Third Party Financing

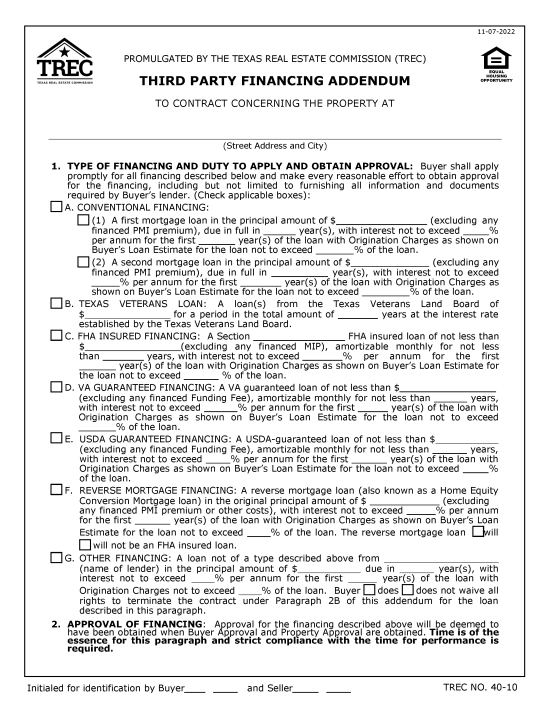

Examples of third party financing include the following:

- Conventional financing (first or second mortgages)

- Reverse mortgages

- FHA insured loans

- VA guaranteed loans

- USDA guaranteed loans

By Type (3)

Download: PDF, Word (.docx), OpenDocument

Standard Third Party Financing Addendum – Relays the financing terms required for the buyer to close and can be used for most third party financing situations.

– Relays the financing terms required for the buyer to close and can be used for most third party financing situations.

