Purpose of Bill of Sale

A business bill of sale is evidence that an individual or entity acquired a business legally and is the rightful owner of the assets listed in the document. Depending on the structure of the company, this can include the transfer of shares, stocks, or the company as a whole.

The bill of sale is prepared and signed once the parties have agreed to a purchase price and the seller has been paid. After signing, a copy should be kept in both parties’ records as proof that the transaction was completed.

Bill of Sale vs. Purchase Agreement

A business bill of sale and a purchase agreement are both used during the transaction but at different steps in the selling process.

A purchase agreement establishes the key terms and conditions of the sale, which the parties will negotiate before it is signed. Once the agreement is signed, both parties must meet any conditions outlined in it, such as completing consent forms and providing estoppel certificates.

After the selling conditions have been met and money has changed hands, a bill of sale is used to finalize the transaction and record the transfer of assets to the new owner.

What to Include

- Names and Addresses – The buyer and seller’s full names and addresses.

- Business Details – The company’s official name, the state in which it was incorporated, and its principal address.

- Purchase Price – The total amount the buyer will be paying for the seller’s business/shares.

- Signatures – The buyer and seller must sign and date the document for it to be official.

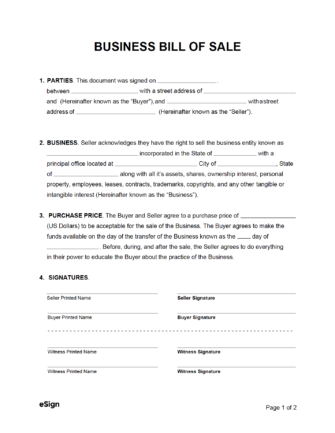

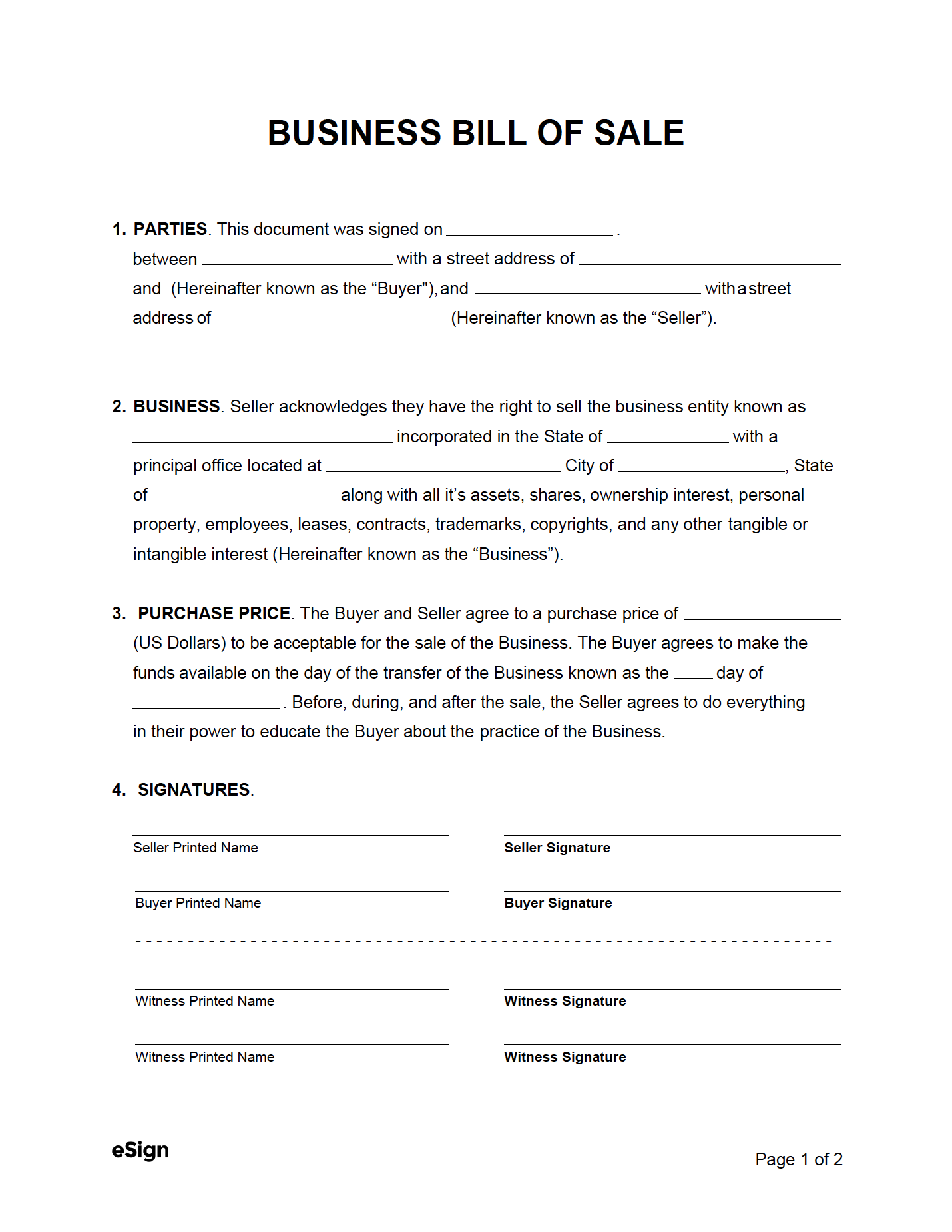

Sample

Download: PDF (Blank) | PDF (Sample Data)

BUSINESS BILL OF SALE

1. PARTIES. This document is between [BUYER NAME] with a street address of [BUYER ADDRESS] (Hereinafter known as the “Buyer”) and [SELLER NAME] with a street address of [SELLER ADDRESS] (Hereinafter known as the “Seller”).

2. BUSINESS. The Seller acknowledges they have the right to sell the business entity known as [BUSINESS NAME] incorporated in the State of [STATE] with a principal office located at [HEADQUARTERS ADDRESS] along with all its assets, shares, ownership interest, personal property, employees, leases, contracts, trademarks, copyrights, and any other tangible or intangible interest (Hereinafter known as the “Business”).

3. PURCHASE PRICE. The Buyer and Seller agree to a purchase price of $[PURCHASE PRICE] (US Dollars) to be acceptable for the sale of the Business. The Buyer agrees to make the funds available on the day of the transfer of the Business on [MM/DD/YYYY]. Before, during, and after the sale, the Seller agrees to do everything in their power to educate the Buyer about the practice of the Business.

4. SIGNATURES.

Buyer’s Signature: ____________________ Date: [MM/DD/YYYY]

Printed Name: [BUYER NAME]

Seller’s Signature: ____________________ Date: [MM/DD/YYYY]

Printed Name: [SELLER NAME]