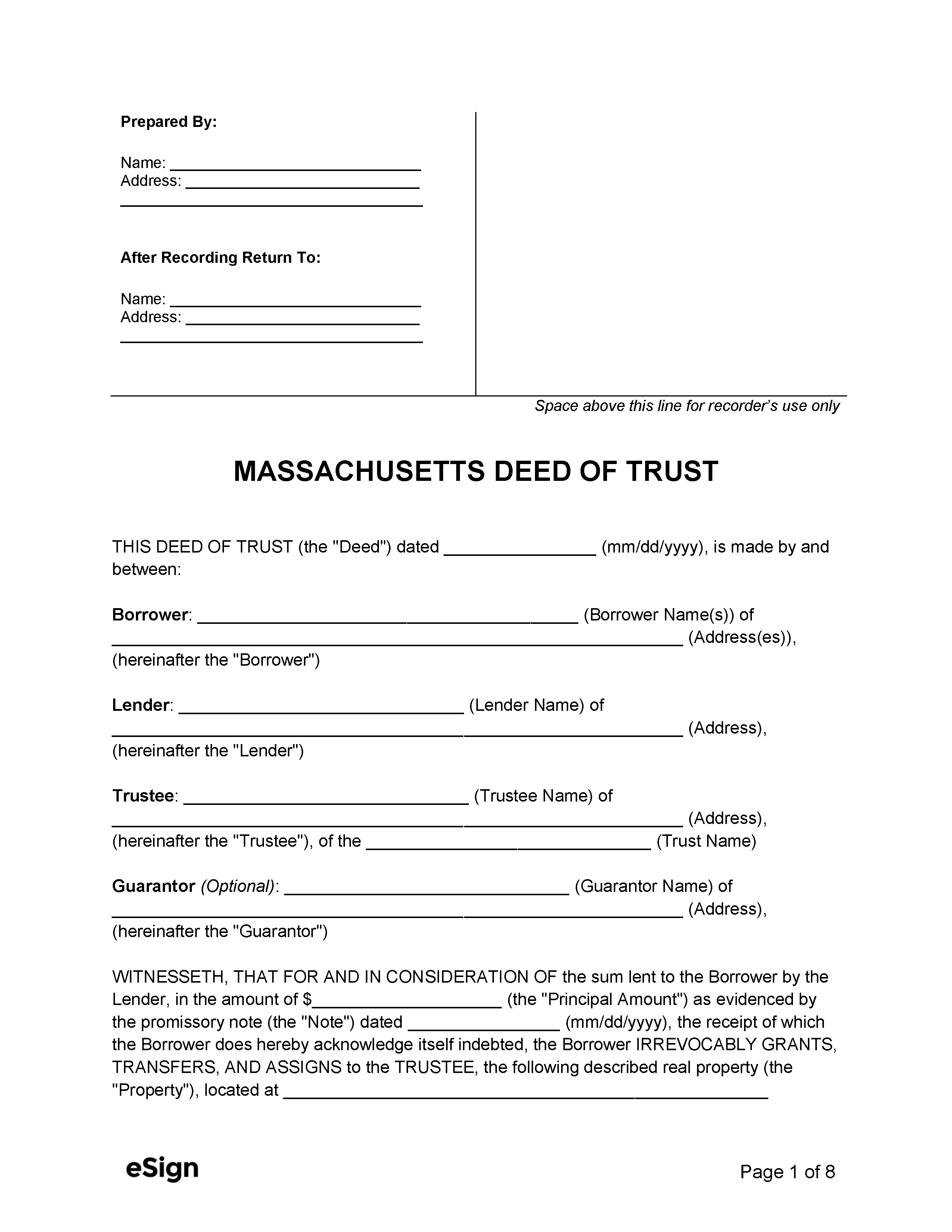

- White paper no larger than 8.5″ x 14″

- 3″ x 3″ blank space at the top right of the first page

Mortgage or Deed of Trust

Massachusetts recognizes both mortgages and deeds of trust. A deed of trust names a trustee to hold title for the duration of the loan and non-judicially foreclose the property if necessary (known as “power of sale”). With a mortgage, the mortgagee holds title, but either the mortgagee or another party may conduct the foreclosure (judicially or non-judicially).[3]