Download: PDF, Word (.docx), OpenDocument

Download: PDF

Sample

Download: PDF, Word (.docx), OpenDocument

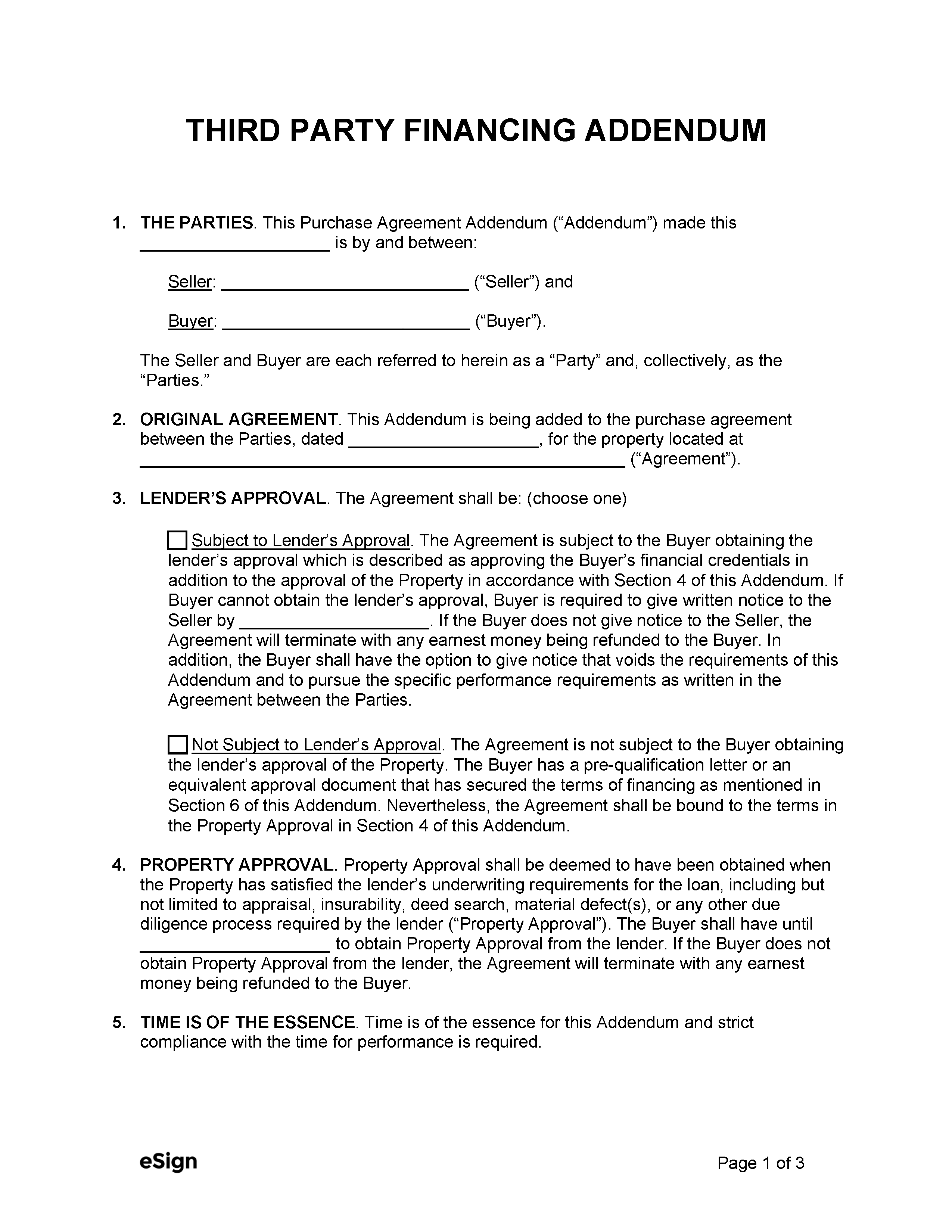

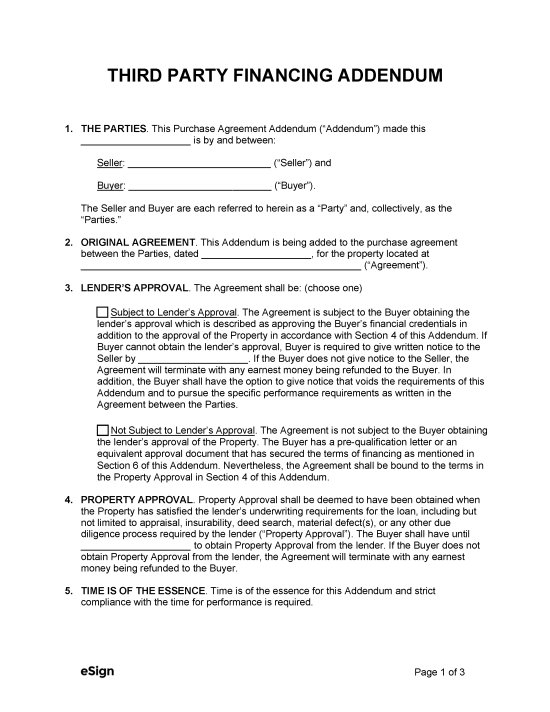

THIRD PARTY FINANCING ADDENDUM

1. THE PARTIES. This Third Party Financing Addendum (“Addendum”) made this [MM/DD/YYYY] is by and between:

Seller: [SELLER’S NAME] (“Seller”) and

Buyer: [BUYER’S NAME] (“Buyer”).

The Seller and Buyer are each referred to herein as a “Party” and, collectively, as the “Parties.”

2. ORIGINAL AGREEMENT. This Addendum is being added to the purchase agreement between the Parties, dated [MM/DD/YYYY], for the property located at [PROPERTY ADDRESS] (“Original Agreement”).

3. LENDER’S APPROVAL. The Agreement shall be subject to the Buyer obtaining the lender’s approval which is described as approving the Buyer’s financial credentials in addition to the approval of the Property in accordance with Section 4 of this Addendum. If Buyer cannot obtain the lender’s approval, Buyer is required to give written notice to the Seller by [MM/DD/YYYY]. If the Buyer does not give notice to the Seller, the Agreement will terminate with any earnest money being refunded to the Buyer. In addition, the Buyer shall have the option to give notice that voids the requirements of this Addendum and to pursue the specific performance requirements as written in the Agreement between the Parties.

4. PROPERTY APPROVAL. Property Approval shall be deemed to have been obtained when the Property has satisfied the lender’s underwriting requirements for the loan, including but not limited to appraisal, insurability, deed search, material defect(s), or any other due diligence process required by the lender (“Property Approval”). The Buyer shall have until [MM/DD/YYYY] to obtain Property Approval from the lender. If the Buyer does not obtain Property Approval from the lender, the Agreement will terminate with any earnest money being refunded to the Buyer.

5. FINANCING. Type of financing and duty to apply and obtain approval shall be for a second mortgage loan in the principal amount of $[AMOUNT] (excluding any financed PMI premium), due in full in [#] ☐ month(s) ☐ year(s), with an interest rate not to exceed [INTEREST RATE]% per annum for the initial [#] ☐ month(s) ☐ year(s) of the loan with origination charges as shown on the Buyer’s loan estimate for the loan not to exceed [CHARGE LIMIT]% of the loan.

6. SECURITY. Each note for the financing described above must be secured by Seller’s deed of trust lien or equivalent deed type.

7. AUTHORIZATION TO RELEASE INFORMATION. Buyer authorizes Buyer’s lender to furnish the Seller or Buyer or any of their representatives information relating to the status of the approval for the financing. Buyer and Seller authorize the Buyer’s lender, title company, and escrow agent to disclose and furnish a copy of the closing disclosures provided in relation to the closing of the Property and completion of the transaction in accordance with the Agreement.

8. EXECUTION. This Addendum may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

Seller’s Signature: ___________________ Date: [MM/DD/YYYY]

Print Name: [SELLER’S NAME]

Buyer’s Signature: ___________________ Date: [MM/DD/YYYY]

Print Name: [BUYER’S NAME]