Formatting Requirements

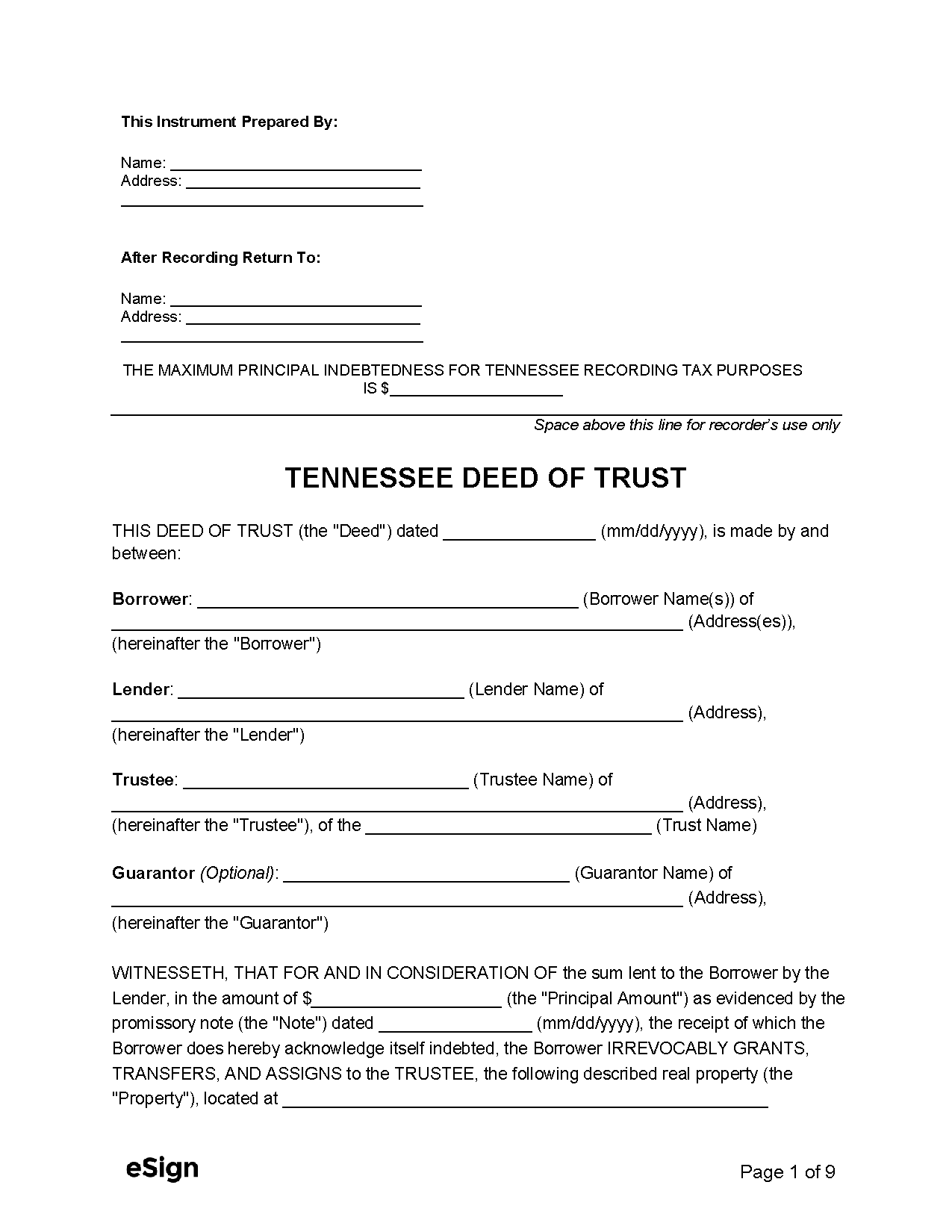

The deed must be filed with the local Register of Deeds.[1] All signing parties must acknowledge their signatures before a notary public.[2]

Formatting standards differ by county. Individuals should check with their local Register of Deeds to verify the county formatting requirements.