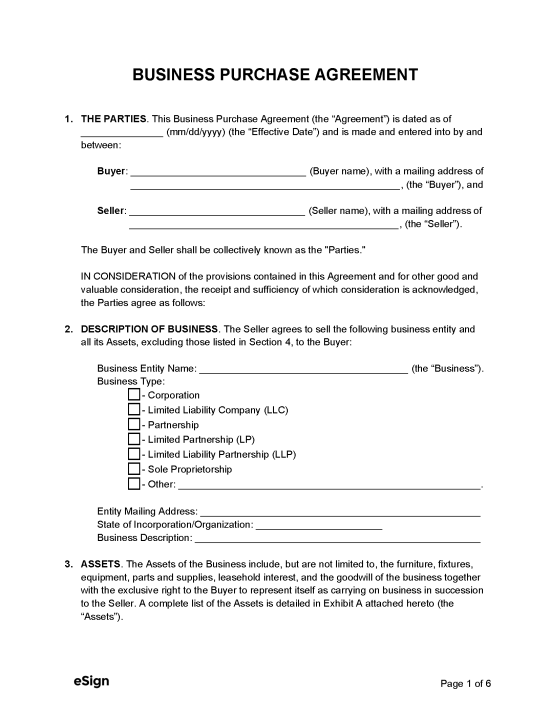

A business purchase agreement is a legal document used to set the terms and conditions of a business sale between a buyer and a seller. It is drafted by the parties and their advisors after a letter of intent has been signed (if applicable) and due diligence has been performed. The parties will negotiate the purchase price and financing options, confidentiality and non-compete, representations and warranties, the terms of the closing, and other key provisions before signing the purchase agreement.

Contents |

What is a Business Purchase Agreement?

A business purchase agreement is a written contract between two (2) parties wherein one party agrees to buy the other party’s company for a specific price. By drafting the legal document, each party warrants and agrees to a set of binding conditions that are enforceable in accordance with state law. The parties and their advisors (brokers, attorneys, accountants, etc.) will negotiate each component of the sale until everyone feels the arrangement is mutually beneficial.

Compared to a Business Bill of Sale

A business purchase agreement contains all the important provisions of a business sale with the intent of creating a fair transaction between a seller and a buyer. All terms are negotiated before the parties sign and money changes hands.

A business bill of sale is a simpler proof of purchase document that shows the transaction has been completed and the buyer is now the new owner of the company. Alternatively, a business bill of sale can be used for transactions that do not warrant complex provisions, or for transfers between acquainted parties.

What’s Included?

Sale Price – The total amount of money the buyer will pay the seller for the business.

Deposit – A deposit is an amount of money that secures the buyer’s right to purchase the business. It is paid after the business purchase agreement is signed and, if the sale goes through, it will count towards the total sale price.

Payment Options – Depending on the preference of the seller, they may ask that the buyer pay using cash, a wire transfer, a check, or another method of payment of their choice.

Closing – The closing is the day the sale finally goes through, the sale price is paid, and ownership of the business legally changes hands.

Representations and Warranties – Both the buyer and seller must make guarantees to the other party that they will perform their duties under the agreement in a professional manner and that they are not acting in any way outside of the law.

Non-Competition – If this provision is agreed upon, the seller is prohibited from engaging in any business activity that is similar to that of the business the buyer just purchased.

Non-Solicitation – Often included within a non-compete clause, non-solicitation means the seller may not approach clients, customers, employees, or any other individuals after the sale in an attempt to hire them or ask for a job.

Confidentiality – The buyer and seller are prohibited from sharing any information about the business, the purchase arrangement, or each other to any third (3rd) party unless they provide consent in writing.

How to Use

Step 1 – The Parties

Purchasing a business typically starts when an interested party (the buyer) contacts an investment banker to help them track down potential businesses to buy. On the other hand, it might be that the owner of a business (the seller) hires a business broker to find a prospective buyer. The investment banker/business broker may continue to work with the parties to prepare and review the letter of intent and provide support and advice during the due diligence process. In addition to bankers and brokers, each party will have an accountant and an attorney to provide counsel and expertise.

Step 2 – NDA + Letter of Intent

Once the parties are ready to discuss the details of the sale, a non-disclosure agreement should be introduced to maintain the confidentiality of each party’s proprietary information. After this, it’s recommended that a letter of intent be drafted and signed so the parties understand the general outline of the acquisition before diving into the more complex business purchase agreement. A letter of intent is not completely legally binding except for any terms that pertain to non-disclosure and due diligence. During the due diligence process, the seller must allow the buyer to examine the company’s properties, records, contracts, legal obligations and liabilities, finances, and operations.

Step 3 – Prepare and Sign Agreement

If the parties wish to continue with the transaction, the terms and conditions of the business purchase agreement can be negotiated by the parties and their counsel. The provisions that take up the bulk of the negotiation process are the purchase price, representations and warranties, indemnification, and closing contingencies. The negotiations for purchasing a small business might take a few months or half a year to conclude, while large business acquisitions can take one (1) or more years. Once the parties and their advisors are satisfied with all the terms of the purchase agreement, the buyer and seller will sign the document.

Step 4 – Closing

The closing of the transaction will involve a number of components. All contingencies must be met upon the date of closing, after which the buyer will deliver a bill of sale (or multiple bills of sale, as the case may be) that conveys the tangible personal property, intangible property, and contracts to the buyer. In addition, any certificates of corporation or other similar documents must be transferred over to the buyer for filing with the secretary of state.

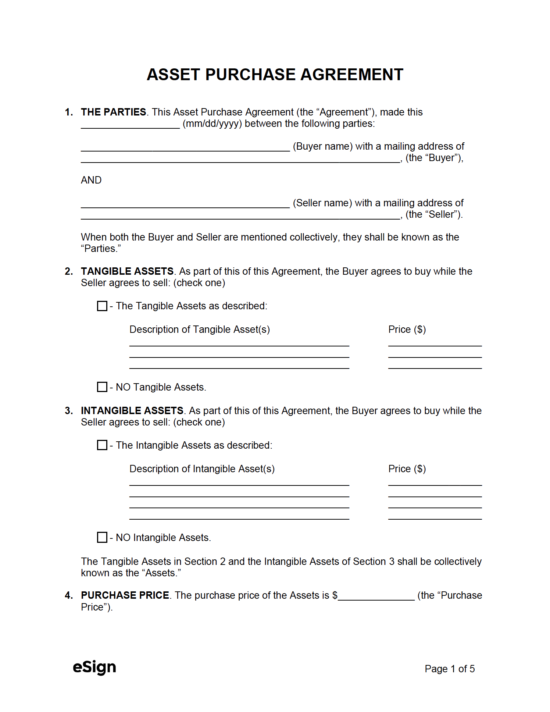

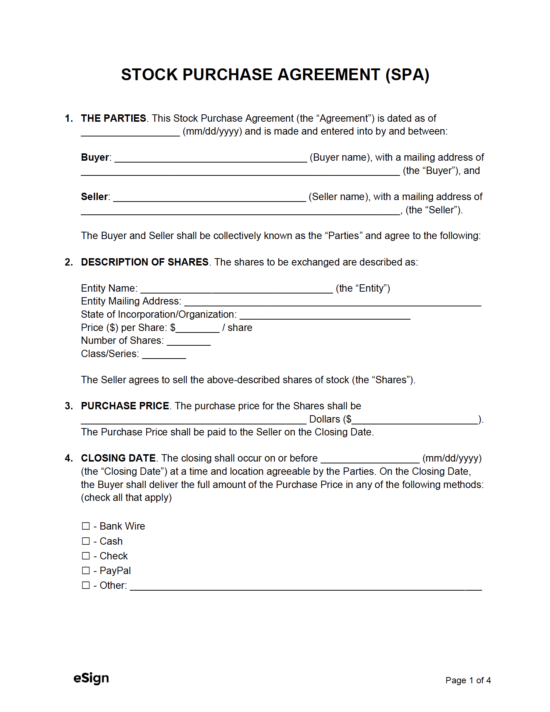

Related Forms

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument